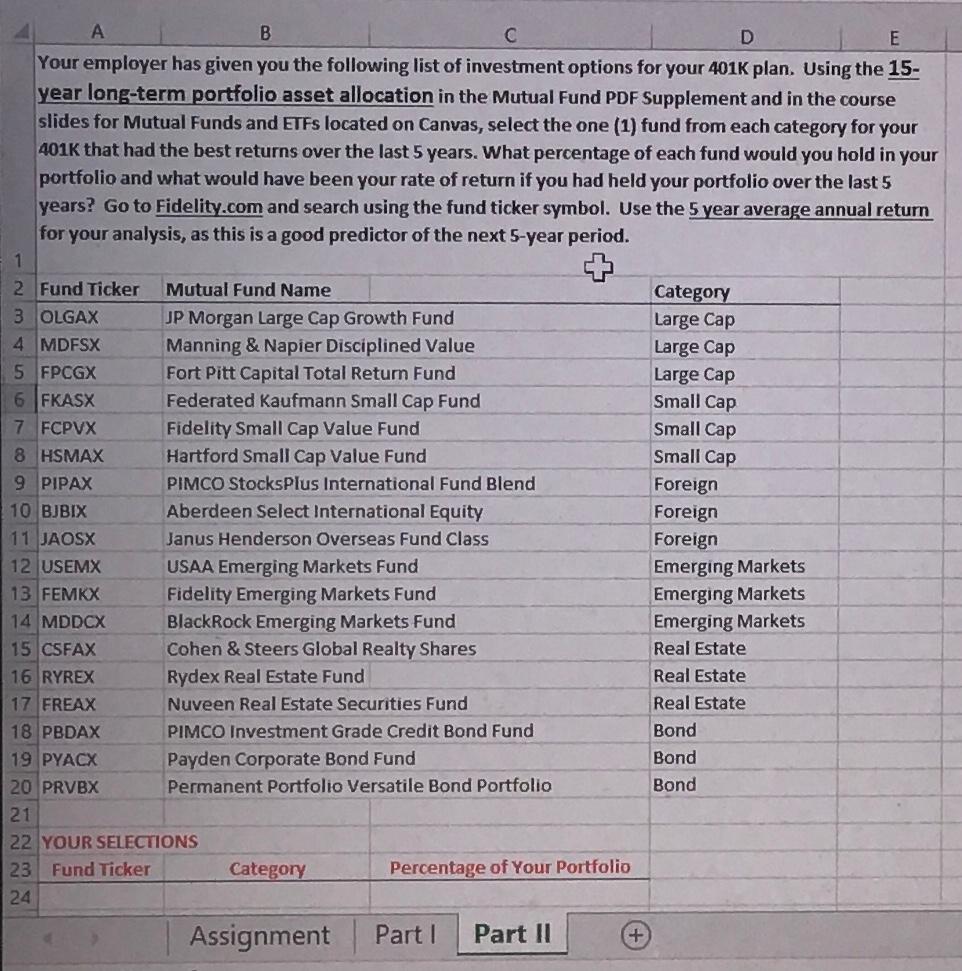

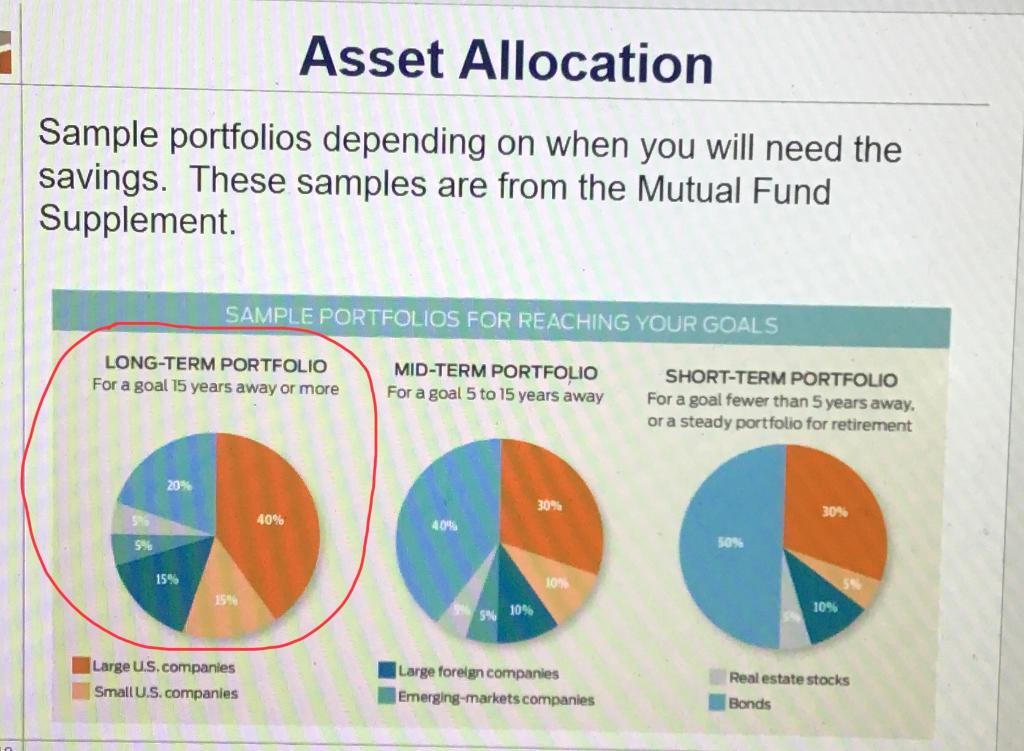

| Your employer has given you the following list of investment options for your 401K plan. Using the 15-year long-term portfolio asset allocation in the Mutual Fund PDF Supplement and in the course slides for Mutual Funds and ETFs located on Canvas, select the one (1) fund from each category for your 401K that had the best returns over the last 5 years. What percentage of each fund would you hold in your portfolio and what would have been your rate of return if you had held your portfolio over the last 5 years? Go to Fidelity.com and search using the fund ticker symbol. Use the 5 year average annual return for your analysis, as this is a good predictor of the next 5-year period. |

