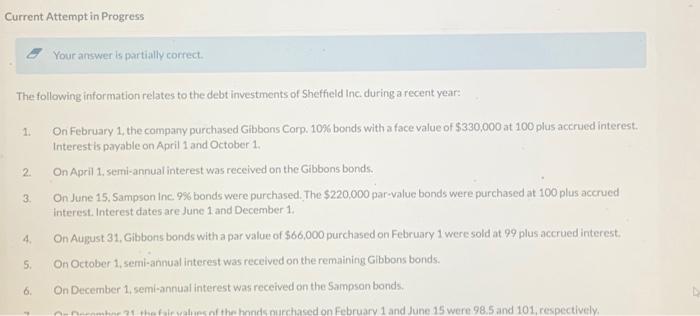

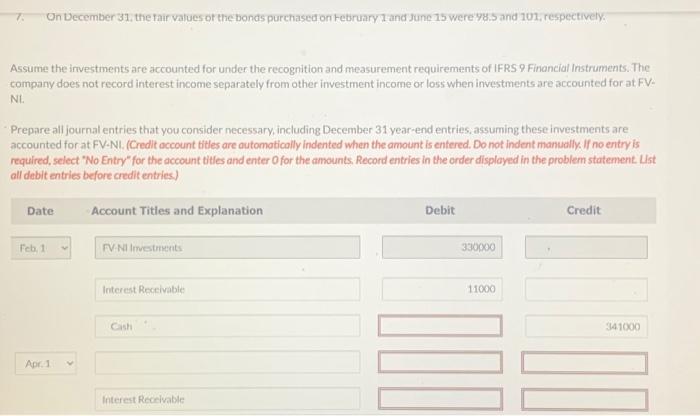

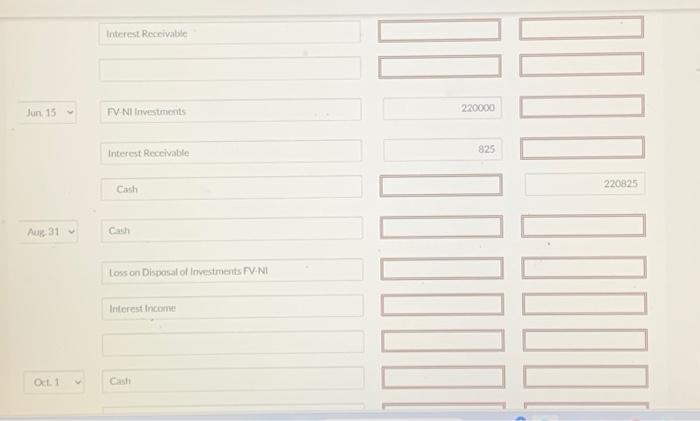

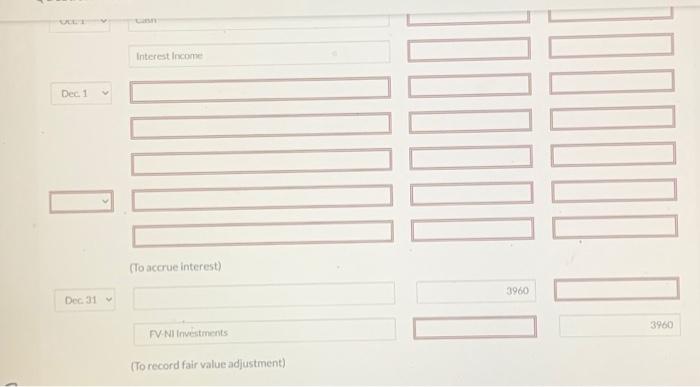

Your answer is partially correct. The following information relates to the debt investments of Sheffield Inc. during a recent year: 1. On February 1, the company purchased Gibbons Corp. 10% bonds with a face value of $330,000 at 100 plus accrued interest. Interest is payable on April 1 and October 1. 2. On April 1. semi-annual interest was received on the Gibbons bonds. 3. On June 15 , Sampson inc 9% bonds were purchased. The $220,000 par-value bonds were purchased at 100 plus accrued interest. Interest dates are June 1 and December 1. 4. On August 31 , Gibbons bonds with a par value of $66,000 purchased on February 1 were sold at 99 plus accrued interest. 5. On October 1 , semi-annual interest was received on the remaining Gibbons bonds. 6. On December 1, semi-annual interest was received on the Sampson bonds. 7. On December 31, the fair vatues or the bonds purchased on tebruary 1 and June 15 were 98.5 and 101 , respectively. Assume the irivestments are accounted for under the recognition and measurement requirements of IFRS 9 Financial Instruments. The company does not record interest income separately from other investment income or loss when investments are accounted for at FV. Ni. Prepare all journal entries that you consider necessary, including December 31 year-end entries, assuming these investments are accounted for at FV-NI. (Credit occount titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record entries in the order displayed in the problem statement. Ust all debit entries before credit entries.) Interest Receivable Jun15 FV NI investments 220000 Interest Reccivable 825 Canh 220825 Aus 31 Can Less on Disposal of linestments FV-NI Interest Inconie Ot.1 Cash ctc1=v cans Interest Irocome Dec. 1 (To accrue interest) Dec 31 FV NII Investments 3960 \begin{tabular}{r} \hline \\ 3960 \end{tabular} (To record fair value adjustment) Your answer is partially correct. The following information relates to the debt investments of Sheffield Inc. during a recent year: 1. On February 1, the company purchased Gibbons Corp. 10% bonds with a face value of $330,000 at 100 plus accrued interest. Interest is payable on April 1 and October 1. 2. On April 1. semi-annual interest was received on the Gibbons bonds. 3. On June 15 , Sampson inc 9% bonds were purchased. The $220,000 par-value bonds were purchased at 100 plus accrued interest. Interest dates are June 1 and December 1. 4. On August 31 , Gibbons bonds with a par value of $66,000 purchased on February 1 were sold at 99 plus accrued interest. 5. On October 1 , semi-annual interest was received on the remaining Gibbons bonds. 6. On December 1, semi-annual interest was received on the Sampson bonds. 7. On December 31, the fair vatues or the bonds purchased on tebruary 1 and June 15 were 98.5 and 101 , respectively. Assume the irivestments are accounted for under the recognition and measurement requirements of IFRS 9 Financial Instruments. The company does not record interest income separately from other investment income or loss when investments are accounted for at FV. Ni. Prepare all journal entries that you consider necessary, including December 31 year-end entries, assuming these investments are accounted for at FV-NI. (Credit occount titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record entries in the order displayed in the problem statement. Ust all debit entries before credit entries.) Interest Receivable Jun15 FV NI investments 220000 Interest Reccivable 825 Canh 220825 Aus 31 Can Less on Disposal of linestments FV-NI Interest Inconie Ot.1 Cash ctc1=v cans Interest Irocome Dec. 1 (To accrue interest) Dec 31 FV NII Investments 3960 \begin{tabular}{r} \hline \\ 3960 \end{tabular} (To record fair value adjustment)