Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm owns a plane that it will eventually need to replace. Suppose the plane can be sold today, one year from now, or two

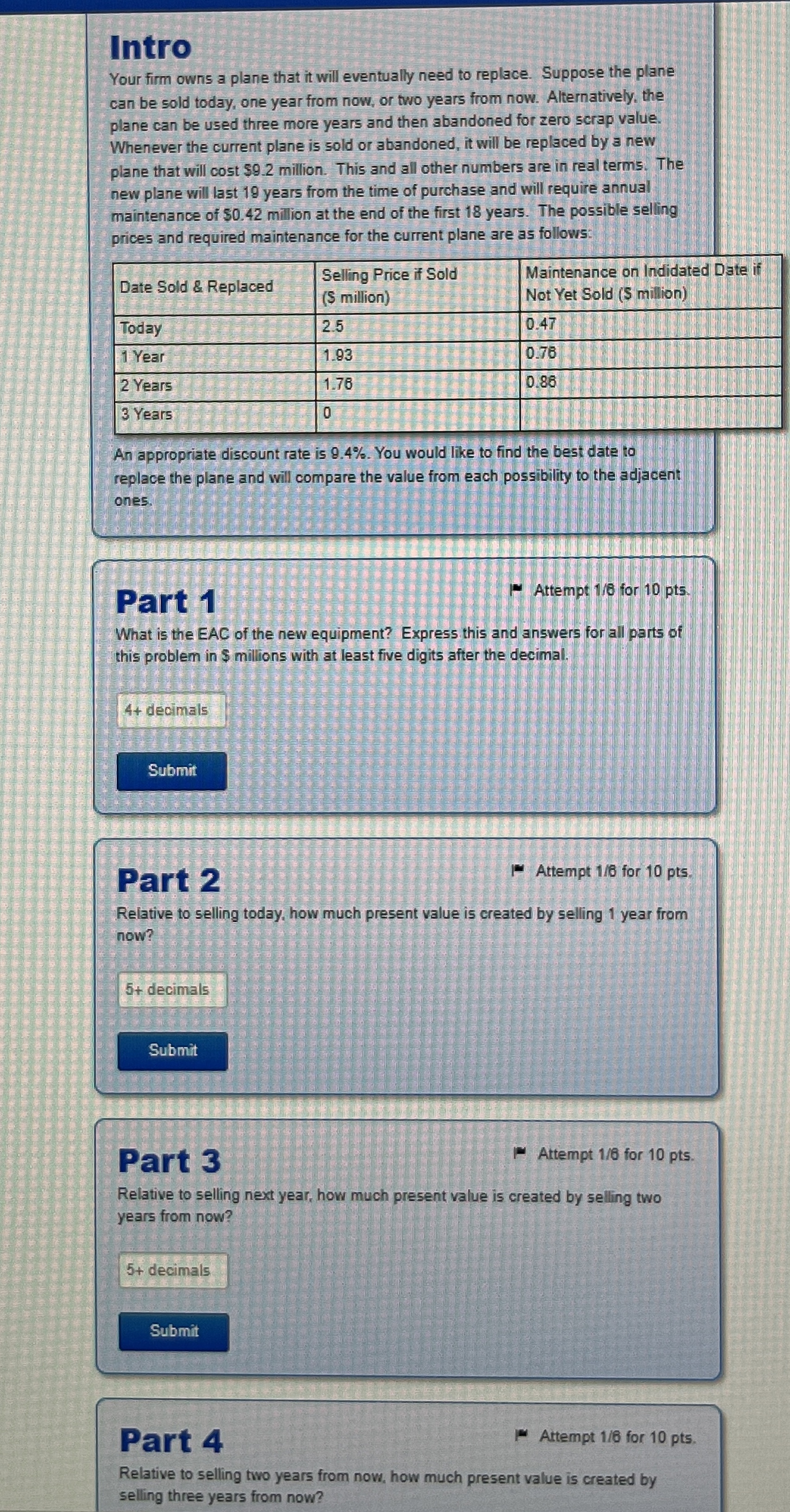

Your firm owns a plane that it will eventually need to replace. Suppose the plane

can be sold today, one year from now, or two years from now. Alternatively, the

plane can be used three more years and then abandoned for zere scrap value.

Whenever the current plane is sold or abandoned, it will be replaced by a new

plane that will cost $ million. This and all other numbers are in real terms. The

new plane will last years from the time of purchase and will require annual

maintenance of $ million at the end of the first years. The possible selling

prices and required maintenance for the current plane are as follows:

An appropriate discount rate is You would like to find the best date to

replace the plane and will compare the value from each possibility to the adjacent

ones.

Part

Attempt for pts

What is the EAC of the new equipment? Express this and answers for all parts of

this problem in $ millions with at least five digits after the decimal.

Part

Attempt for pts

Relative to selling today, how much present value is created by selling year from

now?

Part

Attempt for pts

Relative to selling next year, how much present value is created by selling two

years from now?

Part

Relative to how much present v

Intro

Your firm owns a plane that it will eventually need to replace. Suppose the plane

can be sold today, one year from now, or two years from now. Alternatively, the

plane can be used three more years and then abandoned for zero scrap value.

Whenever the current plane is sold or abandoned, it will be replaced by a new

plane that will cost $ million. This and all other numbers are in real terms. The

new plane will last years from the time of purchase and will require annual

maintenance of $ milion at the end of the first years. The possible selling

prices and required maintenance for the current plane are as follows:

An appropriate discount rate is You would like to find the best date to

replace the plane and will compare the value from each possibility to the adjacent

ones.

Part

What is the EAC of the new equipment? Express this and answers for all parts of

this problem in $ millions with at least five digits after the decimal.

Part

Relative to selling today, how much present value is created by selling year from

now?

Part

Relative to selling next year, how much present value is created by selling two

years from now?

decimals

Part

Relative to selling two years from now, how much present value is created by

selling three years from now?

Intro

Your firm owns a plane that it will eventually need to replace. Suppose the plane

can be sold today, one year from now, or two years from now. Alternatively, the

plane can be used three more years and then abandoned for zero scrap value.

Whenever the current plane is sold or abandoned, it will be replaced by a new

plane that will cost $ million. This and all other numbers are in real terms. The

new plane will last years from the time of purchase and will require annual

maintenance of $ milion at the end of the first years. The possible selling

prices and required maintenance for the current plane are as follows:

An appropriate discount rate is You would like to find the best date to

replace the plane and will compare the value from each possibility to the adjacent

ones.

Part

What is the EAC of the new equipment? Express this and answers for all parts of

this problem in $ millions with at least five digits after the decimal.

Part

Relative to selling today, how much present value is created by selling year from

now?

Part

Relative to selling next year, how much present value is created by selling two

years from now?

decimals

Part

Relative to selling two years from now, how much present value is created by

selling three years from now?alue is created by

selling three years from now?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started