Question

Youve just secured a new client in your accounting practice, Bethany's Bicycle Corporation (BBC), a brand new small business specializing in bicycle repair. The owner,

| Youve just secured a new client in your accounting practice, Bethany's Bicycle Corporation (BBC), a brand new small business specializing in bicycle repair. The owner, Bethany Beck, is a terrific cyclist and bike repair specialist, but definitely not an accountant. Your job is to help Bethany put his affairs in order. Luckily Bethany has only been in operation for a month and things have not gotten too out of hand yet! Bethany has to submit his financial statements to her investors and doesnt know where to begin. Its your job to go through the complete Accounting cycle to prepare the financial statements for the BBC.

|

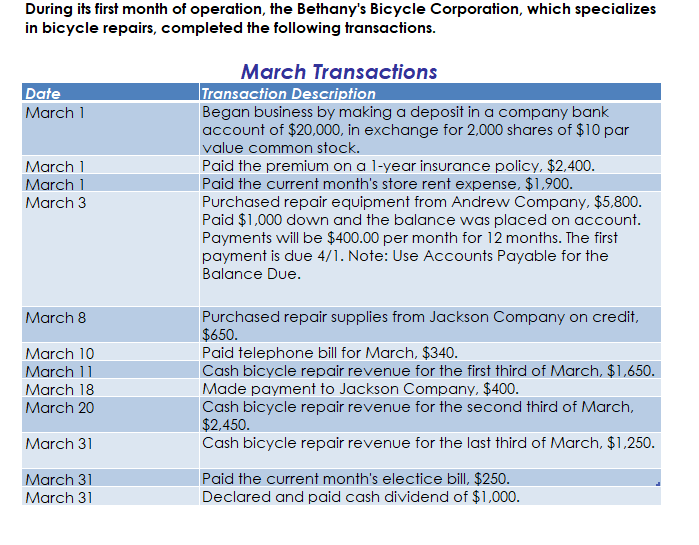

REQUIREMENT #1: Prepare journal entries to record the March transactions in the General Journal below. Remember that Debits must equal CreditsAll of your Journal Entries should balance.

REQUIREMENT #2: Post the March journal entries to the T-Accounts and compute ending balances.

REQUIREMENT #3: Prepare a trial balance for March.

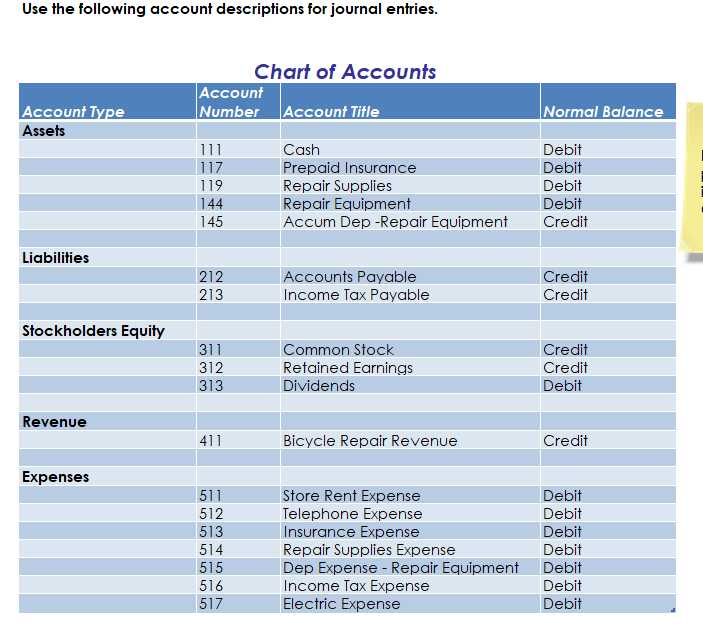

During its first month of operation, the Bethany's Bicycle Corporation, which specializes in bicycle repairs, completed the following transactions March Transactions Transaction Description Began business by making a deposit in a company bank account of $20,000, in exchange for 2,000 shares of $10 par Date March 1 value common stock. Paid the premium on a 1-year insurance policy, $2,400 Paid the current month's store rent expense, $1,900 Purchased repair equipment from Andrew Company, $5,800. Paid $1,000 down and the balance was placed on account. Payments will be $400.00 per month for 12 months. The first payment is due 4/1. Note: Use Accounts Payable for the Balance Due. March 1 March 1 March 3 Purchased repair supplies from Jackson Company on credit, $650. Paid telephone bill for March, $340 Cash bicycle repair revenue for the first third of March, $1,650. Made payment to Jackson Company, $400 Cash bicycle repair revenue for the second third of March, $2,450. Cash bicycle repair revenue for the last third of March, $1,250. March 8 March 10 March 11 March 18 March 20 March 31 Paid the current month's electice bill, $250 Declared and paid cash dividend of $1,000 March 31 March 31 Use the following account descriptions for journal entries. Chart of Accounts Account |Number Account Title Account Type Assets Normal Balance 111 Cash Debit 1 17 119 Prepaid Insurance Repair Supplies Repair Equipment Accum Dep -Repair Equipment Debit Debit 144 Debit Credit 145 Liabilities 212 Accounts Payable Income Tax Payable Credit 213 Credit Stockholders Equity 311 Common Stock Credit Retained Earnings 312 Credit 313 Dividends Debit Revenue 411 Bicycle Repair Revenue Credit Expenses Store Rent Expense Telephone Expense Insurance Expense Repair Supplies Expense Dep Expense - Repair Equipment Income Tax Expense Electric Expense 511 Debit Debit 512 513 Debit 514 Debit 515 Debit 516 517 Debit DebitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started