Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm is considering a new investment project producing a new product. You expect to be able to sell 1 0 0 , 0 0

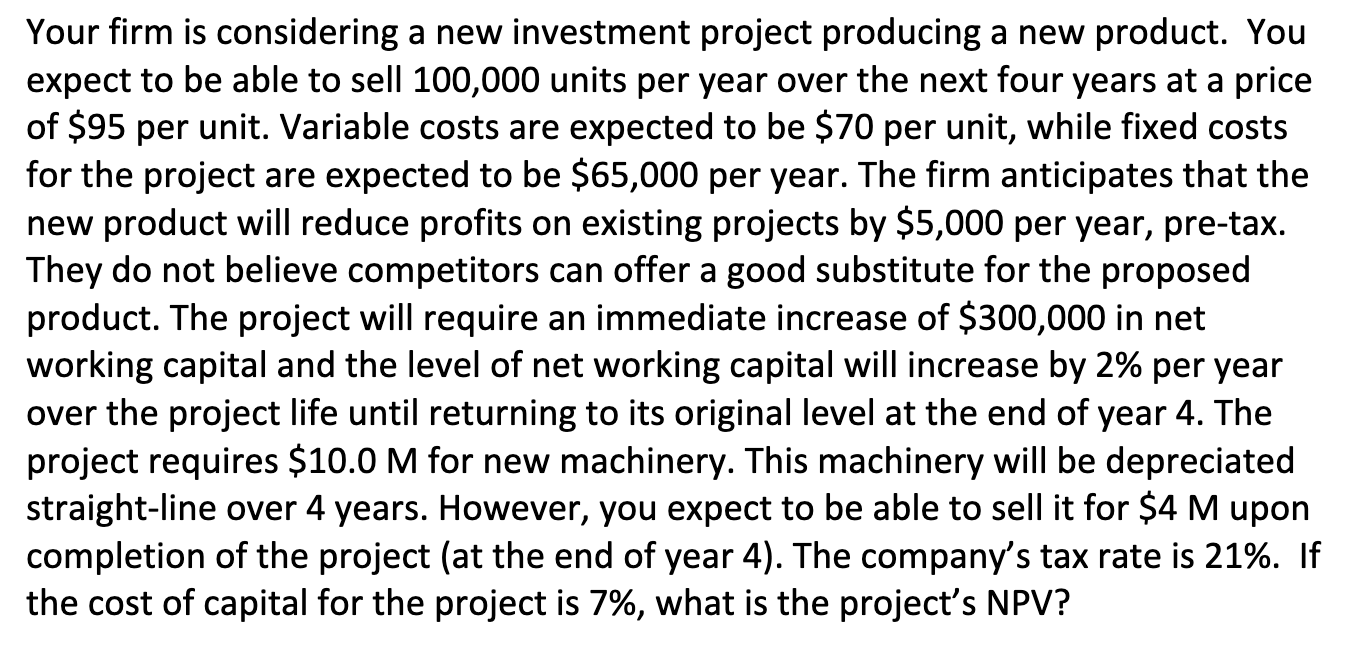

Your firm is considering a new investment project producing a new product. You

expect to be able to sell units per year over the next four years at a price

of $ per unit. Variable costs are expected to be $ per unit, while fixed costs

for the project are expected to be $ per year. The firm anticipates that the

new product will reduce profits on existing projects by $ per year, pretax.

They do not believe competitors can offer a good substitute for the proposed

product. The project will require an immediate increase of $ in net

working capital and the level of net working capital will increase by per year

over the project life until returning to its original level at the end of year The

project requires $ for new machinery. This machinery will be depreciated

straightline over years. However, you expect to be able to sell it for $ upon

completion of the project at the end of year The company's tax rate is If

the cost of capital for the project is what is the project's NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started