Question

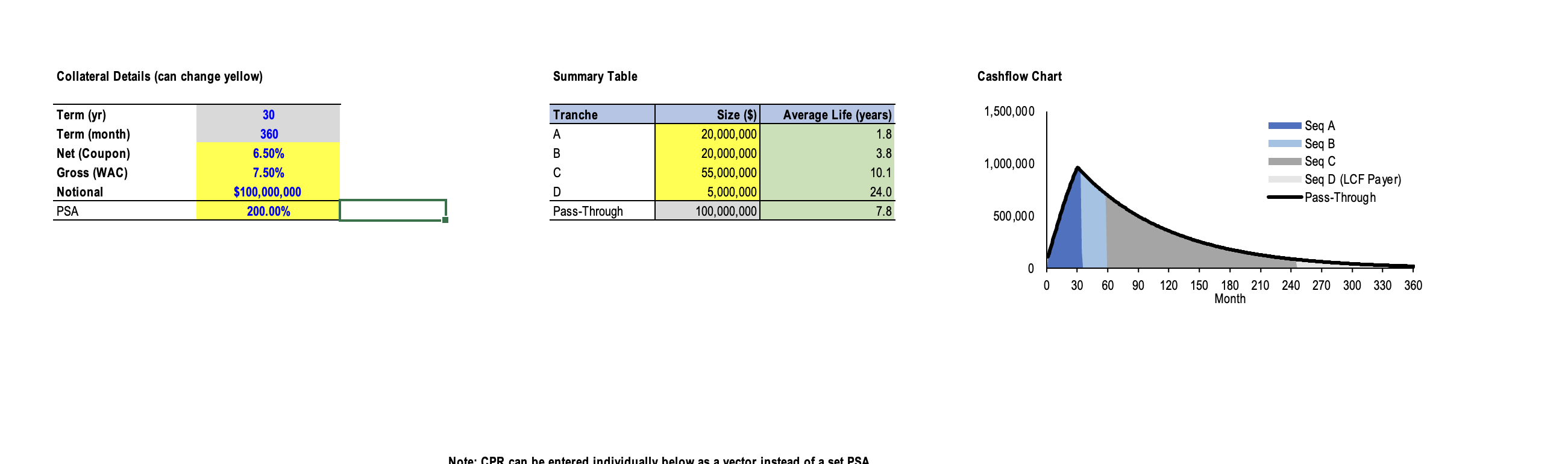

You're building a CMO from this collateral Term (yr) 30 Term (month) 360 Net (Coupon) 6.50% Gross (WAC) 7.50% Notional $100,000,000 PSA 200.00% You have

You're building a CMO from this collateral Term (yr) 30 Term (month) 360 Net (Coupon) 6.50% Gross (WAC) 7.50% Notional $100,000,000 PSA 200.00% You have three clients ? Bank that wants a <2yr Average Life ? MM that wants a ~4yr AL ? Insurance CO that wants a 10yr AL almost exactly but will only buy up to $50MM ? Build a $100M CMO structure that give each buyer the maturity profile they want structured off of a 30yr mortgage with the following characteristics and projected speeds. ? Are you able to sell the whole structure in your solution? Do you need to recommend the CMO structuring desk buy/retain a piece of the capital structure?

0 0 30 Collateral Details (can change yellow) Term (yr) Term (month) Net (Coupon) 30 360 6.50% Summary Table Cashflow Chart Tranche Size ($) Average Life (years) 1,500,000 Gross (WAC) Notional 7.50% $100,000,000 ABC 20,000,000 1.8 20,000,000 3.8 1,000,000 55,000,000 10.1 D 5,000,000 24.0 PSA 200.00% Pass-Through 100,000,000 7.8 500,000 Note: CPR can be entered individually below as a vector instead of a set PSA 660 90 90 Seq A Seq B Seq C Seq D (LCF Payer) Pass-Through 120 150 180 210 240 270 300 330 360 Month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started