Question

Your client Global Holdings Ltd was pleased with the quality of the advocated improvements you provided (Assessment 1). As a result, your client has engaged

Your client Global Holdings Ltd was pleased with the quality of the advocated improvements you provided (Assessment 1). As a result, your client has engaged you further as a consultant to advise them on a proposed acquisition. A division of your client, located in Thailand, whose business is involved in manufacturing flavours for the food industry is considering merging with a competitor whose business is involved in manufacturing perfumes for the personal care industry. You must evaluate the benefits of the merger and quantify the financial impacts.

Task

Use the case study attached in Assessment 2 Case Study Global Fragrances (DOCX 80KB) to prepare financial report evaluation.?

- Evaluate the revenue and profit profiles of the product range of the combined group and place the products into the relevant sectors of a BCG matrix.?

- Investigate the market position of each of the products of the combined group and formulate their current status on a product life cycle diagram.?

- Profit budget for the combined business incorporating the identified cost savings and synergies.

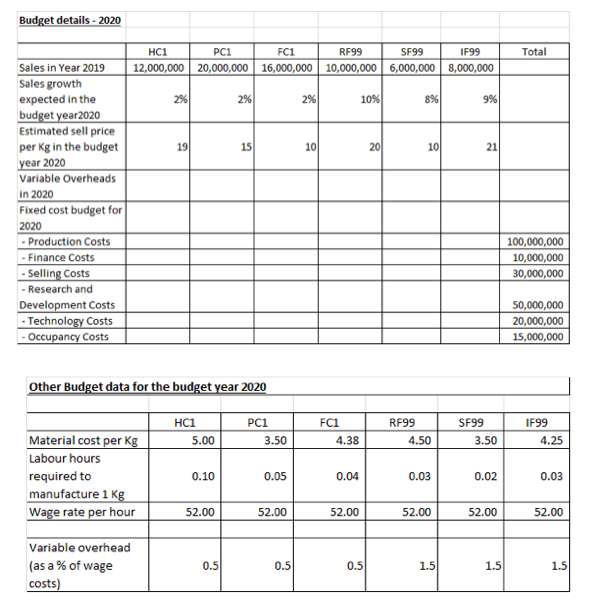

Budget data for preparing the budget for the year 2020.

After consultation with the staff of the business on a bottom up approach you have agreed with the senior management team the following performance parameters for 2020:

Your client Global Holdings Ltd was pleased with the quality of the advocated improvements you provided (Assessment 1). As a result, your client has engaged you further as a consultant to advise them on a proposed acquisition. A division of your client, located in Thailand, whose business is involved in manufacturing flavours for the food industry is considering merging with a competitor whose business is involved in manufacturing perfumes for the personal care industry. You must evaluate the benefits of the merger and quantify the financial impacts.

Task

Use the case study attached to prepare financial report evaluation.?

- Quantify the impact of the profit budget if the risk scenario described in the case data does occur.?

- Rationalise how KPIs can assist with measuring the performance for this new operation after the merger.?

- Explain some of the alternatives to the traditional annual budget preparation process. In your response, consider the type of organization, management style, and organization structure more suited to the traditional budgeting process, and the type of organization that is more suited to the alternative more flexible budget preparation styles.

