Answered step by step

Verified Expert Solution

Question

1 Approved Answer

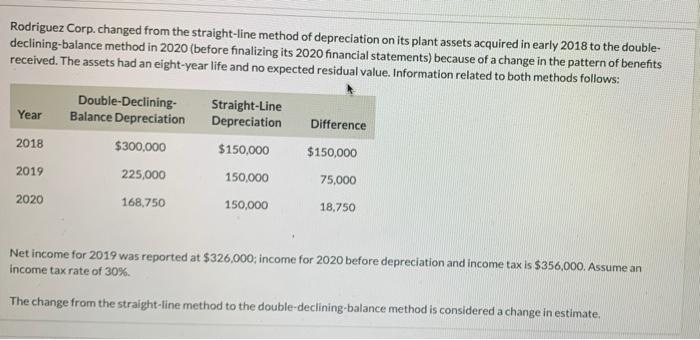

Rodriguez Corp.changed from the straight-line method of depreciation on its plant assets acquired in early 2018 to the double- declining-balance method in 2020 (before

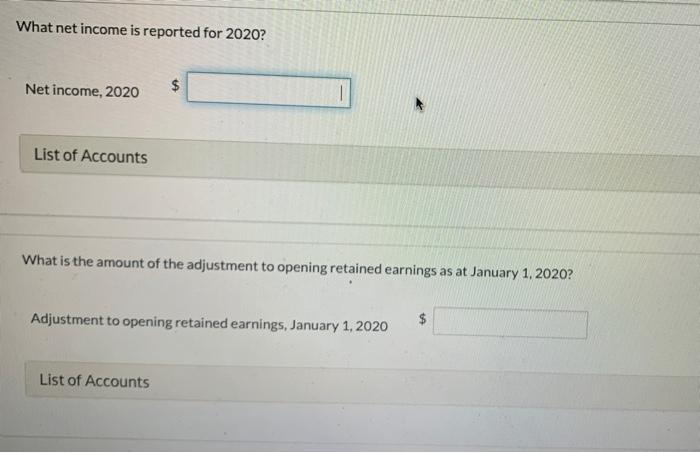

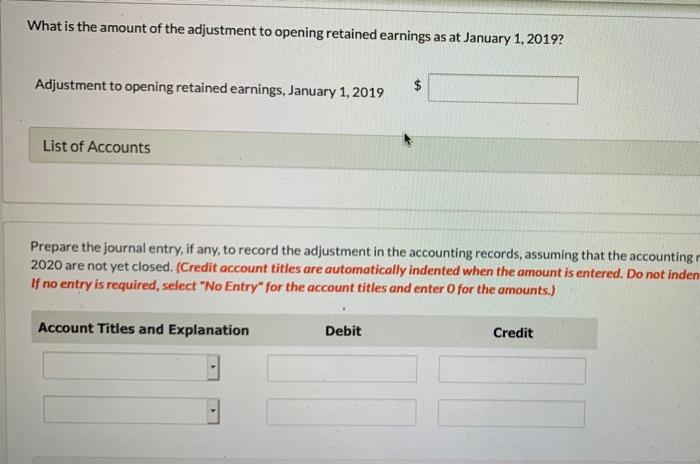

Rodriguez Corp.changed from the straight-line method of depreciation on its plant assets acquired in early 2018 to the double- declining-balance method in 2020 (before finalizing its 2020 financial statements) because of a change in the pattern of benefits received. The assets had an eight-year life and no expected residual value. Information related to both methods follows: Double-Declining- Balance Depreciation Straight-Line Depreciation Year Difference 2018 $300,000 $150,000 $150,000 2019 225,000 150,000 75,000 2020 168,750 150,000 18,750 Net income for 2019 was reported at $326,000; income for 2020 before depreciation and income tax is $356,000. Assume an income tax rate of 30%. The change from the straight-line method to the double-declining-balance method is considered a change in estimate. What net income is reported for 2020? Net income, 2020 List of Accounts What is the amount of the adjustment to opening retained earnings as at January 1, 2020? Adjustment to opening retained earnings, January 1, 2020 List of Accounts %24 What is the amount of the adjustment to opening retained earnings as at January 1, 2019? Adjustment to opening retained earnings, January 1, 2019 List of Accounts Prepare the journal entry, if any, to record the adjustment in the accounting records, assuming that the accounting r 2020 are not yet closed. (Credit account titles are automatically indented when the amount is entered. Do not inden If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Rodriguez Corp Answer 1 Amount Income for 2020 before deprecia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started