Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm has been engaged by the management of Bambi Ltd (Bambi) to undertake a review of and provide an assurance report on the

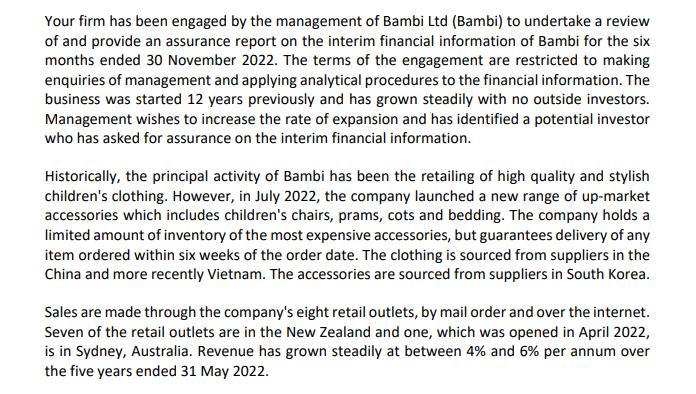

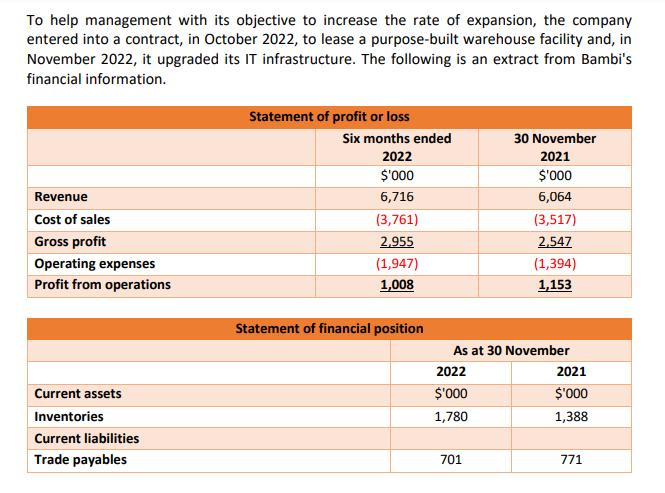

Your firm has been engaged by the management of Bambi Ltd (Bambi) to undertake a review of and provide an assurance report on the interim financial information of Bambi for the six months ended 30 November 2022. The terms of the engagement are restricted to making enquiries of management and applying analytical procedures to the financial information. The business was started 12 years previously and has grown steadily with no outside investors. Management wishes to increase the rate of expansion and has identified a potential investor who has asked for assurance on the interim financial information. Historically, the principal activity of Bambi has been the retailing of high quality and stylish children's clothing. However, in July 2022, the company launched a new range of up-market accessories which includes children's chairs, prams, cots and bedding. The company holds a limited amount of inventory of the most expensive accessories, but guarantees delivery of any item ordered within six weeks of the order date. The clothing is sourced from suppliers in the China and more recently Vietnam. The accessories are sourced from suppliers in South Korea. Sales are made through the company's eight retail outlets, by mail order and over the internet. Seven of the retail outlets are in the New Zealand and one, which was opened in April 2022, is in Sydney, Australia. Revenue has grown steadily at between 4% and 6% per annum over the five years ended 31 May 2022. To help management with its objective to increase the rate of expansion, the company entered into a contract, in October 2022, to lease a purpose-built warehouse facility and, in November 2022, it upgraded its IT infrastructure. The following is an extract from Bambi's financial information. Statement of profit or loss Six months ended 30 November 2022 2021 $'000 $'000 Revenue 6,716 6,064 Cost of sales (3,761) (3,517) Gross profit 2,955 2,547 Operating expenses (1,947) (1,394) Profit from operations 1,008 1,153 Statement of financial position As at 30 November Current assets Inventories Current liabilities Trade payables 2022 $'000 1,780 701 2021 $'000 1,388 771 Your preliminary analytical procedures have identified the following as matters of significance to discuss with management: Six months ended 2022 30 November 2021 6% Increase in revenue 10.80% 44% 42% Gross profit margin Operating margin 15% 19% Inventory days 86 days 72 days Trade payables days 34 days 40 days Required: A. Prepare briefing notes on the matters which you wish to discuss with the management of Bambi in respect of the information provided in the scenario. Your notes should include reference to the results of your preliminary analytical procedures. Note: You are not required to calculate any additional ratios. (18 marks) B. Comment on the level of assurance provided by the report on the financial information of Bambi and explain how and why it differs from the level of assurance provided by an auditor's report on annual financial statements. (5 marks)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Question A Based on the results of the analytical procedures there are more increase in revenues dur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started