Question

Your boss has asked you to identify several properties that meet specific investment criteria ( click here to view the criteria ). Visit the websites

Your boss has asked you to identify several properties that meet specific investment criteria ( click here to view the criteria ). Visit the websites listed above plus one more that you find on your own and identify at least one property from each broker that meets the criteria attached. In performing this task you will only need to look at the summary numbers provided by the broker. No verification or detailed examination is necessary. You can assume that the brokers numbers are accurate for the purpose of preliminarily identifying candidates for acquisition.

You will find it useful to create a spreadsheet that will help you quickly calculate the cash on cash return. (View the sample spreadsheet for an example.) Prepare a memo to your boss discussing the properties you have analyzed and include your spreadsheet for each property. The memo should discuss the pros and cons of each property. There should also be some discussion of the basic strengths and weaknesses of the respective market for each property.

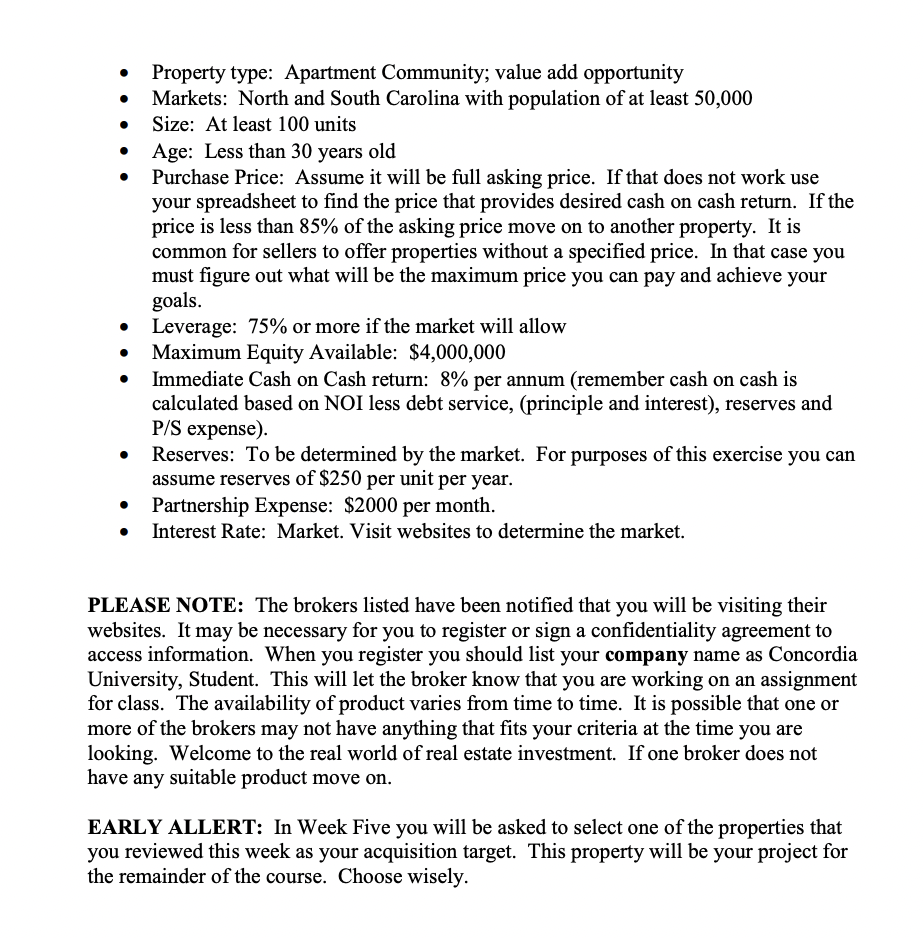

Property type: Apartment Community; value add opportunity Markets: North and South Carolina with population of at least 50,000 Size: At least 100 units Age: Less than 30 years old Purchase Price: Assume it will be full asking price. If that does not work use your spreadsheet to find the price that provides desired cash on cash return. If the price is less than 85% of the asking price move on to another property. It is common for sellers to offer properties without a specified price. In that case you must figure out what will be the maximum price you can pay and achieve your goals. Leverage: 75% or more if the market will allow Maximum Equity Available: $4,000,000 Immediate Cash on Cash return: 8% per annum (remember cash on cash is calculated based on NOI less debt service, (principle and interest), reserves and P/S expense) Reserves: To be determined by the market. For purposes of this exercise you can assume reserves of $250 per unit per year. Partnership Expense: $2000 per month. Interest Rate: Market. Visit websites to determine the market. . PLEASE NOTE: The brokers listed have been notified that you will be visiting their websites. It may be necessary for you to register or sign a confidentiality agreement to access information. When you register you should list your company name as Concordia University, Student. This will let the broker know that you are working on an assignment for class. The availability of product varies from time to time. It is possible that one or more of the brokers may not have anything that fits your criteria at the time you are looking. Welcome to the real world of real estate investment. If one broker does not have any suitable product move on. EARLY ALLERT: In Week Five you will be asked to select one of the properties that you reviewed this week as your acquisition target. This property will be your project for the remainder of the course. Choose wisely. Property type: Apartment Community; value add opportunity Markets: North and South Carolina with population of at least 50,000 Size: At least 100 units Age: Less than 30 years old Purchase Price: Assume it will be full asking price. If that does not work use your spreadsheet to find the price that provides desired cash on cash return. If the price is less than 85% of the asking price move on to another property. It is common for sellers to offer properties without a specified price. In that case you must figure out what will be the maximum price you can pay and achieve your goals. Leverage: 75% or more if the market will allow Maximum Equity Available: $4,000,000 Immediate Cash on Cash return: 8% per annum (remember cash on cash is calculated based on NOI less debt service, (principle and interest), reserves and P/S expense) Reserves: To be determined by the market. For purposes of this exercise you can assume reserves of $250 per unit per year. Partnership Expense: $2000 per month. Interest Rate: Market. Visit websites to determine the market. . PLEASE NOTE: The brokers listed have been notified that you will be visiting their websites. It may be necessary for you to register or sign a confidentiality agreement to access information. When you register you should list your company name as Concordia University, Student. This will let the broker know that you are working on an assignment for class. The availability of product varies from time to time. It is possible that one or more of the brokers may not have anything that fits your criteria at the time you are looking. Welcome to the real world of real estate investment. If one broker does not have any suitable product move on. EARLY ALLERT: In Week Five you will be asked to select one of the properties that you reviewed this week as your acquisition target. This property will be your project for the remainder of the course. Choose wiselyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started