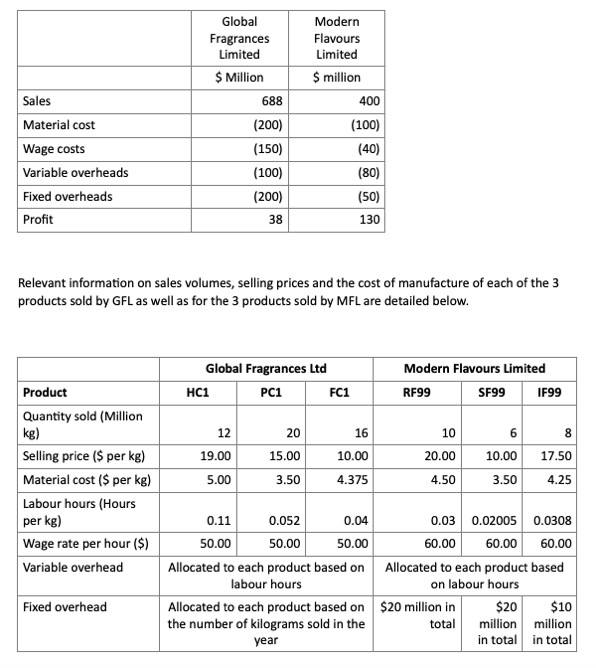

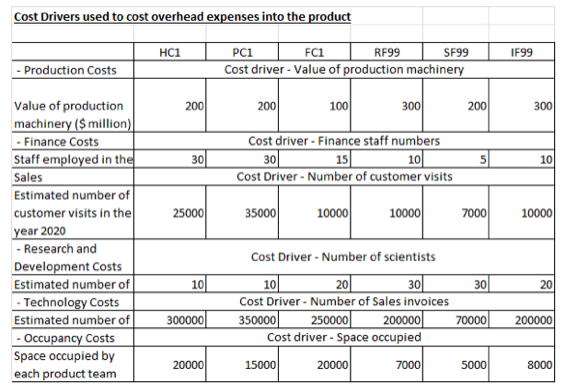

Sales Material cost Wage costs Variable overheads Fixed overheads Profit Product Quantity sold (Million kg) Selling price ($ per kg) Material cost ($ per kg) Labour hours (Hours per kg) Wage rate per hour ($) Variable overhead Global Fragrances Limited $ Million Fixed overhead Relevant information on sales volumes, selling prices and the cost of manufacture of each of the 3 products sold by GFL as well as for the 3 products sold by MFL are detailed below. 688 (200) (150) (100) (200) 38 HC1 Global Fragrances Ltd PC1 12 19.00 5.00 Modern Flavours Limited $ million 20 15.00 3.50 400 (100) (40) (80) (50) 130 FC1 16 10.00 4.375 0.11 0.052 0.04 50.00 50.00 50.00 Allocated to each product based on labour hours Allocated to each product based on the number of kilograms sold in the year Modern Flavours Limited RF99 10 20.00 4.50 SF99 IF99 $20 million in total 6 8 10.00 17.50 3.50 4.25 0.03 0.02005 0.0308 60.00 60.00 60.00 Allocated to each product based on labour hours $20 $10 million million in total in total Budget details - 2020 Sales in Year 2019 Sales growth expected in the budget year2020 Estimated sell price per kg in the budget year 2020 Variable Overheads In 2020 Fixed cost budget for 2020 - Production Costs - Finance Costs -Selling Costs - Research and Development Costs -Technology Costs - Occupancy Costs HC1 12,000,000 Material cost per Kg Labour hours required to manufacture 1 Kg Wage rate per hour Variable overhead (as a % of wage costs) 2% 19 PC1 20,000,000 Other Budget data for the budget year 2020 HC1 5.00 0.10 52.00 2% 0.5 15 FC1 RF99 SF99 16,000,000 10,000,000 6,000,000 PC1 3.50 0.05 52.00 0.5 2% 10 FC1 4.38 0.04 10% 52.00 0.5 20 RF99 8% 10 4.50 0.03 52.00 1.5 IF99 8,000,000 9% SF99 21 3.50 0.02 52.00 1.5 Total 100,000,000 10,000,000 30,000,000 50,000,000 20,000,000 15,000,000 IF99 4.25 0.03 52.00 1.5 Cost Drivers used to cost overhead expenses into the product - Production Costs Value of production machinery ($ million) - Finance Costs Staff employed in the Sales Estimated number of customer visits in the year 2020 - Research and Development Costs Estimated number of - Technology Costs Estimated number of - Occupancy Costs Space occupied by each product team HC1 200 30 25000 10 300000 20000 PC1 FC1 RF99 SF99 Cost driver - Value of production machinery 200 100 Cost driver - Finance staff numbers 15 10 35000 30 Cost Driver - Number of customer visits 15000 300 10000 Cost Driver - Number of scientists 20 30 10 Cost Driver - Number of Sales invoices 350000 200000 250000 Cost driver - Space occupied 20000 10000 7000 200 5 7000 30 70000 5000 IF99 300 10 10000 20 200000 8000

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Recovery rates Activities cost drivers total cost total cost driver recovery rateCD production cost value of production machinary 100000000 1300000000 00769 finance cost finance staff numbers 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started