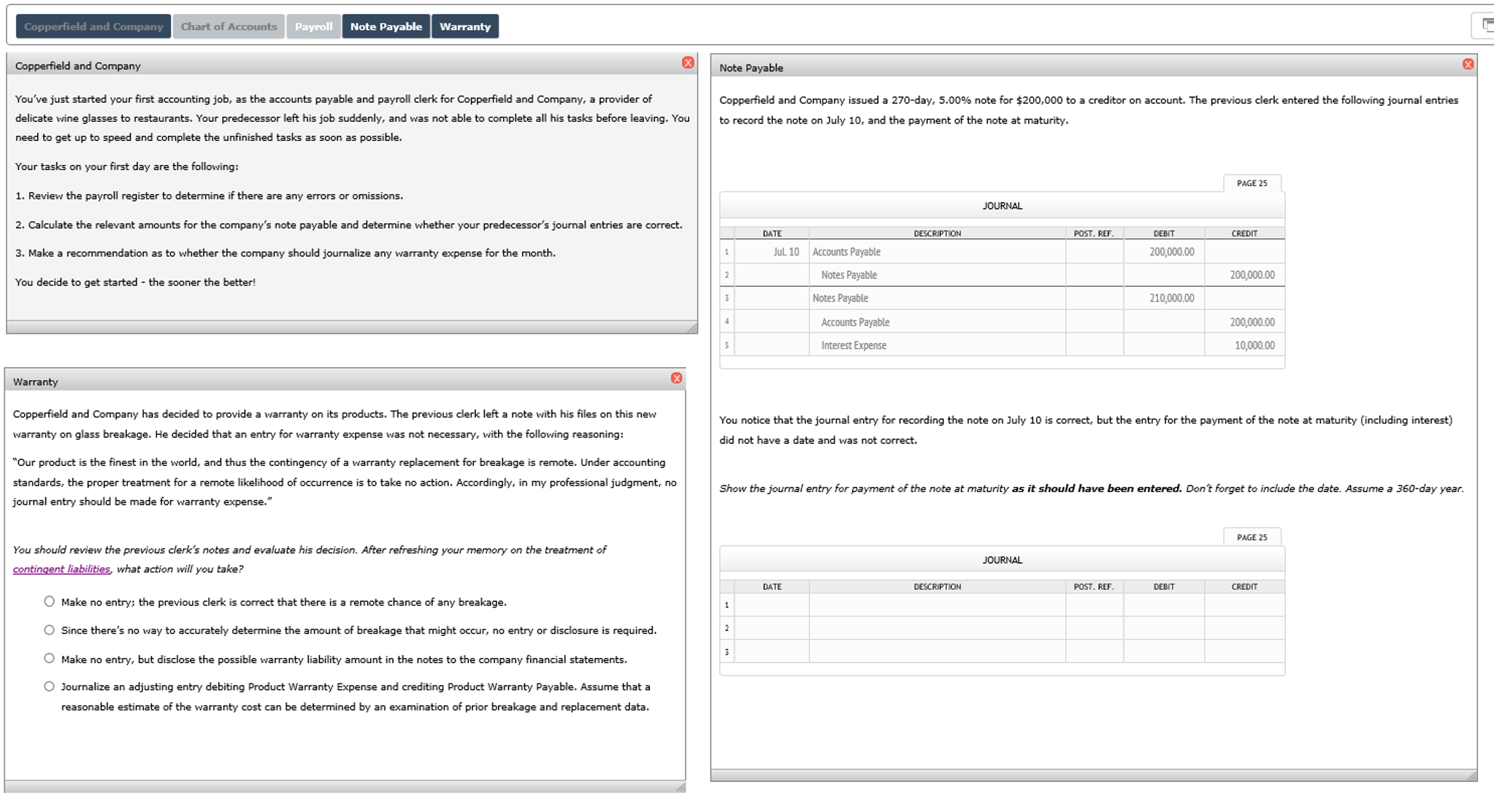

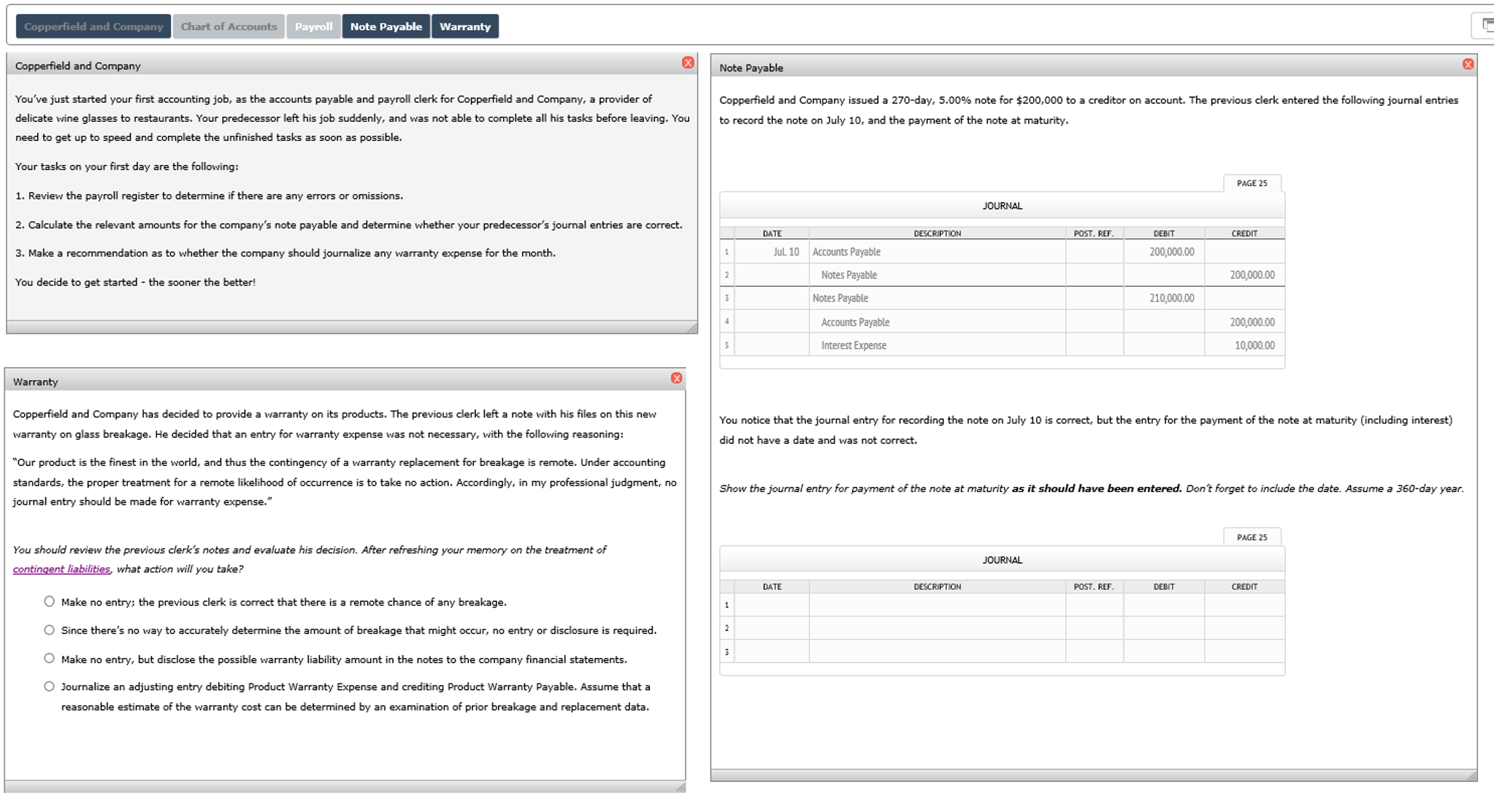

You've just started your first accounting job, as the accounts payable and payroll clerk for Copperfield and Company, a provider of delicate wine glasses to restaurants. Your predecessor left his job suddenly, and was not able to complete all his tasks before leaving. You need to get up to speed and complete the unfinished tasks as soon as possible. Your tasks on your first day are the following: Review the payroll register to determine if there are any errors or omissions. Calculate the relevant amounts for the company's note payable and determine whether your predecessor's journal entries are correct. Make a recommendation as to whether the company should journalize any warranty expense for the month. You decide to get started-the sooner the better! Copperfield and Company has decided to provide a warranty on its products. The previous clerk left a note with his files on this new warranty on glass breakage. He decided that an entry for warranty expense was not necessary, with the following reasoning: "Our product is the finest in the world, and thus the contingency of a warranty replacement for breakage is remote. Under accounting standards, the proper treatment for a remote likelihood of occurrence is to take no action. Accordingly, in my professional judgment, no journal entry should be made for warranty expense." You should review the previous clerk's notes and evaluate his decision. After refreshing your memory on the treatment of contingent liabilities, what action will you take? Make no entry; the previous clerk is correct that there is a remote chance of any breakage. Since there's no way to accurately determine the amount of breakage that might occur, no entry or disclosure is required. Make no entry, but disclose the possible warranty liability amount in the notes to the company financial statements. Journalize an adjusting entry debiting Product Warranty Expense and crediting Product Warranty Payable. Assume that a reasonable estimate of the warranty cost can be determined by an examination of prior breakage and replacement data. Copperfield and Company issued a 270-day, 5.00% note for $200,000 to a creditor on account. The previous clerk entered the following journal entries to record the note on July 10, and the payment of the note at maturity. You notice that the journal entry for recording the note on July 10 is correct, but the entry for the payment of the note at maturity (including interest) did not have a date and was not correct. Show the journal entry for payment of the note at maturity as it should have been entered. Don't forget to include the date. Assume a 360-day year