Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your job is to create a set of GAAP financial statements (income statement, balance sheet, statement of owners equity and cash flow statement). You have

Your job is to create a set of GAAP financial statements (income statement, balance sheet, statement of owners equity and cash flow statement).

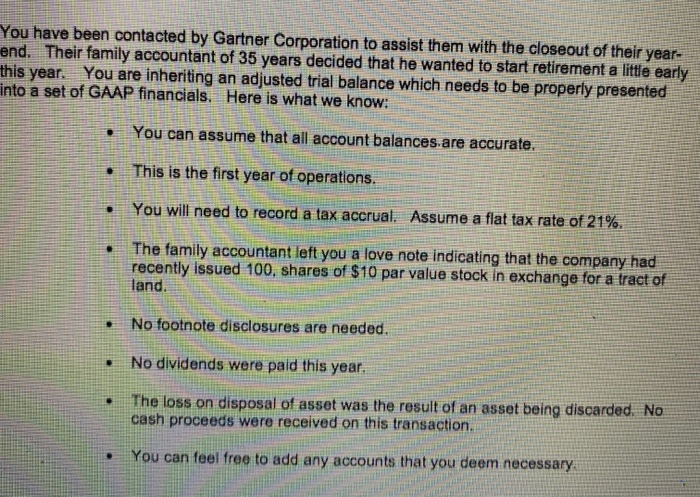

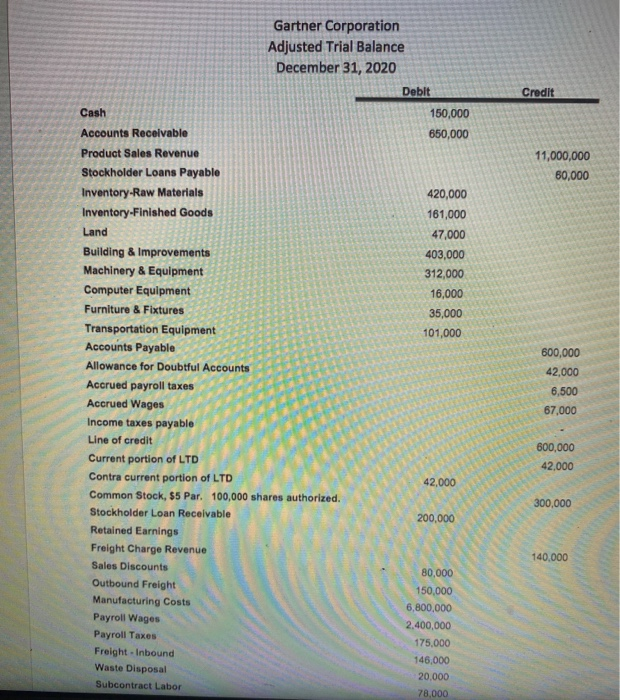

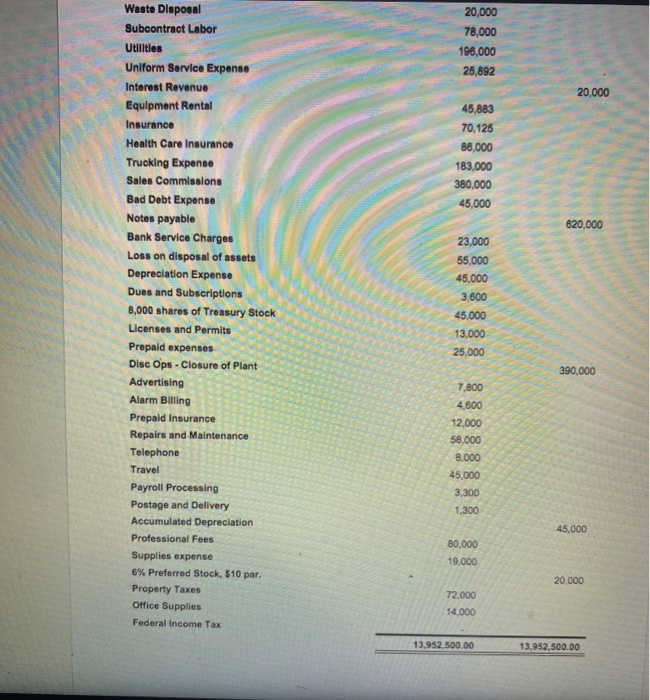

You have been contacted by Gartner Corporation to assist them with the closeout of their year- end. Their family accountant of 35 years decided that he wanted to start retirement a little early You are inheriting an adjusted trial balance which needs to be properly presented into a set of GAAP financials. Here is what we know: this year. o You can assume that all account balances are accurate, . This is the first year of operations. You will need to record a tax accrual. Assume a flat tax rate of 21%. . The family accountant left you a love note indicating that the company had recently issued 100, shares of $10 par value stock in exchange for a tract of land. . No footnote disclosures are needed. No dividends were paid this year. . The loss on disposal of asset was the result of an asset being discarded. No cash proceeds were received on this transaction. You can feel free to add any accounts that you deem necessary Gartner Corporation Adjusted Trial Balance December 31, 2020 Debit Credit Cash 150,000 Accounts Receivable 650,000 11,000,000 60,000 420,000 161,000 47,000 403,000 312,000 16,000 35,000 101,000 600,000 42,000 6,500 67,000 Product Sales Revenue Stockholder Loans Payable Inventory-Raw Materials Inventory-Finished Goods Land Building & Improvements Machinery & Equipment Computer Equipment Furniture & Fixtures Transportation Equipment Accounts Payable Allowance for Doubtful Accounts Accrued payroll taxes Accrued Wages Income taxes payable Line of credit Current portion of LTD Contra current portion of LTD Common Stock, 65 Par. 100,000 shares authorized Stockholder Loan Receivable Retained Earnings Freight Charge Revenue Sales Discounts Outbound Freight Manufacturing Costs Payroll Wages Payroll Taxes Freight - Inbound Waste Disposal Subcontract Labor 600,000 42,000 42,000 300,000 200,000 140.000 80,000 150,000 6,800,000 2.400,000 175.000 146,000 20.000 78,000 20,000 78,000 198,000 25,892 20,000 45,883 70,125 88,000 183,000 380,000 45,000 620,000 Waste Disposal Subcontract Labor Utilities Uniform Service Expense Interest Revenue Equipment Rental Insurance Health Care Insurance Trucking Expense Sales Commissions Bad Debt Expense Notes payable Bank Service Charges Loss on disposal of assets Depreciation Expense Dues and Subscriptions 8,000 shares of Treasury Stock Licenses and Permits Prepaid expenses Disc Ops - Closure of Plant Advertising Alarm Billing Prepaid Insurance Repairs and Maintenance Telephone Travel Payroll Processing Postage and Delivery Accumulated Depreciation Professional Fees Supplies expense 6% Preferred Stock, 510 par. Property Taxes