Answered step by step

Verified Expert Solution

Question

1 Approved Answer

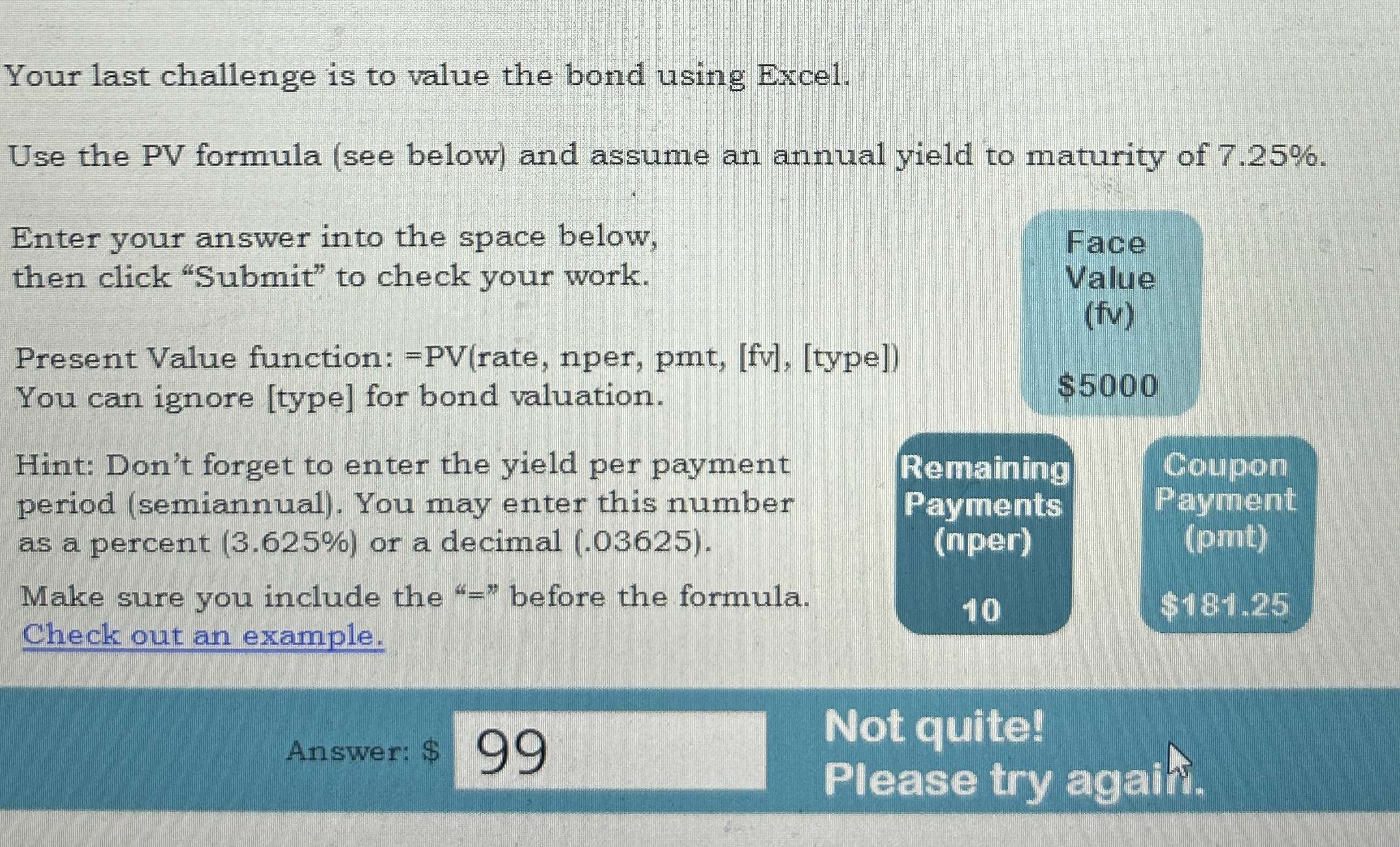

Your last challenge is to value the bond using Excel. Use the PV formula ( see below ) and assume an annual yield to maturity

Your last challenge is to value the bond using Excel.

Use the PV formula see below and assume an annual yield to maturity of

Enter your answer into the space below,

then click "Submit" to check your work.

Present Value function: rate nper, pmtfvtype

You can ignore type for bond valuation.

Face

Value

fv

$

Your last challenge is to value the bond using Excel.

Use the PV formula see below and assume an annual yield to maturity of

Enter your answer into the space below,

then click "Submit" to check your work.

Present Value function: rate, nper, pmtfvtype

You can ignore type for bond valuation.

Face

Value

fv

$

Hint: Don't forget to enter the yield per payment

period semiannual You may enter this number

as a percent or a decimal

Make sure you include the before the formula.

Check out an example.

Answer: $

Not quite!

Please try agahf.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started