Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your corporation is considering investing in a new product line. The annual revenues (sales) for the new product line are expected to be $151,232.00

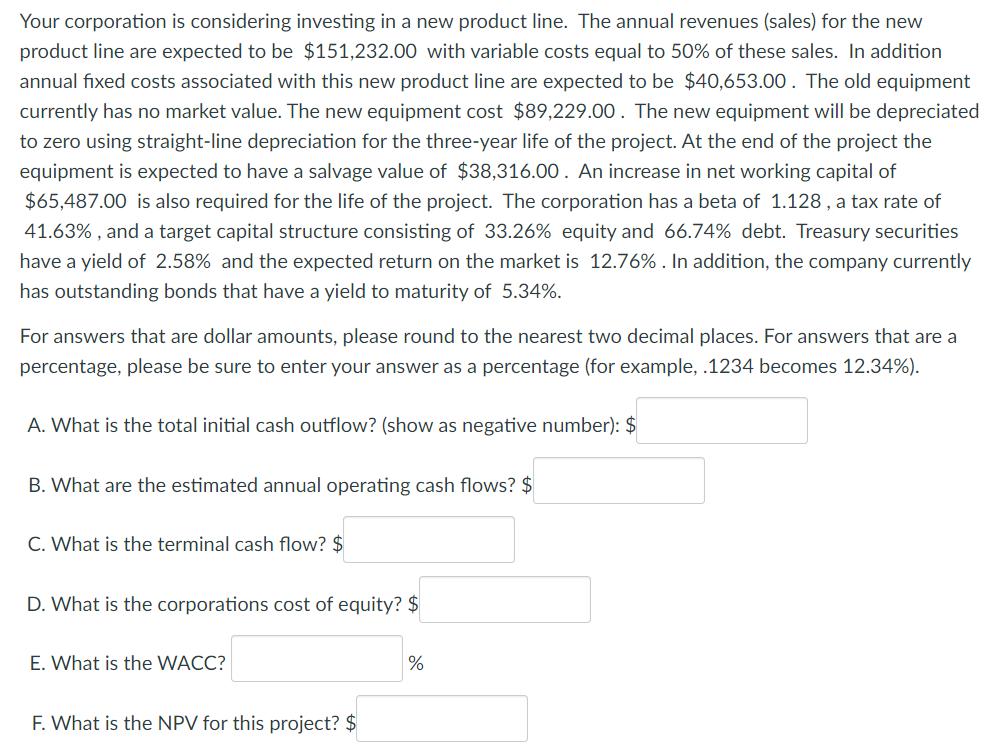

Your corporation is considering investing in a new product line. The annual revenues (sales) for the new product line are expected to be $151,232.00 with variable costs equal to 50% of these sales. In addition annual fixed costs associated with this new product line are expected to be $40,653.00. The old equipment currently has no market value. The new equipment cost $89,229.00. The new equipment will be depreciated to zero using straight-line depreciation for the three-year life of the project. At the end of the project the equipment is expected to have a salvage value of $38,316.00. An increase in net working capital of $65,487.00 is also required for the life of the project. The corporation has a beta of 1.128, a tax rate of 41.63%, and a target capital structure consisting of 33.26% equity and 66.74% debt. Treasury securities have a yield of 2.58% and the expected return on the market is 12.76%. In addition, the company currently has outstanding bonds that have a yield to maturity of 5.34%. For answers that are dollar amounts, please round to the nearest two decimal places. For answers that are a percentage, please be sure to enter your answer as a percentage (for example, .1234 becomes 12.34%). A. What is the total initial cash outflow? (show as negative number): $ B. What are the estimated annual operating cash flows? $ C. What is the terminal cash flow? $ D. What is the corporations cost of equity? $ E. What is the WACC? F. What is the NPV for this project? $ %

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the answers to each of your questions step by step A Total Initial Cash Outflow Initi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started