Answered step by step

Verified Expert Solution

Question

1 Approved Answer

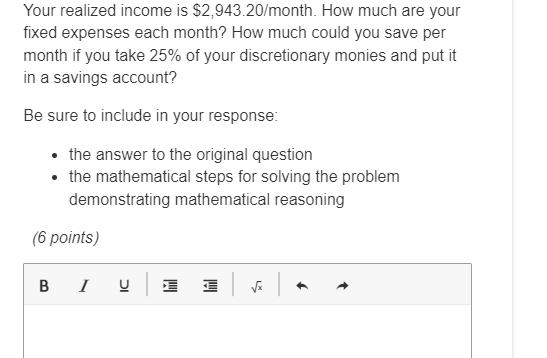

Your realized income is $2,943.20/month. How much are your fixed expenses each month? How much could you save per month if you take 25%

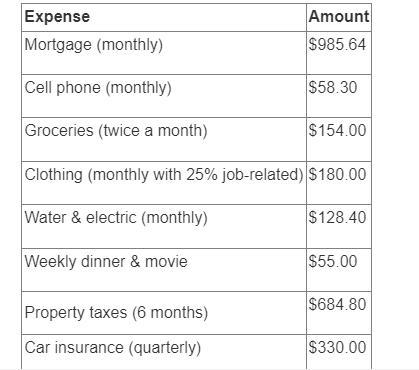

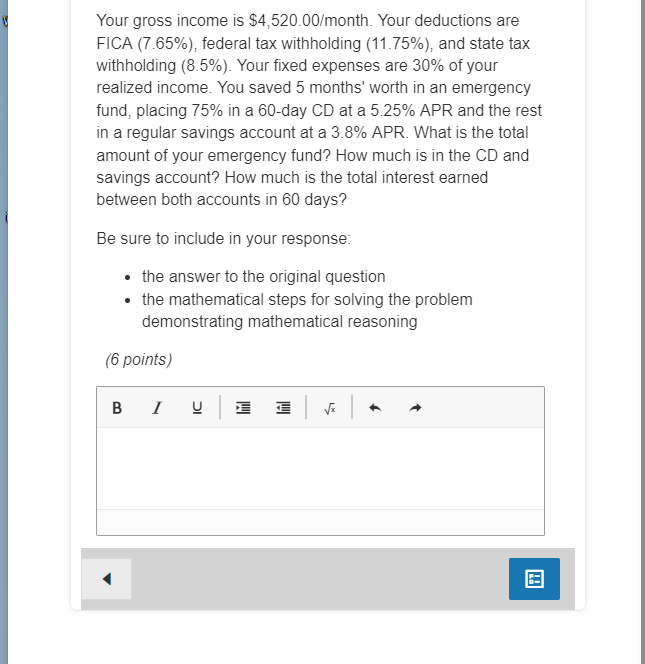

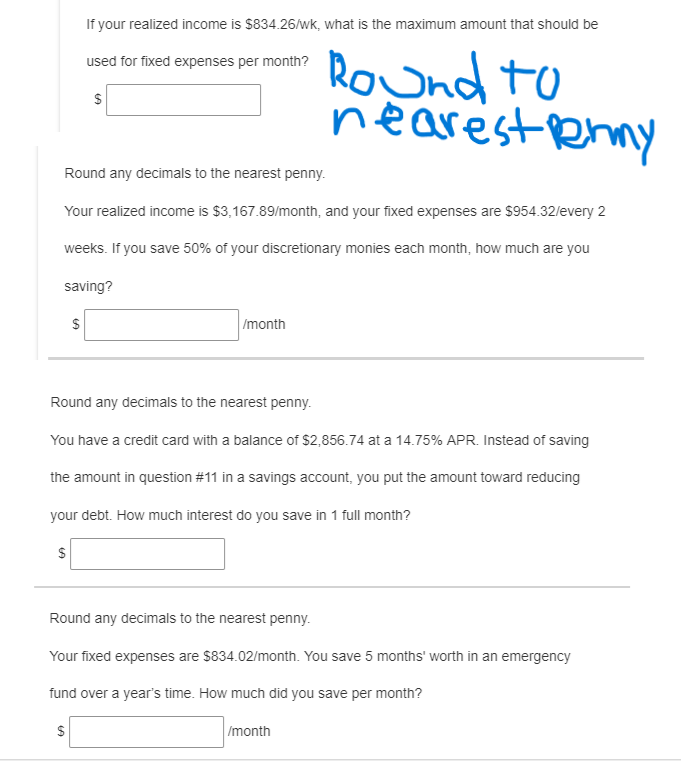

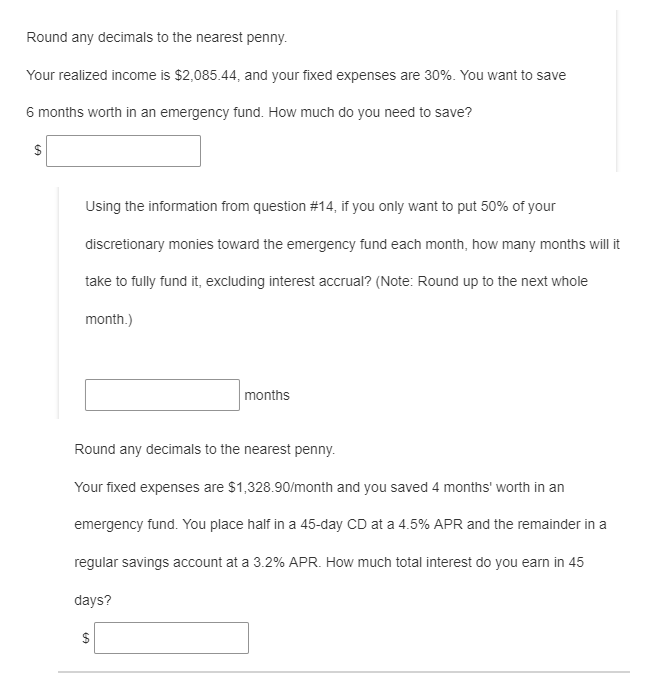

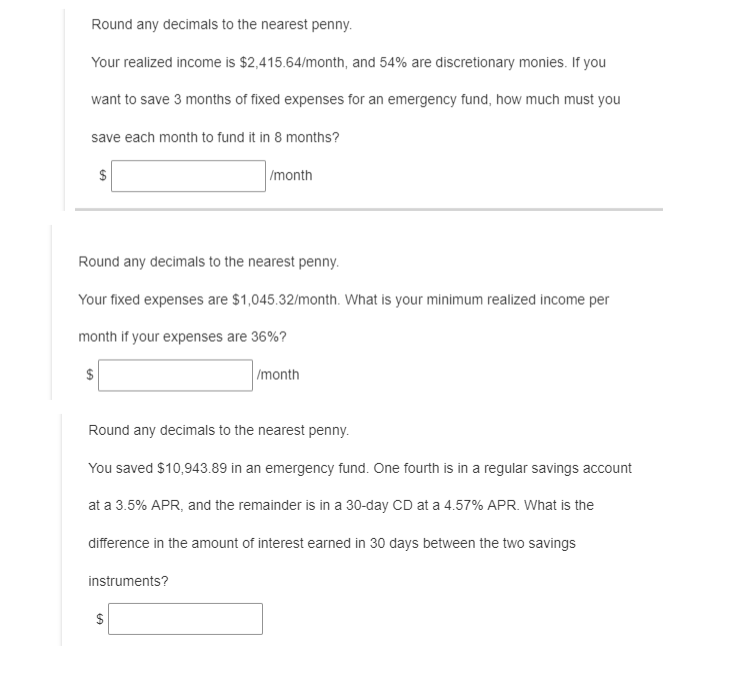

Your realized income is $2,943.20/month. How much are your fixed expenses each month? How much could you save per month if you take 25% of your discretionary monies and put it in a savings account? Be sure to include in your response: the answer to the original question the mathematical steps for solving the problem demonstrating mathematical reasoning (6 points) B I U x Expense Mortgage (monthly) Cell phone (monthly) Groceries (twice a month) Amount $985.64 $58.30 $154.00 Clothing (monthly with 25% job-related) $180.00 Water & electric (monthly) $128.40 Weekly dinner & movie $55.00 $684.80 Property taxes (6 months) Car insurance (quarterly) $330.00 Your gross income is $4,520.00/month. Your deductions are FICA (7.65%), federal tax withholding (11.75%), and state tax withholding (8.5%). Your fixed expenses are 30% of your realized income. You saved 5 months' worth in an emergency fund, placing 75% in a 60-day CD at a 5.25% APR and the rest in a regular savings account at a 3.8% APR. What is the total amount of your emergency fund? How much is in the CD and savings account? How much is the total interest earned between both accounts in 60 days? Be sure to include in your response: the answer to the original question the mathematical steps for solving the problem demonstrating mathematical reasoning (6 points) B I U x If your realized income is $834.26/wk, what is the maximum amount that should be used for fixed expenses per month? $ Round to nearest Renny Round any decimals to the nearest penny. Your realized income is $3,167.89/month, and your fixed expenses are $954.32/every 2 