Question

Your client wants to develop a piece of land that he is considering purchasing, and he is clueless about property taxes. Fortunately, you are an

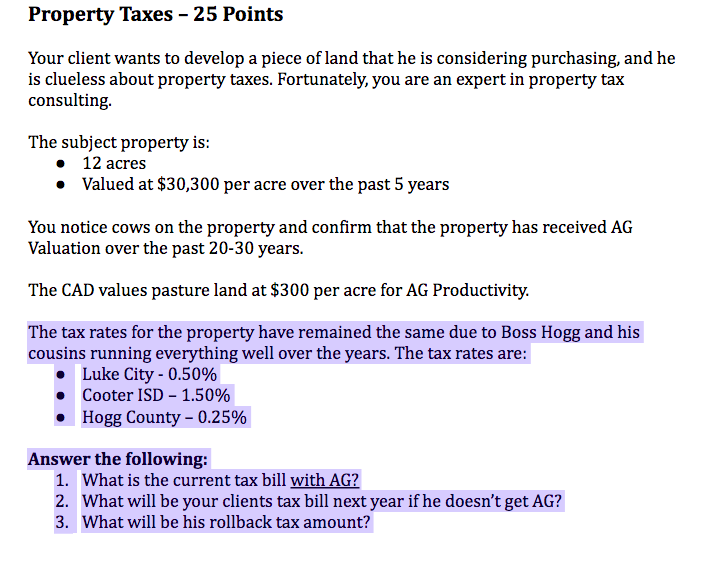

Your client wants to develop a piece of land that he is considering purchasing, and he is clueless about property taxes. Fortunately, you are an expert in property tax consulting. The subject property is: 12 acres Valued at $30,300 per acre over the past 5 years You notice cows on the property and confirm that the property has received AG Valuation over the past 20-30 years. The CAD values pasture land at $300 per acre for AG Productivity. The tax rates for the property have remained the same due to Boss Hogg and his cousins running everything well over the years. The tax rates are: Luke City - 0.50% Cooter ISD 1.50% Hogg County 0.25% Answer the following: 1. What is the current tax bill with AG? 2. What will be your clients tax bill next year if he doesnt get AG? 3. What will be his rollback tax amount?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started