Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You've just finished your degree and recently landed a job within your dream career path, albeit an entry level position. You've aligned your income

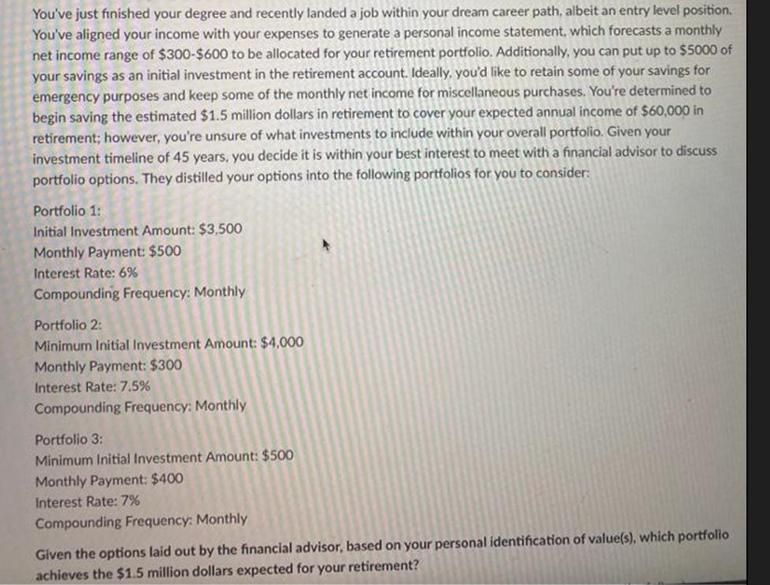

You've just finished your degree and recently landed a job within your dream career path, albeit an entry level position. You've aligned your income with your expenses to generate a personal income statement, which forecasts a monthly net income range of $300-$600 to be allocated for your retirement portfolio. Additionally, you can put up to $5000 of your savings as an initial investment in the retirement account. Ideally, you'd like to retain some of your savings for emergency purposes and keep some of the monthly net income for miscellaneous purchases. You're determined to begin saving the estimated $1.5 million dollars in retirement to cover your expected annual income of $60,000 in retirement; however, you're unsure of what investments to include within your overall portfolio. Given your investment timeline of 45 years, you decide it is within your best interest to meet with a financial advisor to discuss portfolio options. They distilled your options into the following portfolios for you to consider: Portfolio 1: Initial Investment Amount: $3,500 Monthly Payment: $500 Interest Rate: 6% Compounding Frequency: Monthly Portfolio 2: Minimum Initial Investment Amount: $4,000 Monthly Payment: $300 Interest Rate: 7.5% Compounding Frequency: Monthly Portfolio 3: Minimum Initial Investment Amount: $500 Monthly Payment: $400 Interest Rate: 7% Compounding Frequency: Monthly Given the options laid out by the financial advisor, based on your personal identification of value(s), which portfolio achieves the $1.5 million dollars expected for your retirement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which portfolio achieves the 15 million expected for your retirement we can calculate t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started