Question

Your firm has a cost of capital of 18.7%. You are considering two projects. Project A will cost $121,000 and provide benefits of $27,000

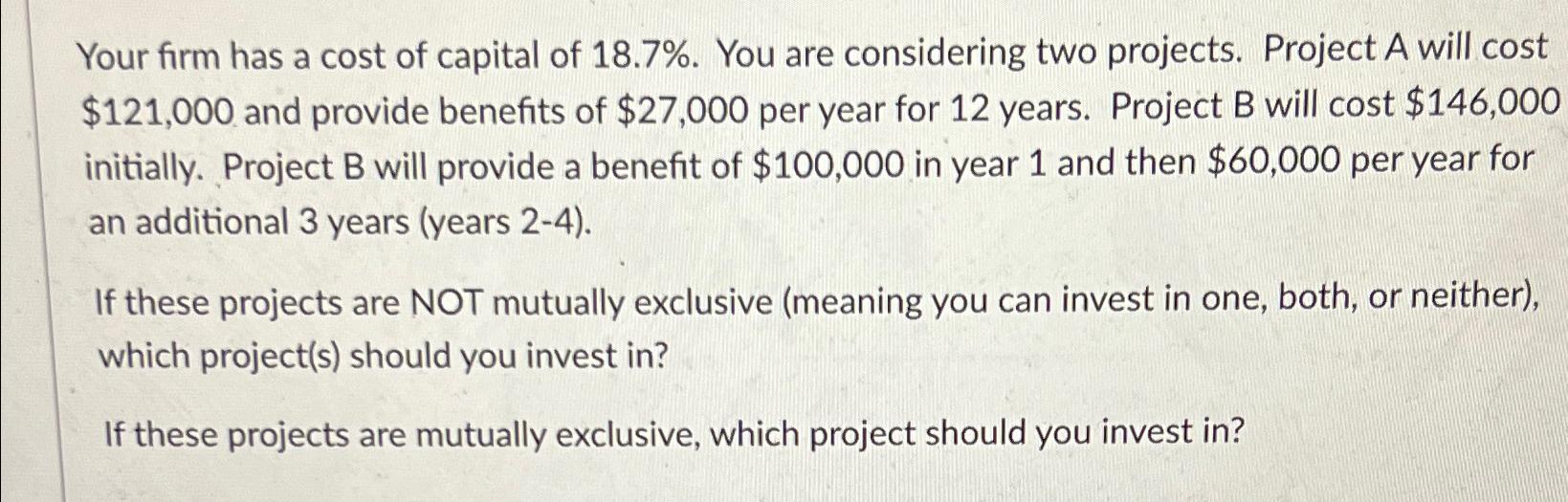

Your firm has a cost of capital of 18.7%. You are considering two projects. Project A will cost $121,000 and provide benefits of $27,000 per year for 12 years. Project B will cost $146,000 initially. Project B will provide a benefit of $100,000 in year 1 and then $60,000 per year for an additional 3 years (years 2-4). If these projects are NOT mutually exclusive (meaning you can invest in one, both, or neither), which project(s) should you invest in? If these projects are mutually exclusive, which project should you invest in?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Project Selection Analysis 1 Project Evaluation We will evaluate each project independently using Ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting For Business

Authors: Peter Scott

3rd Edition

0198807791, 978-0198807797

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App