Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm would like to evaluate a proposed new operating division. You have forecasted cash flows for this division for the next five years, and

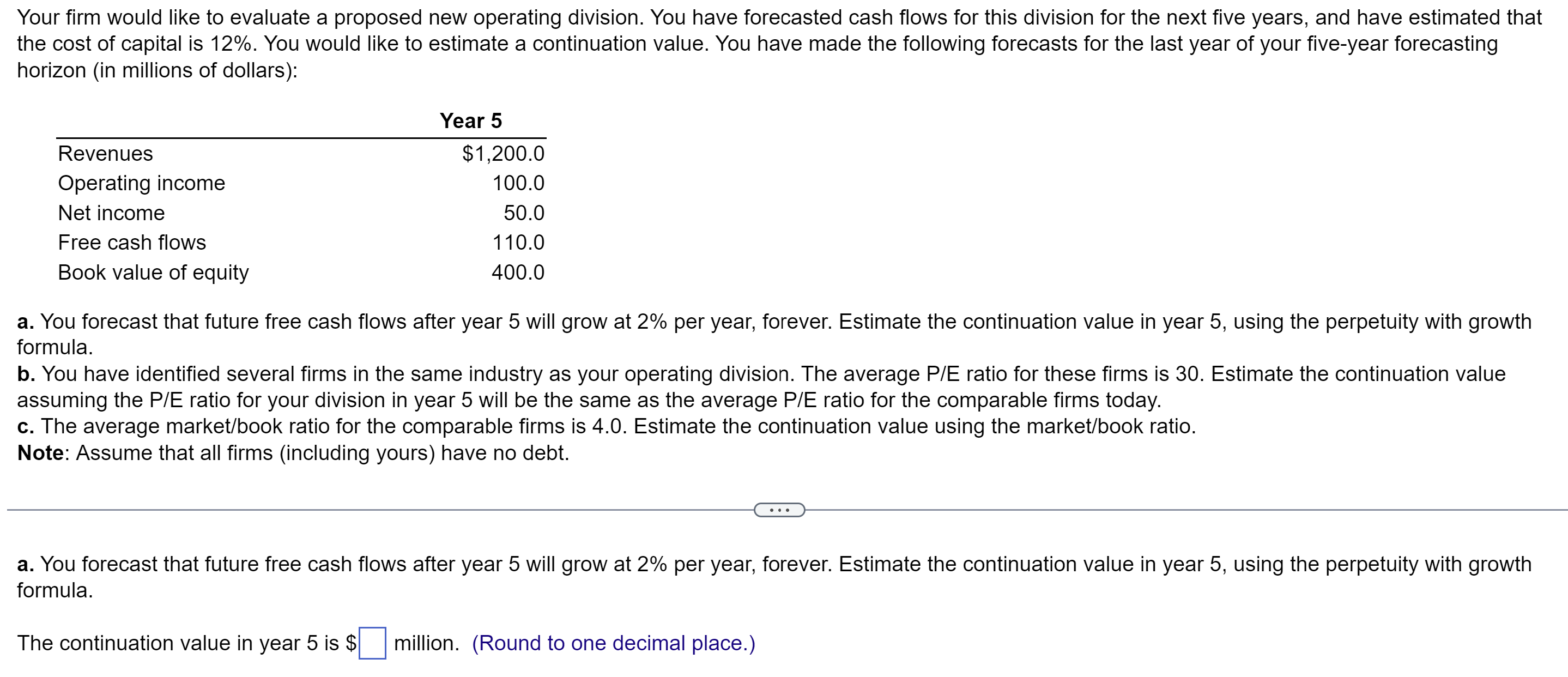

Your firm would like to evaluate a proposed new operating division. You have forecasted cash flows for this division for the next five years, and have estimated that the cost of capital is 12%. You would like to estimate a continuation value. You have made the following forecasts for the last year of your five-year forecasting horizon (in millions of dollars): a. You forecast that future free cash flows after year 5 will grow at 2% per year, forever. Estimate the continuation value in year 5 , using the perpetuity with growth formula. b. You have identified several firms in the same industry as your operating division. The average P/E ratio for these firms is 30 . Estimate the continuation value assuming the P/E ratio for your division in year 5 will be the same as the average P/E ratio for the comparable firms today. c. The average market/book ratio for the comparable firms is 4.0. Estimate the continuation value using the market/book ratio. Note: Assume that all firms (including yours) have no debt. a. You forecast that future free cash flows after year 5 will grow at 2% per year, forever. Estimate the continuation value in year 5 , using the perpetuity with growth formula. The continuation value in year 5 is $ million. (Round to one decimal place.)

Your firm would like to evaluate a proposed new operating division. You have forecasted cash flows for this division for the next five years, and have estimated that the cost of capital is 12%. You would like to estimate a continuation value. You have made the following forecasts for the last year of your five-year forecasting horizon (in millions of dollars): a. You forecast that future free cash flows after year 5 will grow at 2% per year, forever. Estimate the continuation value in year 5 , using the perpetuity with growth formula. b. You have identified several firms in the same industry as your operating division. The average P/E ratio for these firms is 30 . Estimate the continuation value assuming the P/E ratio for your division in year 5 will be the same as the average P/E ratio for the comparable firms today. c. The average market/book ratio for the comparable firms is 4.0. Estimate the continuation value using the market/book ratio. Note: Assume that all firms (including yours) have no debt. a. You forecast that future free cash flows after year 5 will grow at 2% per year, forever. Estimate the continuation value in year 5 , using the perpetuity with growth formula. The continuation value in year 5 is $ million. (Round to one decimal place.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started