Your uncle, Larson E. Whipsnade, has asked you for some financial advice. His retirement savings are currently invested as follows: $20,000 in the riskless

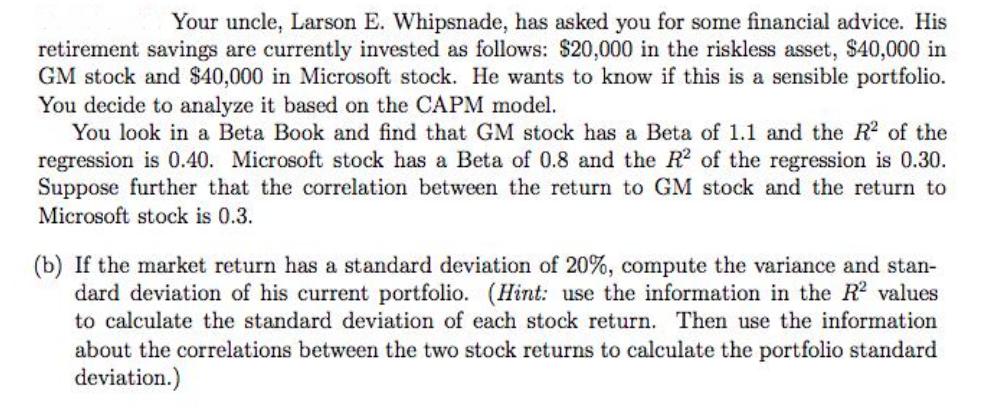

Your uncle, Larson E. Whipsnade, has asked you for some financial advice. His retirement savings are currently invested as follows: $20,000 in the riskless asset, $40,000 in GM stock and $40,000 in Microsoft stock. He wants to know if this is a sensible portfolio. You decide to analyze it based on the CAPM model. You look in a Beta Book and find that GM stock has a Beta of 1.1 and the R2 of the regression is 0.40. Microsoft stock has a Beta of 0.8 and the R? of the regression is 0.30. Suppose further that the correlation between the return to GM stock and the return to Microsoft stock is 0.3. (b) If the market return has a standard deviation of 20%, compute the variance and stan- dard deviation of his current portfolio. (Hint: use the information in the R values to calculate the standard deviation of each stock return. Then use the information about the correlations between the two stock returns to calculate the portfolio standard deviation.)

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started