Question

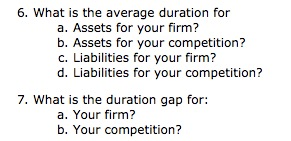

Your employer has asked you to examine the interest-rate risk of your bank relative to your direct competition. Management is concerned that interest rates will

Your employer has asked you to examine the interest-rate risk of your bank relative to your direct competition. Management is concerned that interest rates will fall by the end of the year and wants to see what would happen to the relative profitability of the firm if the decline actually occurs.

Interest-rate risk depends on each bank's relative position of interest-sensitive assets and liabilities. You begin the analysis by collecting the information and estimates.

please show clear calculation process (please do not just show a whole table without each equation and formula)

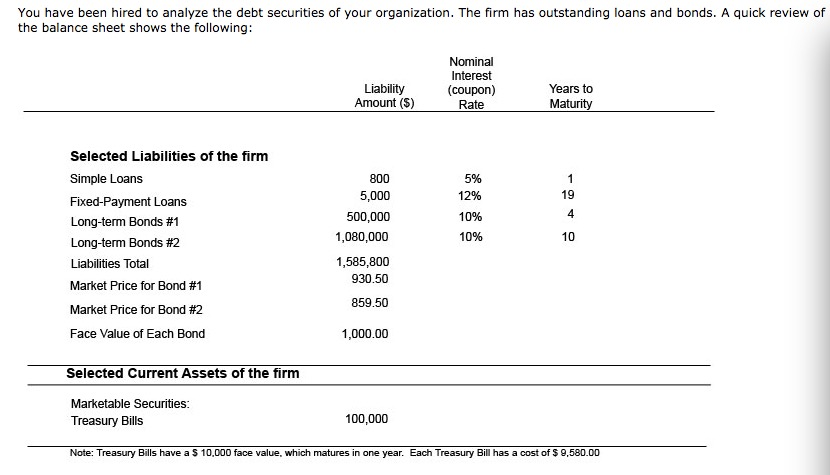

You have been hired to analyze the debt securities of your organization. The firm has outstanding loans and bonds. A quick review of the balance sheet shows the following: Nominal Interest (coupon) Rate Liability Amount (S) Years to Ma Selected Liabilities of the firm Simple Loans Fixed-Payment Loans Long-term Bonds #1 Long-term Bonds #2 Liabilities Total Market Price for Bond #1 Market Price for Bond #2 Face Value of Each Bond 800 5,000 500,000 1,080,000 1,585,800 930.50 859.50 5% 1296 1096 1096 4 10 1,000.00 Selected Current Assets of the firm Marketable Securities Treasury Bills 100,000 Note: Treasury Bills have a S 10,000 face value, which matures in one year. Each Treasury Bill has a cost of $ 9,580.00 You have been hired to analyze the debt securities of your organization. The firm has outstanding loans and bonds. A quick review of the balance sheet shows the following: Nominal Interest (coupon) Rate Liability Amount (S) Years to Ma Selected Liabilities of the firm Simple Loans Fixed-Payment Loans Long-term Bonds #1 Long-term Bonds #2 Liabilities Total Market Price for Bond #1 Market Price for Bond #2 Face Value of Each Bond 800 5,000 500,000 1,080,000 1,585,800 930.50 859.50 5% 1296 1096 1096 4 10 1,000.00 Selected Current Assets of the firm Marketable Securities Treasury Bills 100,000 Note: Treasury Bills have a S 10,000 face value, which matures in one year. Each Treasury Bill has a cost of $ 9,580.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started