weeks. If you save 50% of your discretionary monies each month, how much are you saving? $ 10 /month Round any decimals to the nearest penny. You have a credit card with a balance of $2,856.74 at a 14.75% APR. Instead of saving the amount in question #11 in a savings account, you put the amount toward reducing your debt. How much interest do you save in 1 full month? $ Round any decimals to the nearest penny. Your fixed expenses are $834.02/month. You save 5 months' worth in an emergency fund over a year's time. How much did you save per month? $ /month Round any decimals to the nearest penny. Your realized income is $2,085.44, and your fixed expenses are 30%. You want to save 6 months worth in an emergency fund. How much do you need to save? $ Using the information from question #14, if you only want to put 50% of your discretionary monies toward the emergency fund each month, how many months will take to fully fund it, excluding interest accrual? (Note: Round up to the next whole month.) months Round any decimals to the nearest penny. Your fixed expenses are $1,328.90/month and you saved 4 months' worth in an emergency fund. You place half in a 45-day CD at a 4.5% APR and the remainder in a regular savings account at a 3.2% APR. How much total interest do you earn in 45 days? $ Round any decimals to the nearest penny. Your realized income is $2,415.64/month, and 54% are discretionary monies. If you want to save 3 months of fixed expenses for an emergency fund, how much must you save each month to fund it in 8 months? $ /month Round any decimals to the nearest penny. Your fixed expenses are $1,045.32/month. What is your minimum realized income per month if your expenses are 36%? $ /month Round any decimals to the nearest penny. You saved $10,943.89 in an emergency fund. One fourth is in a regular savings account at a 3.5% APR, and the remainder is in a 30-day CD at a 4.57% APR. What is the difference in the amount of interest earned in 30 days between the two savings instruments? $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started