Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Consider the following information for Mr. and Mrs. O'Leary, who file a joint return: 5/1/2021: Mr. and Mrs. O'Leary sold their principal residence

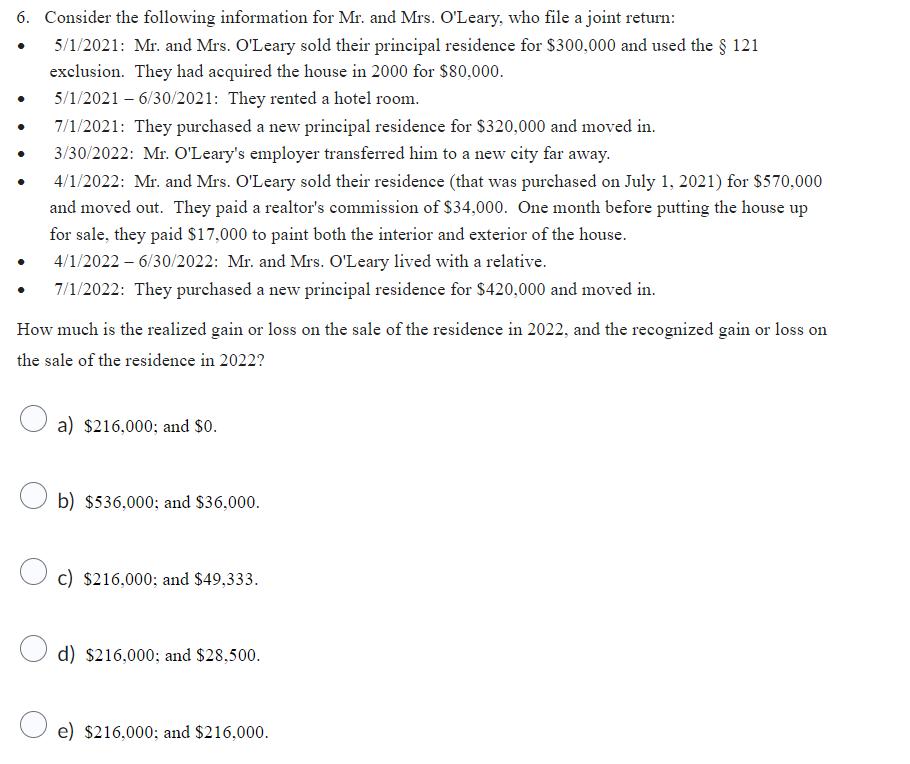

6. Consider the following information for Mr. and Mrs. O'Leary, who file a joint return: 5/1/2021: Mr. and Mrs. O'Leary sold their principal residence for $300,000 and used the 121 exclusion. They had acquired the house in 2000 for $80,000. 5/1/2021-6/30/2021: They rented a hotel room. . . 7/1/2021: They purchased a new principal residence for $320,000 and moved in. 3/30/2022: Mr. O'Leary's employer transferred him to a new city far away. 4/1/2022: Mr. and Mrs. O'Leary sold their residence (that was purchased on July 1, 2021) for $570,000 and moved out. They paid a realtor's commission of $34,000. One month before putting the house up for sale, they paid $17,000 to paint both the interior and exterior of the house. 4/1/2022-6/30/2022: Mr. and Mrs. O'Leary lived with a relative. 7/1/2022: They purchased a new principal residence for $420,000 and moved in. How much is the realized gain or loss on the sale of the residence in 2022, and the recognized gain or loss on the sale of the residence in 2022? a) $216,000; and $0. b) $536,000; and $36,000. c) $216,000; and $49,333. d) $216,000; and $28,500. e) $216,000; and $216,000.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The correct answer is C 216000 and 49333 EXPLANATION The realized gain or loss on the sale of the re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started