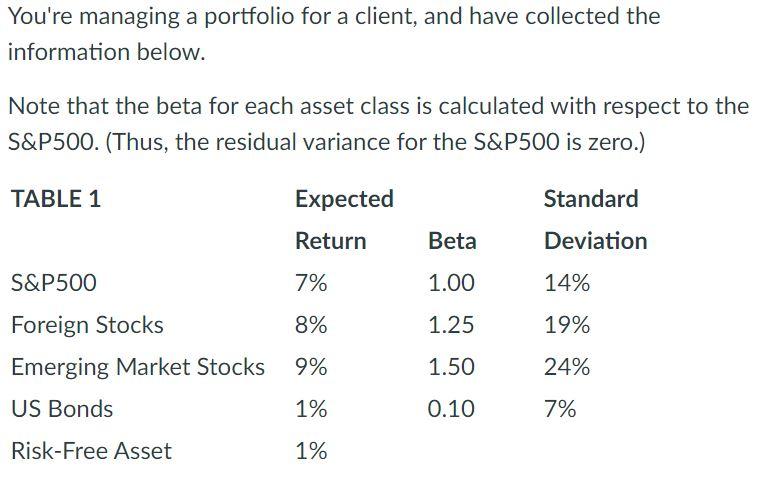

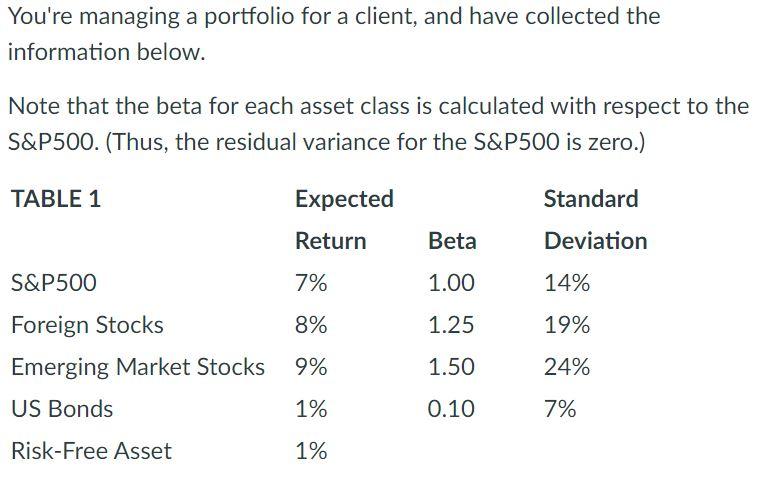

You're managing a portfolio for a client, and have collected the information below. Note that the beta for each asset class is calculated with respect to the S&P500. (Thus, the residual variance for the S&P500 is zero.) TABLE 1 Standard Expected Return Beta Deviation S&P500 7% 1.00 14% 1.25 19% Foreign Stocks 8% Emerging Market Stocks 9% US Bonds 1% 1.50 24% 0.10 7% Risk-Free Asset 1% You want to construct a portfolio with the highest expected return from the four risky asset classes above (no risk-free asset). However, the tracking error of this portfolio must be less than or equal to 5%, and all portfolio weights must be greater than or equal to zero (i.e. you can't short risky assets). Hint. This is a constrained optimization problem. Set it up in Excel and use Excel's solver. You will want to play around with your results, to ensure that Excel has indeed found the maximum value. Enter the portfolio weights below. Note: enter each number below with no decimal place and a percentage sign (for example, 15% or 20%). S&P500 Foreign Stocks Emerging Market Stocks US Bonds You're managing a portfolio for a client, and have collected the information below. Note that the beta for each asset class is calculated with respect to the S&P500. (Thus, the residual variance for the S&P500 is zero.) TABLE 1 Standard Expected Return Beta Deviation S&P500 7% 1.00 14% 1.25 19% Foreign Stocks 8% Emerging Market Stocks 9% US Bonds 1% 1.50 24% 0.10 7% Risk-Free Asset 1% You want to construct a portfolio with the highest expected return from the four risky asset classes above (no risk-free asset). However, the tracking error of this portfolio must be less than or equal to 5%, and all portfolio weights must be greater than or equal to zero (i.e. you can't short risky assets). Hint. This is a constrained optimization problem. Set it up in Excel and use Excel's solver. You will want to play around with your results, to ensure that Excel has indeed found the maximum value. Enter the portfolio weights below. Note: enter each number below with no decimal place and a percentage sign (for example, 15% or 20%). S&P500 Foreign Stocks Emerging Market Stocks US Bonds