Question: # Your company is considering 2 projects, Project IOT and Project ERP, each of which requires and initial outlay of 50 million BDT. Your company

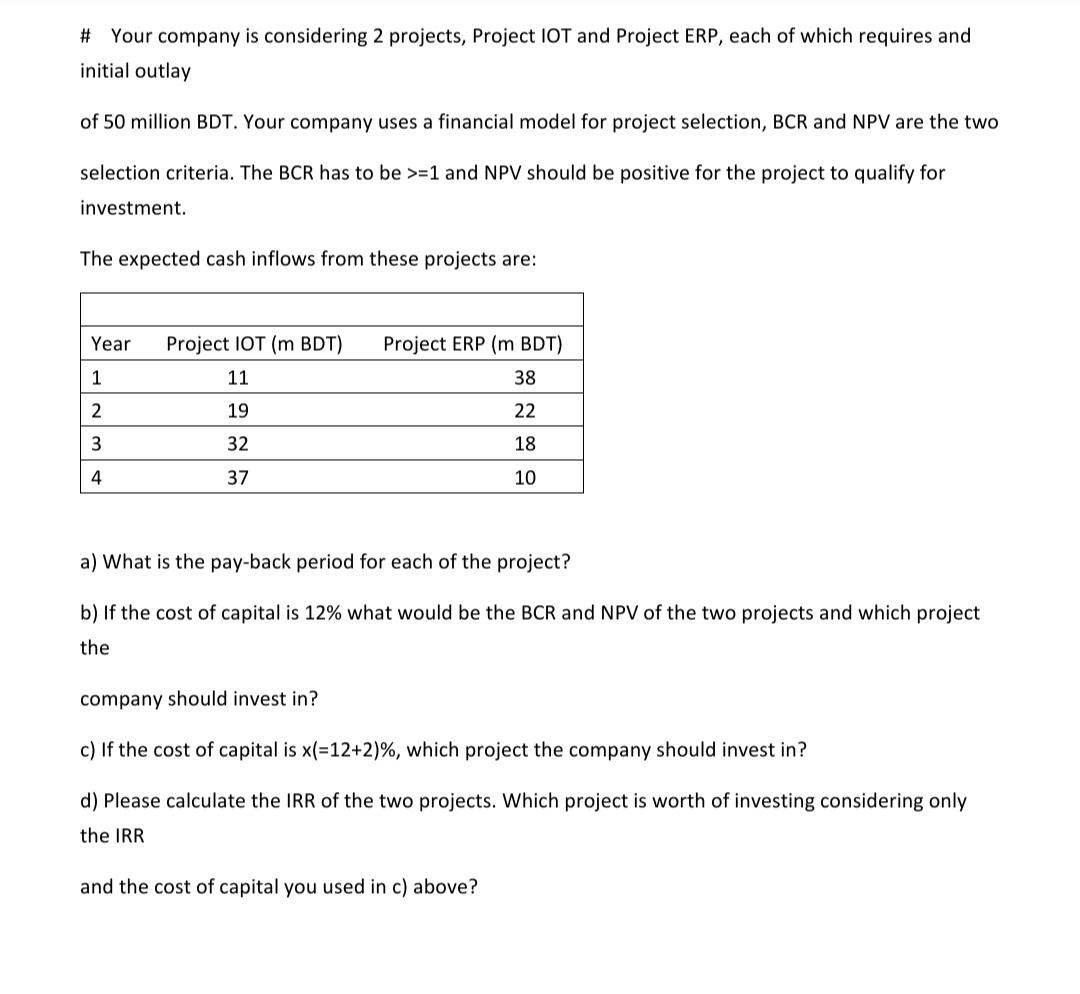

\# Your company is considering 2 projects, Project IOT and Project ERP, each of which requires and initial outlay of 50 million BDT. Your company uses a financial model for project selection, BCR and NPV are the two selection criteria. The BCR has to be >=1 and NPV should be positive for the project to qualify for investment. The expected cash inflows from these projects are: a) What is the pay-back period for each of the project? b) If the cost of capital is 12% what would be the BCR and NPV of the two projects and which project the company should invest in? c) If the cost of capital is x(=12+2)%, which project the company should invest in? d) Please calculate the IRR of the two projects. Which project is worth of investing considering only the IRR and the cost of capital you used in c) above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts