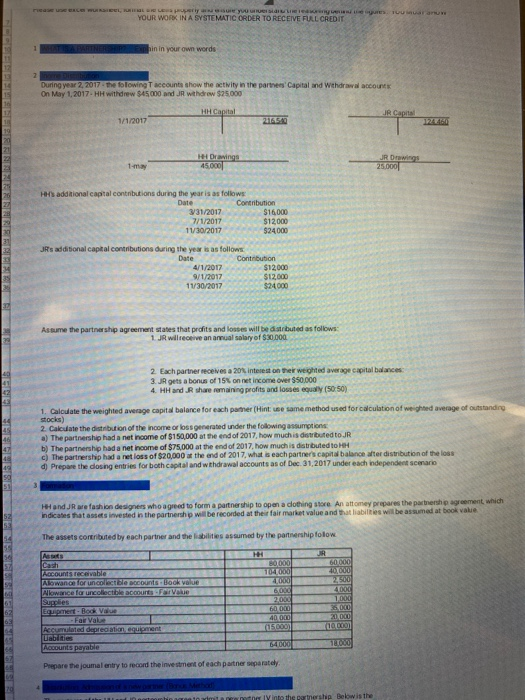

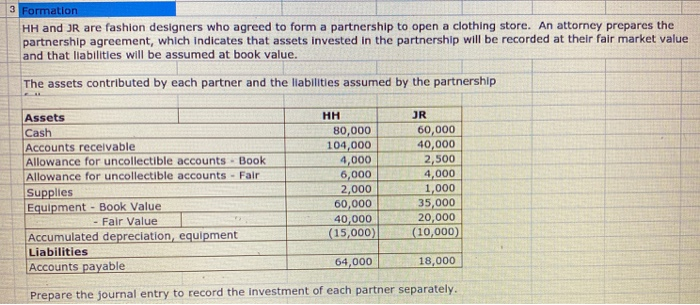

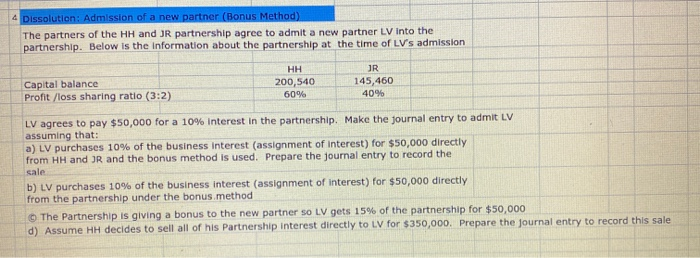

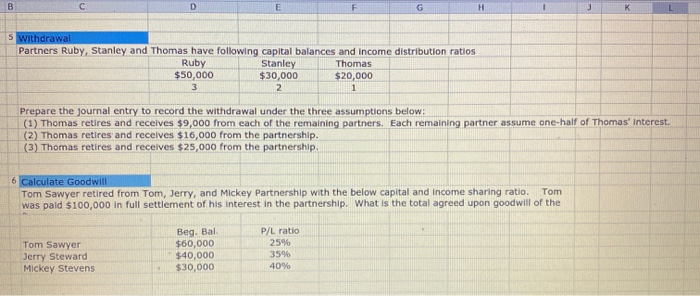

YOUR WORK IN A SYSTEMATIC ORDER TO RECEIVE FULL CREDIT in in your own words During year 2, 2017 the flowing accounts show the activity in the partners Capital and Withdrawal account On May 1, 2017 - HH withdrew $45.000 and JR withdrow $25,000 HH Capital JR Capit 1/1/2017 216540 Hringe 45,000 1-may JR Dig 25.000 His additional capital contrbutions during the year is as follows: Date Contribution 3/31/2017 $16,000 7/1/2017 $12,000 11/30/2017 $24000 JR's additional capital contributions during the year is as follows Date Contribution 4/1/2017 $12000 9/1/2017 $12.000 11/30/2017 $24000 Assume the partnership agreement states that profits and losses will be distributed as follows: 1. JR will receive an annual salary of $30.000 EEL 2. Each partner receives a 20% interest on their weighted average capital balance 3. JR gets a bonus of 15% on net income over $50,000 4. HH and share remaining profits and losses equaly (50:50) METEO 1. Calculate the weighted average capital balance for each other (Hint we same method used for calculation of weighted average of outstanding stocks) 2. Calculate the distribution of the income or loss generated under the following assumption a) The partnership hada net income of $150,000 at the end of 2017 how much is distributed to JR b) The partnership hada net income of $75,000 at the end of 2017, how much is distributed to c) The partnership had a net loss of $20,000 at the end of 2017, what is each partner's capital balance after distribution of the loss d) Prepare the dosing entries for both capital and withdrawal accounts as of Dec 31, 2017 under each independent scenario Hand JR wefashion designers who agreed to form a partnership to open a clothing store. An attomey prepares the partnership agreement which indicates that assets invested in the partnership will be recorded at their fair market value and that liabilities will be assumed at book value The assets contributed by each partner and the liabilities assumed by the partnership folow JR BO DOO 104000 000 60 000 20000 Accounts receivable Allowance for uncolat countsBOOK Value Allowance for uncollectible cours TV 4000 100 35,000 20.000 la Esmert-Book Far Value Accumulated depreciation equioment Labines Accounts payable 60 000 40.000 (5000) 64000 1000 Prepare the journal entry to record the investment of each partner parately only into the partnership Below is the 3 Formation HH and JR are fashion designers who agreed