Question

Your question: Course: ACC 212 Sweet Acacia Company prepares monthly cash budgets. Relevant data from operating budgets for 2023 are as follows: January February Sales

Your question:

Course: ACC 212

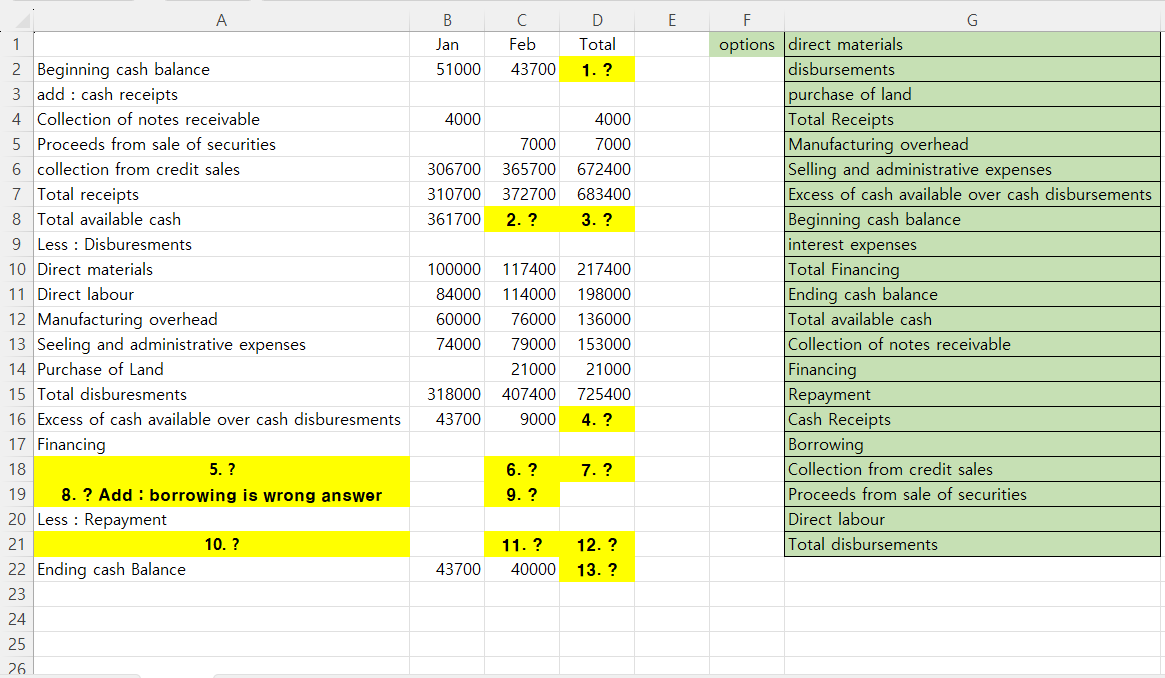

Sweet Acacia Company prepares monthly cash budgets. Relevant data from operating budgets for 2023 are as follows:

| January | February | |||

| Sales | $349,000 | $396,000 | ||

| Direct materials purchases | 121,000 | 109,000 | ||

| Direct labour | 84,000 | 114,000 | ||

| Manufacturing overhead | 60,000 | 76,000 | ||

| Selling and administrative expenses | 74,000 | 79,000 |

All sales are on account. Sweet Acacia expects collections to be 50% in the month of sale, 40% in the first month following the sale, and 10% in the second month following the sale. It pays 30% of direct materials purchases in cash in the month of purchase and the balance due in the month following the purchase. Other data are as follows:

| 1. | Credit sales: November 2022, $198,000; December 2022, $281,000 |

| 2. | Purchases of direct materials: December 2022, $91,000 |

| 3. | Other receipts: January?collection of December 31, 2022, notes receivable $4,000; February?proceeds from sale of securities $7,000 |

| 4. | Other disbursements: February?payment of $21,000 for land |

The company expects its cash balance on January 1, 2023, to be $51,000. It wants to maintain a minimum cash balance of $40,000. Prepare a cash budget for January and February using columns for each month. Please fill all the yellow blanks / all the numbers given are correct answers Please tell me the answer in order. 1.

2.

3.

4.

5. Choose one among the options

6.

7.

8. Choose one among the options

9.

10. Choose one among the options

11.

12.

13.

1 2 Beginning cash balance 3 add cash receipts options direct materials A B C D E F Jan Feb Total 51000 43700 1. ? 4 Collection of notes receivable 5 Proceeds from sale of securities 6 collection from credit sales 7 Total receipts 8 Total available cash 9 Less: Disburesments 10 Direct materials 11 Direct labour 12 Manufacturing overhead 13 Seeling and administrative expenses 14 Purchase of Land 4000 4000 7000 7000 306700 365700 672400 310700 372700 361700 2. ? 683400 3. ? 100000 117400 217400 84000 114000 198000 60000 76000 136000 74000 79000 153000 21000 21000 725400 15 Total disburesments 318000 407400 16 Excess of cash available over cash disburesments 17 Financing 43700 9000 4. ? 18 5. ? 19 8. ? Add borrowing is wrong answer 20 Less: Repayment 21 22 Ending cash Balance 10. ? 6. ? 7. ? 9. ? 11. ? 12. ? 43700 40000 13. ? disbursements purchase of land Total Receipts Manufacturing overhead G Selling and administrative expenses Excess of cash available over cash disbursements Beginning cash balance interest expenses Total Financing Ending cash balance Total available cash Collection of notes receivable Financing Repayment Cash Receipts Borrowing Collection from credit sales Proceeds from sale of securities Direct labour Total disbursements 23 24 25 26

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started