Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm is comparing two mutually exclusive investment opportunities, one lasting 3 years and the other lasting 6 years. At a 1 0 % cost

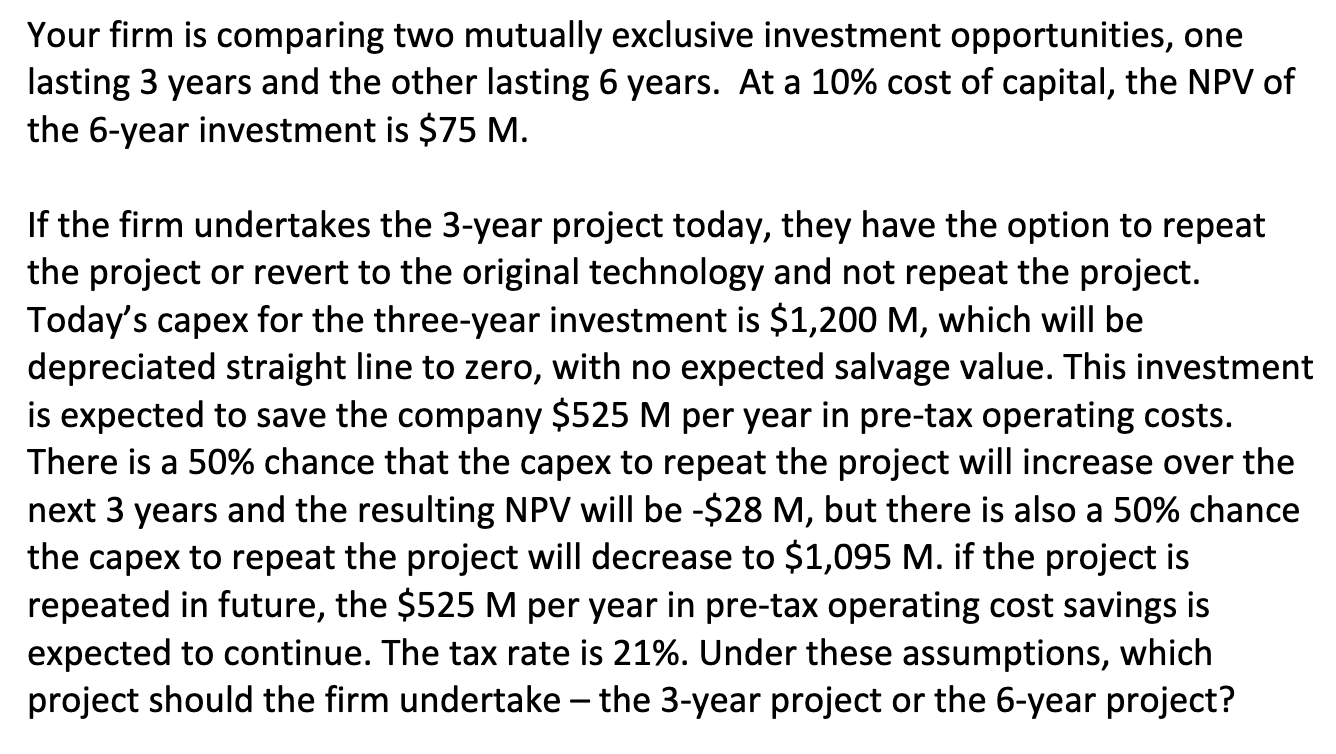

Your firm is comparing two mutually exclusive investment opportunities, one

lasting years and the other lasting years. At a cost of capital, the NPV of

the year investment is $

If the firm undertakes the year project today, they have the option to repeat

the project or revert to the original technology and not repeat the project.

Today's capex for the threeyear investment is $ which will be

depreciated straight line to zero, with no expected salvage value. This investment

is expected to save the company $ per year in pretax operating costs.

There is a chance that the capex to repeat the project will increase over the

next years and the resulting NPV will be $ but there is also a chance

the capex to repeat the project will decrease to $ if the project is

repeated in future, the $ per year in pretax operating cost savings is

expected to continue. The tax rate is Under these assumptions, which

project should the firm undertake the year project or the year project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started