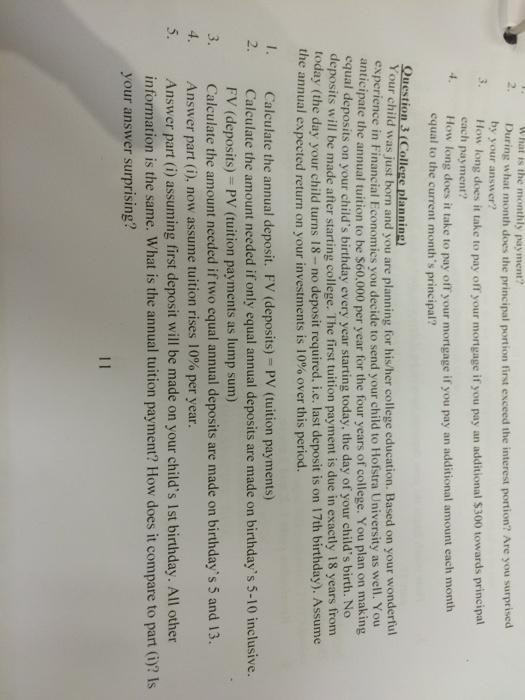

Your child was just born and you are planning for his/her college education. Based on your wonderful experience in Financial Economies you decide to send your child to Hofstra University as well. You anticipate the annual tuition to be $60,000 per year for the four years of college. You plan on making equal deposits on your child's birthday every year starting today, the day of your child's birth. No deposits will be made after starting college. The first tuition payment is due in exactly 18 years from today (the day your child turns 18 - no deposit required, i.e. last deposit is on 17th birthday). Assume the annual expected return on your investments is 10% over this period. Calculate the annual deposit. FV (deposits) = PV (tuition payments) Calculate the amount needed if only equal annual deposits are made on birthday's 5-10 inclusive. FV (deposits) = PV (tuition payments as lump sum) Calculate the amount needed if two equal annual deposits are made on birthday's 5 and 13. Answer part (i), now assume tuition rises 10% per year. Answer part (i) assuming first deposit will be made on your child's 1st birthday. All other information is the same. What is the annual tuition payment? How does it compare to part (i)? Is your answer surprising? Your child was just born and you are planning for his/her college education. Based on your wonderful experience in Financial Economies you decide to send your child to Hofstra University as well. You anticipate the annual tuition to be $60,000 per year for the four years of college. You plan on making equal deposits on your child's birthday every year starting today, the day of your child's birth. No deposits will be made after starting college. The first tuition payment is due in exactly 18 years from today (the day your child turns 18 - no deposit required, i.e. last deposit is on 17th birthday). Assume the annual expected return on your investments is 10% over this period. Calculate the annual deposit. FV (deposits) = PV (tuition payments) Calculate the amount needed if only equal annual deposits are made on birthday's 5-10 inclusive. FV (deposits) = PV (tuition payments as lump sum) Calculate the amount needed if two equal annual deposits are made on birthday's 5 and 13. Answer part (i), now assume tuition rises 10% per year. Answer part (i) assuming first deposit will be made on your child's 1st birthday. All other information is the same. What is the annual tuition payment? How does it compare to part (i)? Is your answer surprising