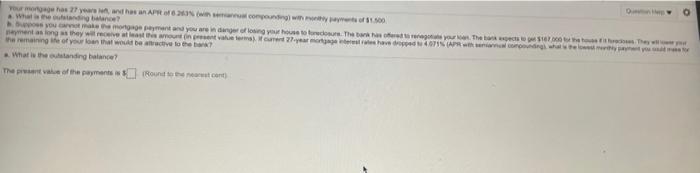

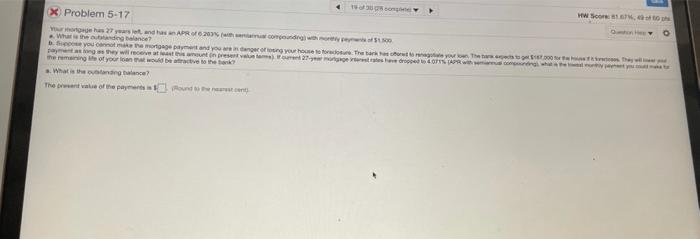

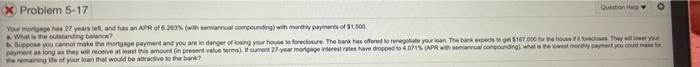

Your mortgage has 28 years left, and has an APR of 6.558% (with semiannual compounding) with monthly payments of $1500 a. What is the outstanding balance? b. Suppose you cannot make the mortgage payment and you are in danger of losing your house to foreclosure. The bank has offered to renegotiate your loan. The bank expects to get $167000 for the house if it forecloses. They will lower your payment as long as they will receive at least this amount (in present value terms). If current 28 -year mortgage interest rates have dropped to 4.263% (APR with semiannual compounding), what is the lowest monthly payment you could make for the remaining life of your loan that would be attractive to the bank?

plz dont do above one. instead do this.

You sy and has an AR 6 compte s you make more at and you are found out how to down. The resource. Then he mayment as long as they receive as the most interest mortgage rates have de 4071 APR or whale the remaining of your that we traction What is the standing balance? There of the payments Rounter cert) HW SONG X Problem 5-17 was wat and has APR 06.200cm Was the big balance ce you cannot make it and you can get on your house for the barro corto you. There pay they will receive the winter mongoose OS APR which was the remaining of your or would be trive to the What is the once? The rent vatie of the payments were X Problem 5-17 Button Your morges 7 years left, and has an APR 260 with compounding with monthly payment of 1.500 What meaning oss you cannot make a mortgage payment and you are indenger of losing your house for the banks to it your own The burred 5187.000 They nasiongey will receive the mountain presente coment2 year morate vedopped to 41. APR compounding what is more you could the age of your loan that would be active to the bank? You sy and has an AR 6 compte s you make more at and you are found out how to down. The resource. Then he mayment as long as they receive as the most interest mortgage rates have de 4071 APR or whale the remaining of your that we traction What is the standing balance? There of the payments Rounter cert) HW SONG X Problem 5-17 was wat and has APR 06.200cm Was the big balance ce you cannot make it and you can get on your house for the barro corto you. There pay they will receive the winter mongoose OS APR which was the remaining of your or would be trive to the What is the once? The rent vatie of the payments were X Problem 5-17 Button Your morges 7 years left, and has an APR 260 with compounding with monthly payment of 1.500 What meaning oss you cannot make a mortgage payment and you are indenger of losing your house for the banks to it your own The burred 5187.000 They nasiongey will receive the mountain presente coment2 year morate vedopped to 41. APR compounding what is more you could the age of your loan that would be active to the bank