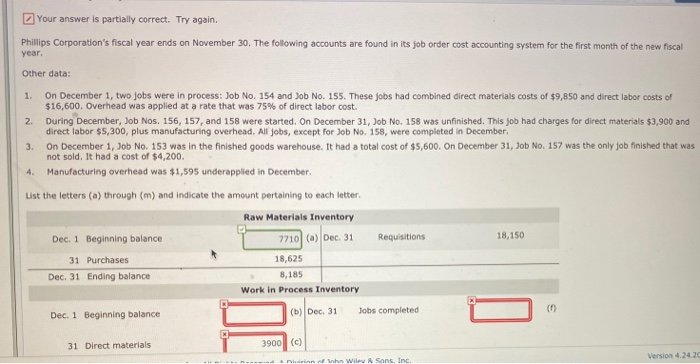

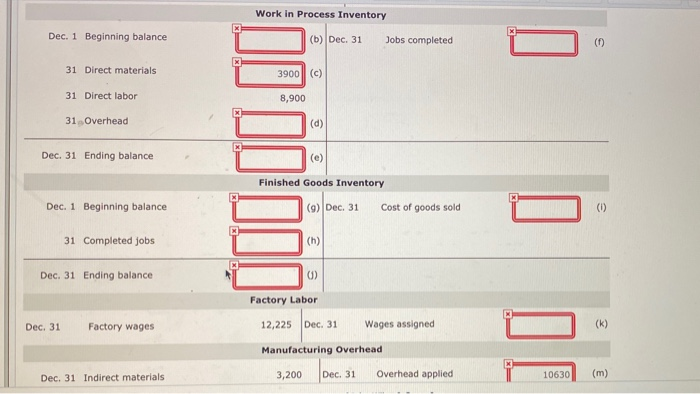

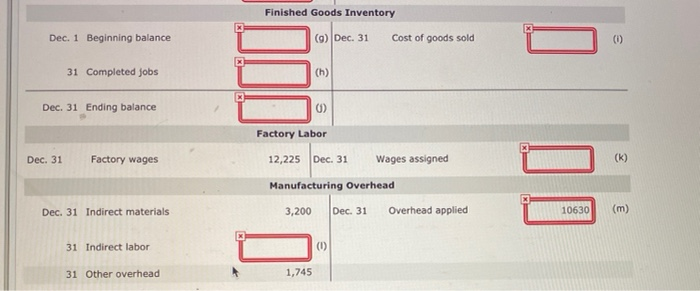

Your answer is partially correct. Try again. Phillips Corporation's fiscal year ends on November 30. The following accounts are found in its job order cost accounting system for the first month of the new fiscal year. Other data: 1 2. On December 1, two jobs were in process: Job No. 154 and Job No. 155. These jobs had combined direct materials costs of $9,850 and direct labor costs of $16,600. Overhead was applied at a rate that was 75% of direct labor cost. During December, Job Nos. 156, 157, and 158 were started. On December 31, Job No. 158 was unfinished. This job had charges for direct materials $3,900 and direct labor $5,300, plus manufacturing overhead. All jobs, except for Job No. 158, were completed in December. 3. On December 1, Job No. 153 was in the finished goods warehouse. It had a total cost of $5,600. On December 31, Job No. 157 was the only job finished that was a 4. Manufacturing overhead was $1,595 underapplied in December List the letters (a) through (m) and indicate the amount pertaining to each letter. Raw Materials Inventory Dec. 1 Beginning balance 7710 (6) Dec 31 Requisitions 18,625 Dec. 31 Ending balance 8,185 Work in Process Inventory 18,150 31 Purchases Dec. 1 Beginning balance (b) Dec. 31 Jobs completed 0 31 Direct materials 3900 (c) Version 4.24.20 w Wilsons, Inc. Work in Process Inventory Dec. 1 Beginning balance (b) Dec. 31 Jobs completed 31 Direct materials 3900 (c) 31 Direct labor 8,900 31 Overhead (d) Dec. 31 Ending balance (e) Finished Goods Inventory Dec. 1 Beginning balance (9) Dec. 31 Cost of goods sold (0) 31 Completed jobs (h) Dec. 31 Ending balance 0) Factory Labor Dec. 31 Factory wages 12,225 Dec. 31 Wages assigned Manufacturing Overhead x Dec. 31 Indirect materials 3,200 Dec. 31 Overhead applied 10630 (m) Finished Goods Inventory Dec. 1 Beginning balance (9) Dec. 31 Cost of goods sold (6) 31 Completed jobs Dec. 31 Ending balance 0) Factory Labor Dec. 31 Factory wages 12,225 Dec. 31 Wages assigned (k) Manufacturing Overhead Dec. 31 Indirect materials 3,200 Dec. 31 Overhead applied 10630 (m) 31 Indirect labor (0) 31 Other overhead 1,745 Phillips Corporation's fiscal year ends on November 30. The following accounts are found in its job order cost accounting system for the first month of the new fiscal year. Other data: 1. 2. On December 1, two jobs were in process: Job No. 154 and Job No. 155. These jobs had combined direct materials costs of $9,850 and direct labor costs of $16,600. Overhead was applied at a rate that was 75% of direct labor cost. During December, Job Nos. 156, 157, and 158 were started. On December 31, Job No. 158 was unfinished. This job had charges for direct materials $3,900 and direct labor $5,300, plus manufacturing overhead. All jobs, except for Job No. 158, were completed in December On December 1, Job No. 153 was in the finished goods warehouse. It had a total cost of $5,600. On December 31, Job No. 157 was the only job finished that was not sold. It had a cost of $4,200. Manufacturing overhead was $1,595 underapplied in December 3 4. List the letters (a) through (m) and indicate the amount pertaining to each letter