to form a partnership to open a clothing store. An attorney prepares the partnership agreement, which indicates that assets invested in the partnership will be recorded at their fair market value and that liabilities will be assumed at book value. The assets contributed by each partner and the liabilities assumed by the partnership Assets Cash Accounts receivable Allowance for uncollectible accounts - Book Allowance for uncollectible accounts - Fair Supplies Equipment - Book Value - Fair Value Accumulated depreciation, equipment Liabilities Accounts payable HH 80,000 104,000 4,000 6,000 2,000 60,000 40,000 (15,000) JR 60,000 40,000 2,500 4,000 1,000 35,000 20,000 (10,000) 64,000 18,000 Prepare the journal entry to record the investment of each partner separately. 4 Dissolution: Admission of a new partner (Bonus Method) The partners of the HH and JR partnership agree to admit a new partner LV into the partnership. Below is the information about the partnership at the time of LV's admission Capital balance Profit/loss sharing ratio (3:2) HH 200,540 60% JR 145,460 40% LV agrees to pay $50,000 for a 10% interest in the partnership. Make the journal entry to admit LV assuming that: a) LV purchases 10% of the business interest (assignment of interest) for $50,000 directly from HH and JR and the bonus method is used. Prepare the journal entry to record the sale b) LV purchases 10% of the business interest (assignment of interest) for $50,000 directly from the partnership under the bonus method The Partnership is giving a bonus to the new partner so LV gets 15% of the partnership for $50,000 d) Assume HH decides to sell all of his partnership interest directly to LV for $350,000. Prepare the journal entry to record this sale B G H 3 K 5 withdrawal Partners Ruby, Stanley and Thomas have following capital balances and income distribution ratios Ruby Stanley Thomas $50,000 $30,000 $20,000 3 2. 1 Prepare the journal entry to record the withdrawal under the three assumptions below: (1) Thomas retires and receives $9,000 from each of the remaining partners. Each remaining partner assume one-half of Thomas' Interest. (2) Thomas retires and receives $16,000 from the partnership. (3) Thomas retires and receives $25,000 from the partnership. 6 Calculate Goodwill Tom Sawyer retired from Tom, Jerry, and Mickey Partnership with the below capital and income sharing ratio. Tom was paid $100,000 in full settlement of his interest in the partnership. What is the total agreed upon goodwill of the Tom Sawyer Jerry Steward Mickey Stevens Beg. Bal $60,000 $40,000 $30,000 P/L ra 25% 35% 40%