A B C D E Your employer has given you the following list of investment options for your 401K plan. Using the 15- year long-term portfolio asset allocation in the Mutual Fund PDF Supplement and in the course slides for Mutual Funds and ETFS located on Canvas, select the one (1) fund from each category for your 401K that had the best returns over the last 5 years. What percentage of each fund would you hold in your portfolio and what would have been your rate of return if you had held your portfolio over the last 5 years? Go to Fidelity.com and search using the fund ticker symbol. Use the 5 year average annual return for your analysis, as this is a good predictor of the next 5-year period. 1 2 Fund Ticker Mutual Fund Name Category Large Cap 3 OLGAX JP Morgan Large Cap Growth Fund 4 MDFSX Large Cap Manning & Napier Disciplined Value Fort Pitt Capital Total Return Fund Federated Kaufmann Small Cap Fund 5 FPCGX 6 FKASX Large Cap Small Cap Fidelity Small Cap Value Fund Small Cap 7 FCPVX 8 HSMAX Hartford Small Cap Value Fund Small Cap PIMCO StocksPlus International Fund Blend Foreign Aberdeen Select International Equity Foreign Janus Henderson Overseas Fund Class Foreign USAA Emerging Markets Fund Emerging Markets 9 PIPAX 10 BJBIX 11 JAOSX 12 USEMX 13 FEMKX 14 MDDCX 15 CSFAX 16 RYREX 17 FREAX Fidelity Emerging Markets Fund Emerging Markets BlackRock Emerging Markets Fund Emerging Markets Real Estate Cohen & Steers Global Realty Shares Rydex Real Estate Fund Real Estate Nuveen Real Estate Securities Fund Real Estate 18 PBDAX PIMCO Investment Grade Credit Bond Fund Bond 19 PYACX Payden Corporate Bond Fund Bond 20 PRVBX Permanent Portfolio Versatile Bond Portfolio Bond 21 22 YOUR SELECTIONS 23 Fund Ticker Category 24 Assignment Percentage of Your Portfolio Part I Part II + Asset Allocation Sample portfolios depending on when you will need the savings. These samples are from the Mutual Fund Supplement. SAMPLE PORTFOLIOS FOR REACHING YOUR GOALS LONG-TERM PORTFOLIO For a goal 15 years away or more MID-TERM PORTFOLIO For a goal 5 to 15 years away 20% 30% 40% 40% 5% 15% 15% Large U.S. companies Small U.S. companies 10% 5% 10% Large foreign companies Emerging-markets companies SHORT-TERM PORTFOLIO For a goal fewer than 5 years away. or a steady portfolio for retirement 30% 50% 10% Real estate stocks Bonds A B C D E Your employer has given you the following list of investment options for your 401K plan. Using the 15- year long-term portfolio asset allocation in the Mutual Fund PDF Supplement and in the course slides for Mutual Funds and ETFS located on Canvas, select the one (1) fund from each category for your 401K that had the best returns over the last 5 years. What percentage of each fund would you hold in your portfolio and what would have been your rate of return if you had held your portfolio over the last 5 years? Go to Fidelity.com and search using the fund ticker symbol. Use the 5 year average annual return for your analysis, as this is a good predictor of the next 5-year period. 1 2 Fund Ticker Mutual Fund Name Category Large Cap 3 OLGAX JP Morgan Large Cap Growth Fund 4 MDFSX Large Cap Manning & Napier Disciplined Value Fort Pitt Capital Total Return Fund Federated Kaufmann Small Cap Fund 5 FPCGX 6 FKASX Large Cap Small Cap Fidelity Small Cap Value Fund Small Cap 7 FCPVX 8 HSMAX Hartford Small Cap Value Fund Small Cap PIMCO StocksPlus International Fund Blend Foreign Aberdeen Select International Equity Foreign Janus Henderson Overseas Fund Class Foreign USAA Emerging Markets Fund Emerging Markets 9 PIPAX 10 BJBIX 11 JAOSX 12 USEMX 13 FEMKX 14 MDDCX 15 CSFAX 16 RYREX 17 FREAX Fidelity Emerging Markets Fund Emerging Markets BlackRock Emerging Markets Fund Emerging Markets Real Estate Cohen & Steers Global Realty Shares Rydex Real Estate Fund Real Estate Nuveen Real Estate Securities Fund Real Estate 18 PBDAX PIMCO Investment Grade Credit Bond Fund Bond 19 PYACX Payden Corporate Bond Fund Bond 20 PRVBX Permanent Portfolio Versatile Bond Portfolio Bond 21 22 YOUR SELECTIONS 23 Fund Ticker Category 24 Assignment Percentage of Your Portfolio Part I Part II + Asset Allocation Sample portfolios depending on when you will need the savings. These samples are from the Mutual Fund Supplement. SAMPLE PORTFOLIOS FOR REACHING YOUR GOALS LONG-TERM PORTFOLIO For a goal 15 years away or more MID-TERM PORTFOLIO For a goal 5 to 15 years away 20% 30% 40% 40% 5% 15% 15% Large U.S. companies Small U.S. companies 10% 5% 10% Large foreign companies Emerging-markets companies SHORT-TERM PORTFOLIO For a goal fewer than 5 years away. or a steady portfolio for retirement 30% 50% 10% Real estate stocks Bonds