Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your client's gross pay is $52,000 with a tax rate of 15%. Your client is paid semi-monthly and contributes 5% of gross pay to retirement.

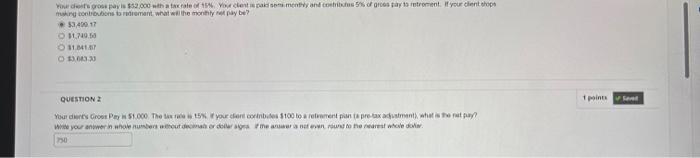

Your client's gross pay is $52,000 with a tax rate of 15%. Your client is paid semi-monthly and contributes 5% of gross pay to retirement. If your client stops making contributions to retirement, what will the monthly net pay be? $3,499.17 $1,749.58 $1,841.67 $3,683.33

QUESTION 2 Your client's Gross Pay is $1,000. The tax rate is 15%. If your client contributes $100 to a retirement plan (a pre-tax adjustment), what is the net pay? Write your answer in whole numbers without decimals or dollar signs. If the answer is not even, round to the nearest whole dollar. 750 is not the correct answer. please help me with these wuestions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started