Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your clients are a couple both age 35. They have two small children, ages 5 and 7. They are both currently working and have

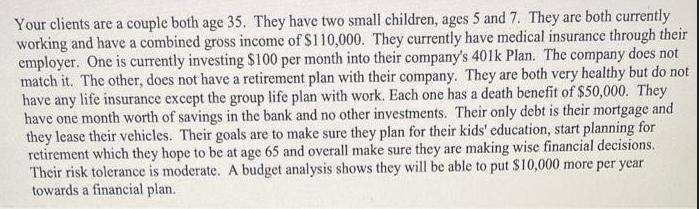

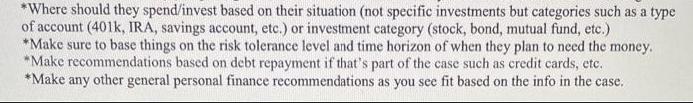

Your clients are a couple both age 35. They have two small children, ages 5 and 7. They are both currently working and have a combined gross income of $110,000. They currently have medical insurance through their employer. One is currently investing $100 per month into their company's 401k Plan. The company does not match it. The other, does not have a retirement plan with their company. They are both very healthy but do not have any life insurance except the group life plan with work. Each one has a death benefit of $50,000. They have one month worth of savings in the bank and no other investments. Their only debt is their mortgage and they lease their vehicles. Their goals are to make sure they plan for their kids' education, start planning for retirement which they hope to be at age 65 and overall make sure they are making wise financial decisions. Their risk tolerance is moderate. A budget analysis shows they will be able to put $10,000 more per year towards a financial plan. Questions *Where should they spend/invest based on their situation (not specific investments but categories such as a type of account (401k, IRA, savings account, etc.) or investment category (stock, bond, mutual fund, etc.) *Make sure to base things on the risk tolerance level and time horizon of when they plan to need the money. *Make recommendations based on debt repayment if that's part of the case such as credit cards, etc. *Make any other general personal finance recommendations as you see fit based on the info in the case.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the given information here are some recommendations for the couples financial situation a Retirement Planning 1 Maximize 401k Contributions T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started