Office Supplies Federal Income Tax 23,000 55,000 45,000 3,600 45,000 13,000 25,000 390,000 7,800 4,600 12,000 58,000 8.000 45,000 3,300 1.300 45,000 80,000 19.000 20,000 72.000 14,000 13.952,500.00 13,952,500.00 You have been contacted by Gartner Corporation to assist them with the closeout of their year- end. Their family accountant of 35 years decided that he wanted to start retirement a little early You are inheriting an adjusted trial balance which needs to be properly presented into a set of GAAP financials. Here is what we know: this year. o You can assume that all account balances are accurate, . This is the first year of operations. You will need to record a tax accrual. Assume a flat tax rate of 21%. . The family accountant left you a love note indicating that the company had recently issued 100, shares of $10 par value stock in exchange for a tract of land. . No footnote disclosures are needed. No dividends were paid this year. . The loss on disposal of asset was the result of an asset being discarded. No cash proceeds were received on this transaction. You can feel free to add any accounts that you deem necessary Gartner Corporation Adjusted Trial Balance December 31, 2020 Debit Credit Cash 150,000 Accounts Receivable 650,000 11,000,000 60,000 420,000 161,000 47,000 403,000 312,000 16,000 35,000 101,000 600,000 42,000 6,500 67,000 Product Sales Revenue Stockholder Loans Payable Inventory-Raw Materials Inventory-Finished Goods Land Building & Improvements Machinery & Equipment Computer Equipment Furniture & Fixtures Transportation Equipment Accounts Payable Allowance for Doubtful Accounts Accrued payroll taxes Accrued Wages Income taxes payable Line of credit Current portion of LTD Contra current portion of LTD Common Stock, 65 Par. 100,000 shares authorized Stockholder Loan Receivable Retained Earnings Freight Charge Revenue Sales Discounts Outbound Freight Manufacturing Costs Payroll Wages Payroll Taxes Freight - Inbound Waste Disposal Subcontract Labor 600,000 42,000 42,000 300,000 200,000 140.000 80,000 150,000 6,800,000 2.400,000 175.000 146,000 20.000 78,000 20,000 78,000 198,000 25,892 20,000 45,883 70,125 88,000 183,000 380,000 45,000 620,000 Waste Disposal Subcontract Labor Utilities Uniform Service Expense Interest Revenue Equipment Rental Insurance Health Care Insurance Trucking Expense Sales Commissions Bad Debt Expense Notes payable Bank Service Charges Loss on disposal of assets Depreciation Expense Dues and Subscriptions 8,000 shares of Treasury Stock Licenses and Permits Prepaid expenses Disc Ops - Closure of Plant Advertising Alarm Billing Prepaid Insurance Repairs and Maintenance Telephone Travel Payroll Processing Postage and Delivery Accumulated Depreciation Professional Fees Supplies expense 6% Preferred Stock, 510 par. Property Taxes Office Supplies Federal Income Tax 23,000 55,000 45,000 3,600 45,000 13,000 25,000 390,000 7,800 4,600 12,000 58,000 8.000 45,000 3,300 1.300 45,000 80,000 19.000 20,000 72.000 14,000 13.952,500.00 13,952,500.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started