Answered step by step

Verified Expert Solution

Question

1 Approved Answer

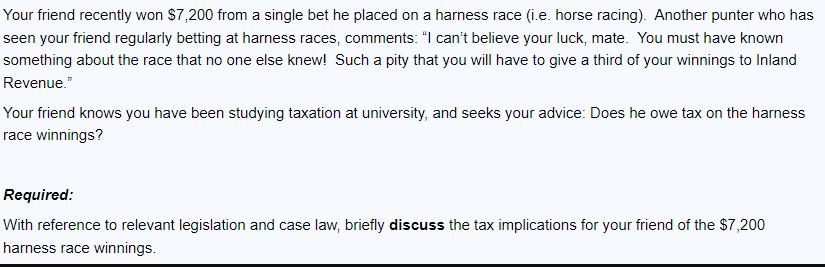

Your friend recently won $7,200 from a single bet he placed on a harness race (i.e. horse racing). Another punter who has seen your

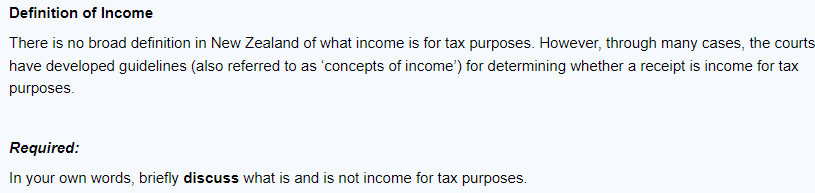

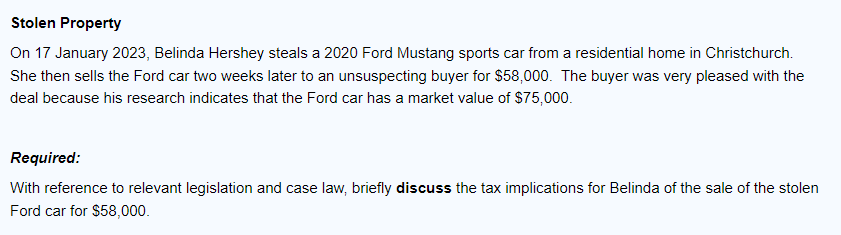

Your friend recently won $7,200 from a single bet he placed on a harness race (i.e. horse racing). Another punter who has seen your friend regularly betting at harness races, comments: "I can't believe your luck, mate. You must have known something about the race that no one else knew! Such a pity that you will have to give a third of your winnings to Inland Revenue." Your friend knows you have been studying taxation at university, and seeks your advice: Does he owe tax on the harness race winnings? Required: With reference to relevant legislation and case law, briefly discuss the tax implications for your friend of the $7,200 harness race winnings. Definition of Income There is no broad definition in New Zealand of what income is for tax purposes. However, through many cases, the courts have developed guidelines (also referred to as 'concepts of income') for determining whether a receipt is income for tax purposes. Required: In your own words, briefly discuss what is and is not income for tax purposes. Stolen Property On 17 January 2023, Belinda Hershey steals a 2020 Ford Mustang sports car from a residential home in Christchurch. She then sells the Ford car two weeks later to an unsuspecting buyer for $58,000. The buyer was very pleased with the deal because his research indicates that the Ford car has a market value of $75,000. Required: With reference to relevant legislation and case law, briefly discuss the tax implications for Belinda of the sale of the stolen Ford car for $58,000.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

In most jurisdictions including the United States gambling winnings are generally considered taxable income The Internal Revenue Service IRS considers gambling winnings as taxable income and requires ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started