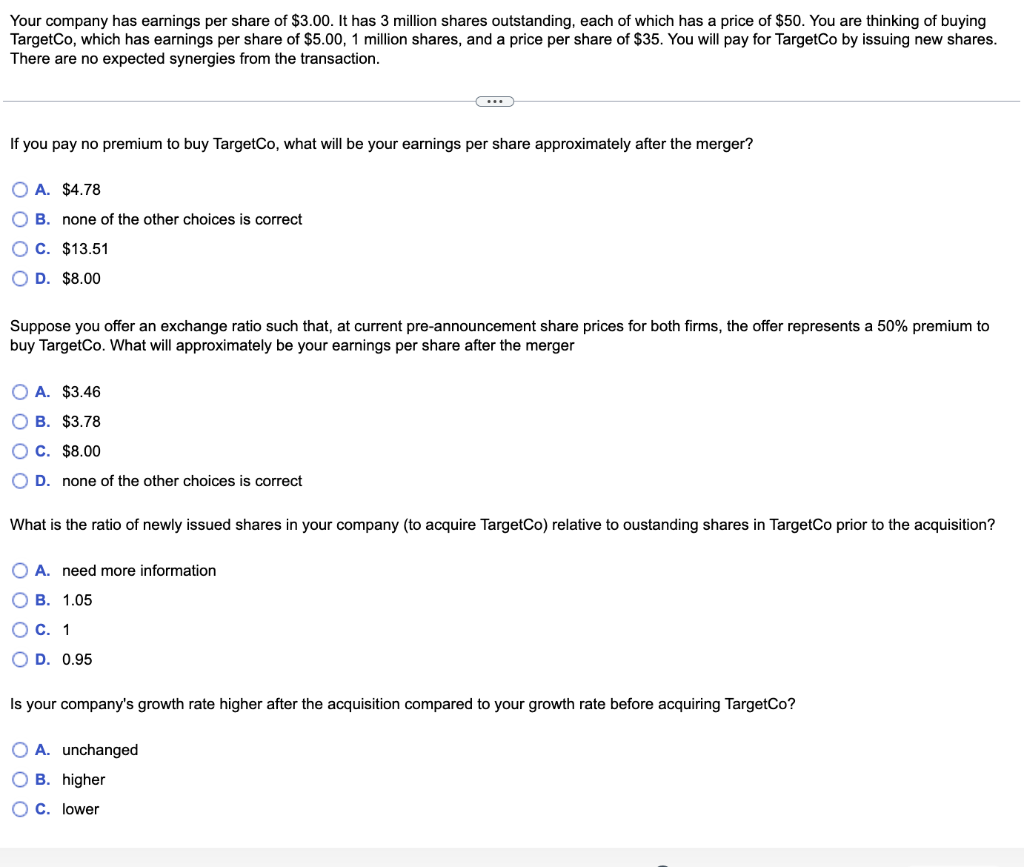

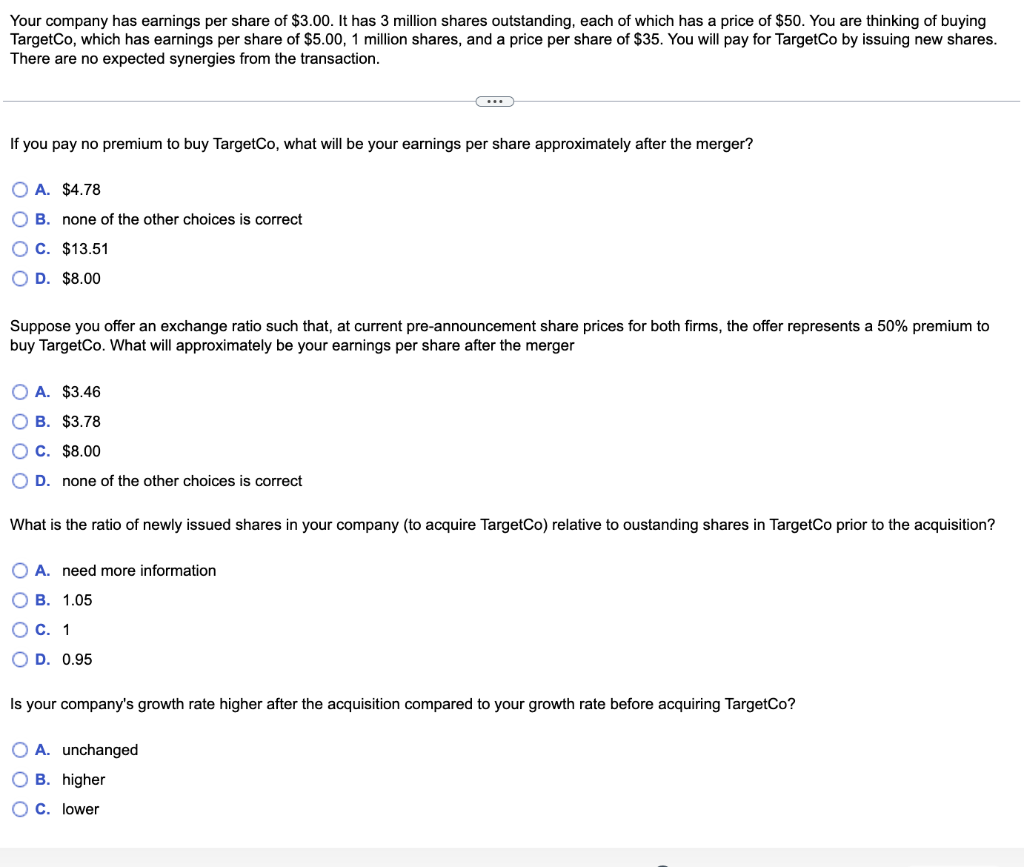

Your company has earnings per share of $3.00. It has 3 million shares outstanding, each of which has a price of $50. You are thinking of buying TargetCo, which has earnings per share of $5.00, 1 million shares, and a price per share of $35. You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction. If you pay no premium to buy TargetCo, what will be your earnings per share approximately after the merger? O A. $4.78 O B. none of the other choices is correct O C. $13.51 OD. $8.00 Suppose you offer an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 50% premium to buy TargetCo. What will approximately be your earnings per share after the merger O A. $3.46 OB. $3.78 O C. $8.00 OD. none of the other choices is correct What is the ratio of newly issued shares in your company (to acquire TargetCo) relative to oustanding shares in TargetCo prior to the acquisition? O A. need more information OB. 1.05 O C. 1 OD. 0.95 Is your company's growth rate higher after the acquisition compared to your growth rate before acquiring TargetCo? O A. unchanged OB. higher O C. lower Your company has earnings per share of $3.00. It has 3 million shares outstanding, each of which has a price of $50. You are thinking of buying TargetCo, which has earnings per share of $5.00, 1 million shares, and a price per share of $35. You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction. If you pay no premium to buy TargetCo, what will be your earnings per share approximately after the merger? O A. $4.78 O B. none of the other choices is correct O C. $13.51 OD. $8.00 Suppose you offer an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 50% premium to buy TargetCo. What will approximately be your earnings per share after the merger O A. $3.46 OB. $3.78 O C. $8.00 OD. none of the other choices is correct What is the ratio of newly issued shares in your company (to acquire TargetCo) relative to oustanding shares in TargetCo prior to the acquisition? O A. need more information OB. 1.05 O C. 1 OD. 0.95 Is your company's growth rate higher after the acquisition compared to your growth rate before acquiring TargetCo? O A. unchanged OB. higher O C. lower