Question

Your company has been in business for some time now, steadily building its revenue streams and implementing strategies for growth. Having gone public, you know

Your company has been in business for some time now, steadily building its revenue streams and implementing strategies for growth. Having gone public, you know the importance investors, creditors, and analysts place on various financial ratios and trends. You want to continue to act ethically, apply appropriate GAAP standards, and maintain high quality earnings. However, if there are areas where your company can improve financial ratios and trends, you want to take advantage of these opportunities and implement relevant strategies. For Module 12, your focus will be on the financial statement analysis.

You will complete four accounting tasks as well as answer several multiple choice questions to confirm what you know:

- Balance Sheet Analysis

- Income Statement Analysis

- Calculate Financial Ratios

- DuPont Analysis

For each task, review its specific instructions and complete the required data entry or tables provided.

Balance Sheet Analysis

2.5 points possible (graded)

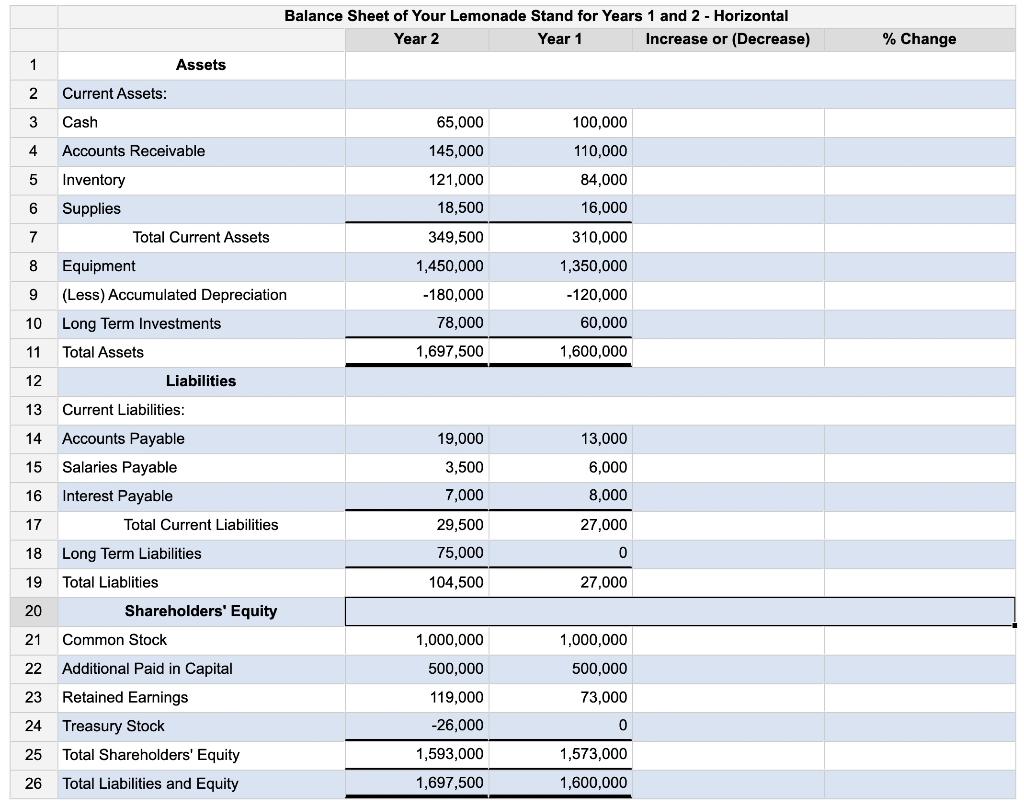

Horizontal Analysis

Below is your comparative balance sheet. Using horizontal analysis, first calculate the amount of the change from Year 1 to Year 2. For accounts that decreased, enter amount as negative. For the last column, calculate the percentage change from Year 1 to Year 2. For amounts that decreased, enter as negative. For dollar amounts, do not enter commas, dollar signs, or decimals. For percentages, convert to percent format (e.g. 0.6543 to 65.43).

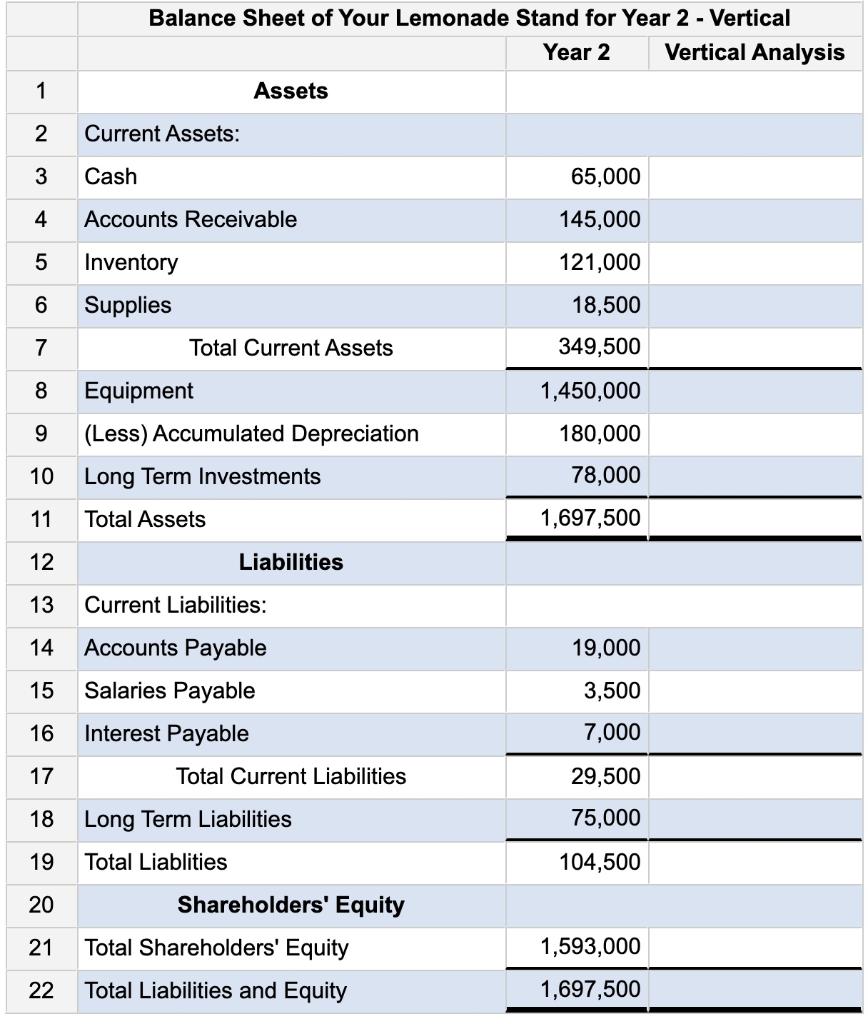

Vertical Analysis

Below is select information from your balance sheet. Perform vertical analysis for Year 2. For percentages, convert to percent format (e.g. 0.6543 to 65.43). Round answers to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started