Question

Your wealth at the begining of the period under consideration is $100. You have an opportunity to invest Sz in a risky asset, 0

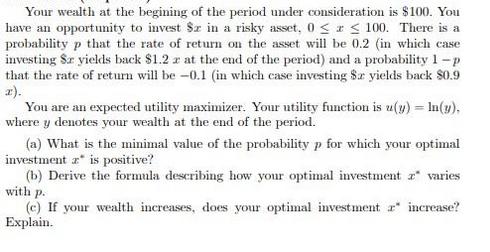

Your wealth at the begining of the period under consideration is $100. You have an opportunity to invest Sz in a risky asset, 0 < 100. There is a probability p that the rate of return on the asset will be 0.2 (in which case investing Sr yields back $1.2 x at the end of the period) and a probability 1-p that the rate of return will be -0.1 (in which case investing $a yields back $0.9 2). You are an expected utility maximizer. Your utility function is u(y) = ln(y). where y denotes your wealth at the end of the period. (a) What is the minimal value of the probability p for which your optimal investment is positive? (b) Derive the formula describing how your optimal investment " varies with p. (c) If your wealth increases, does your optimal investment * increase? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International financial management

Authors: Jeff Madura

12th edition

1133947832, 978-1305195011, 978-1133947837

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App