Question

Your report should be written in a dissertation way and not in a form of questions and answers. Report should be between 1,000 1,500 words

Your report should be written in a dissertation way and not in a form of questions and answers. Report should be between 1,000 1,500 words.

Required report sections: I. Introduction (10%): This introduction needs to explain what your report is all about. Introduce in few lines, the organization you were assigned to complete your internship.

II. Description of the organization (20%): In this part provide a general information about the companys latest operational development, including measures to tackle COVID-19.

III. Financial Statement Analysis of your assigned Company (60%) In this part of the assessment you must conduct some financial statement analysis for your assigned firm based on the financial and economic information available for the latest 3 years.

The information is available on Boursa Kuwait website. The link of assigned company has earlier been shared with each student through an email.

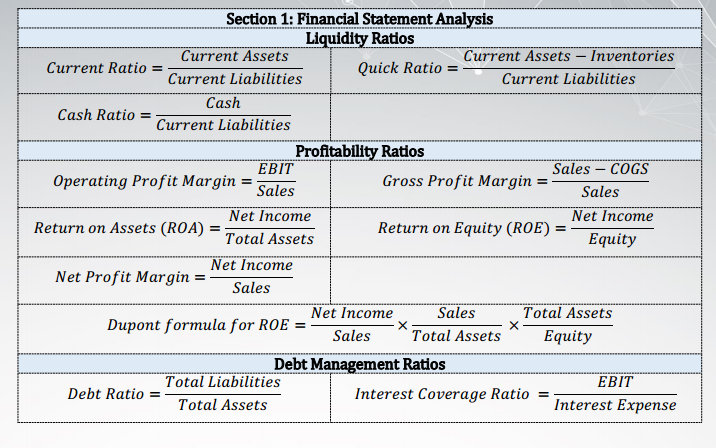

The downloaded financial statements must be uploaded through a separate link on Moodle named as Upload Financial Statements as an artefact/evidence. Your financial statement analysis must include the calculation and interpretation of the following ratios for the assigned company for a period of 3 recent years: i. Liquidity Ratios (10 marks) ii. Profitability Ratios (30 marks) iii. Debt Management Ratios (10 marks)

Note: Calculate all ratios for each category using the formulas at the end of this document (Annexure A). For example, you will need to calculate and interpret following liquidity ratios: quick ratio, current ratio, cash ratio.

Finally, calculate the same ratios for one of the listed foreign competitors for three financial years. (Specified in your Assessment -1). Compare the performance of your assigned company with the foreign competitors with a conclusion. (10 marks) IV. Bibliography and references: (10%)

Annexure A: Formula Sheet Section 1: Financial Statement Analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started