Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your company currently has $400 million debt and $600 million equity, i.e. debt ratio of 40%. The current debt market condition prevents you from

![]()

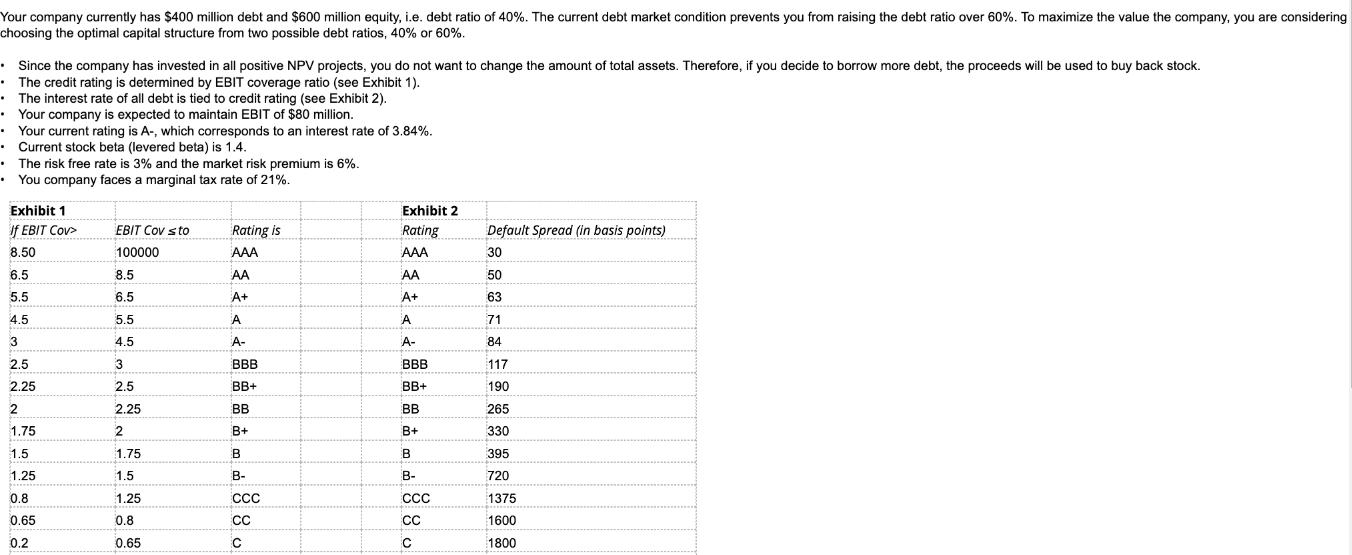

Your company currently has $400 million debt and $600 million equity, i.e. debt ratio of 40%. The current debt market condition prevents you from raising the debt ratio over 60%. To maximize the value the company, you are considering choosing the optimal capital structure from two possible debt ratios, 40% or 60%. Since the company has invested in all positive NPV projects, you do not want to change the amount of total assets. Therefore, if you decide to borrow more debt, the proceeds will be used to buy back stock. The credit rating is determined by EBIT coverage ratio (see Exhibit 1). The interest rate of all debt is tied to credit rating (see Exhibit 2). Your company is expected to maintain EBIT of $80 million. Your current rating is A-, which corresponds to an interest rate of 3.84%. Current stock beta (levered beta) is 1.4. The risk free rate is 3% and the market risk premium is 6%. You company faces a marginal tax rate of 21%. Exhibit 1 If EBIT Cov> 8.50 6.5 5.5 4.5 3 2.5 2.25 2 1.75 1.5 1.25 0.8 0.65 0.2 EBIT Cov sto 100000 8.5 6.5 5.5 4.5 3 2.5 2.25 2 1.75 1.5 1.25 0.8 0.65 Rating is AAA AA A+ A A- BBB BB+ BB B+ B B- CCC CC C Exhibit 2 Rating AAA AA A+ A A- BBB BB+ BB B+ B CCC CC C Default Spread (in basis points) 30 50 63 71 84 117 190 265 330 395 720 1375 1600 1800 -100000 0.2 D What is the cost of equity if debt ratio is increased to 60%? D 2000 If debt ratio is increased to 60%, the EBIT coverage ratio of the company will be reduced to 2.26. What will be the cost of debt for you company?

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

AUB 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started