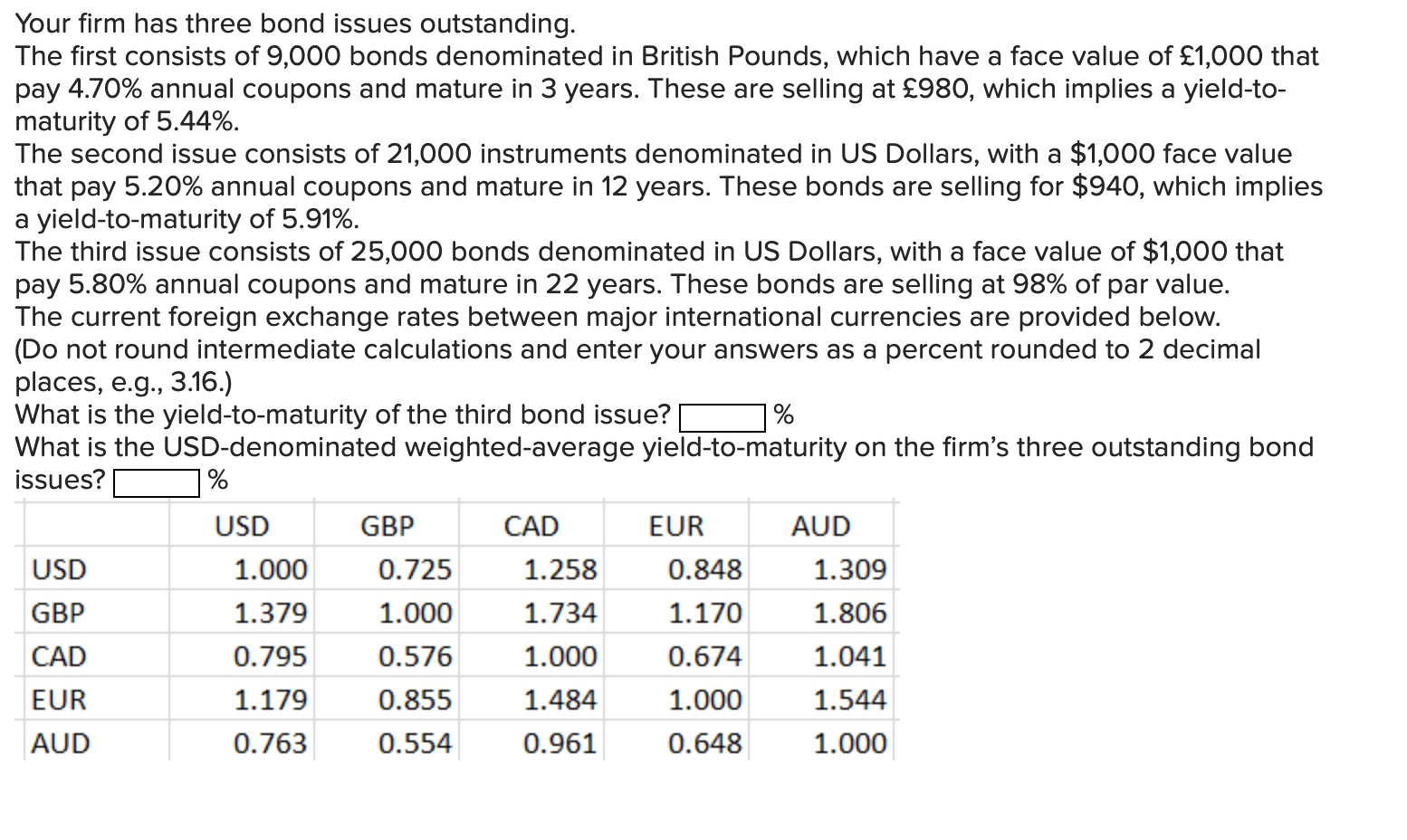

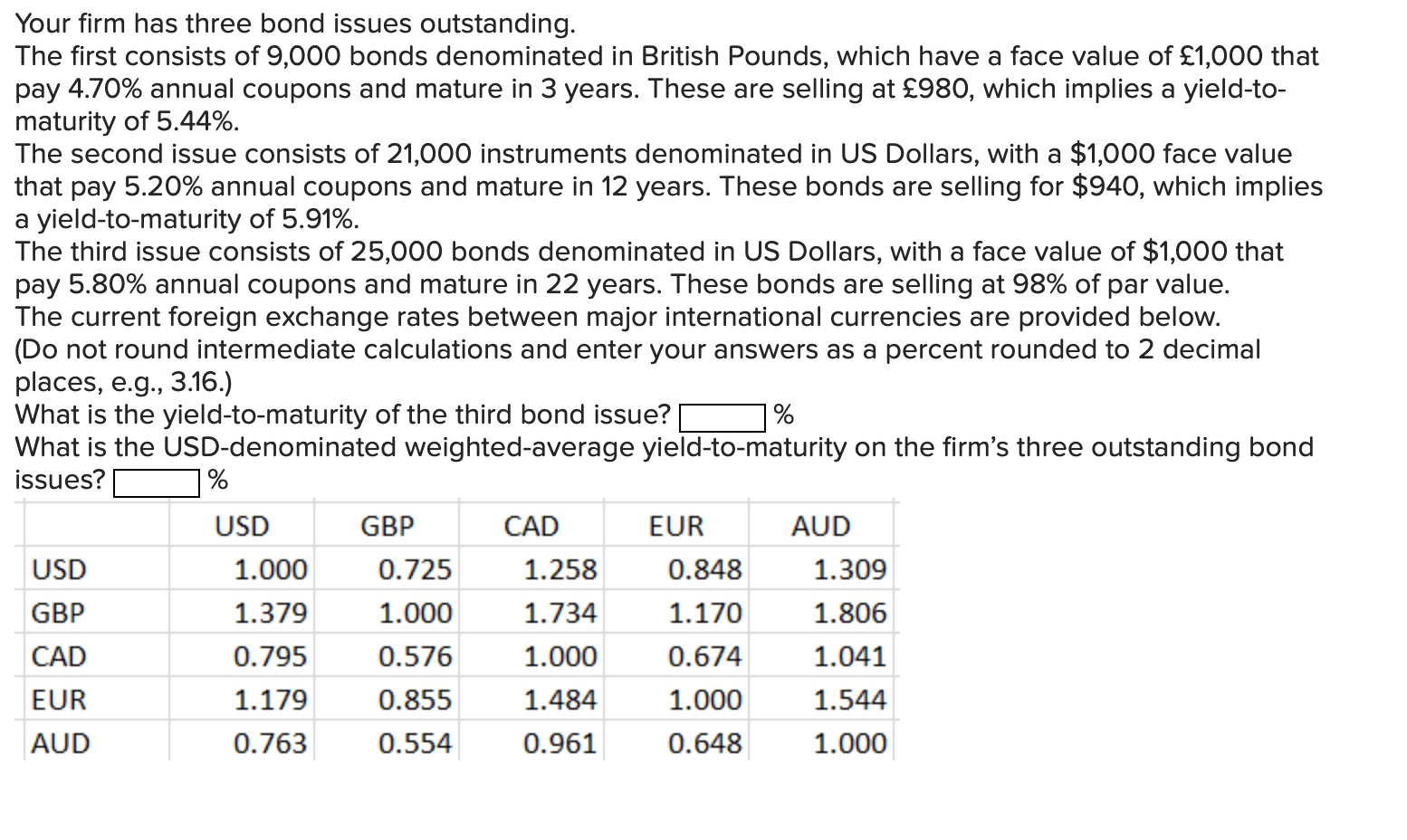

Your firm has three bond issues outstanding. The first consists of 9,000 bonds denominated in British Pounds, which have a face value of 1,000 that pay 4.70% annual coupons and mature in 3 years. These are selling at 980, which implies a yield-to- maturity of 5.44%. The second issue consists of 21,000 instruments denominated in US Dollars, with a $1,000 face value that pay 5.20% annual coupons and mature in 12 years. These bonds are selling for $940, which implies a yield-to-maturity of 5.91%. The third issue consists of 25,000 bonds denominated in US Dollars, with a face value of $1,000 that pay 5.80% annual coupons and mature in 22 years. These bonds are selling at 98% of par value. The current foreign exchange rates between major international currencies are provided below. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 3.16.) What is the yield-to-maturity of the third bond issue? % What is the USD-denominated weighted-average yield-to-maturity on the firm's three outstanding bond issues? % USD GBP CAD EUR AUD USD 1.000 0.725 1.258 0.848 1.309 GBP 1.379 1.000 1.734 1.170 1.806 CAD 0.795 0.576 1.000 0.674 1.041 EUR 1.179 0.855 1.484 1.000 1.544 AUD 0.763 0.554 0.961 0.648 1.000 Your firm has three bond issues outstanding. The first consists of 9,000 bonds denominated in British Pounds, which have a face value of 1,000 that pay 4.70% annual coupons and mature in 3 years. These are selling at 980, which implies a yield-to- maturity of 5.44%. The second issue consists of 21,000 instruments denominated in US Dollars, with a $1,000 face value that pay 5.20% annual coupons and mature in 12 years. These bonds are selling for $940, which implies a yield-to-maturity of 5.91%. The third issue consists of 25,000 bonds denominated in US Dollars, with a face value of $1,000 that pay 5.80% annual coupons and mature in 22 years. These bonds are selling at 98% of par value. The current foreign exchange rates between major international currencies are provided below. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 3.16.) What is the yield-to-maturity of the third bond issue? % What is the USD-denominated weighted-average yield-to-maturity on the firm's three outstanding bond issues? % USD GBP CAD EUR AUD USD 1.000 0.725 1.258 0.848 1.309 GBP 1.379 1.000 1.734 1.170 1.806 CAD 0.795 0.576 1.000 0.674 1.041 EUR 1.179 0.855 1.484 1.000 1.544 AUD 0.763 0.554 0.961 0.648 1.000