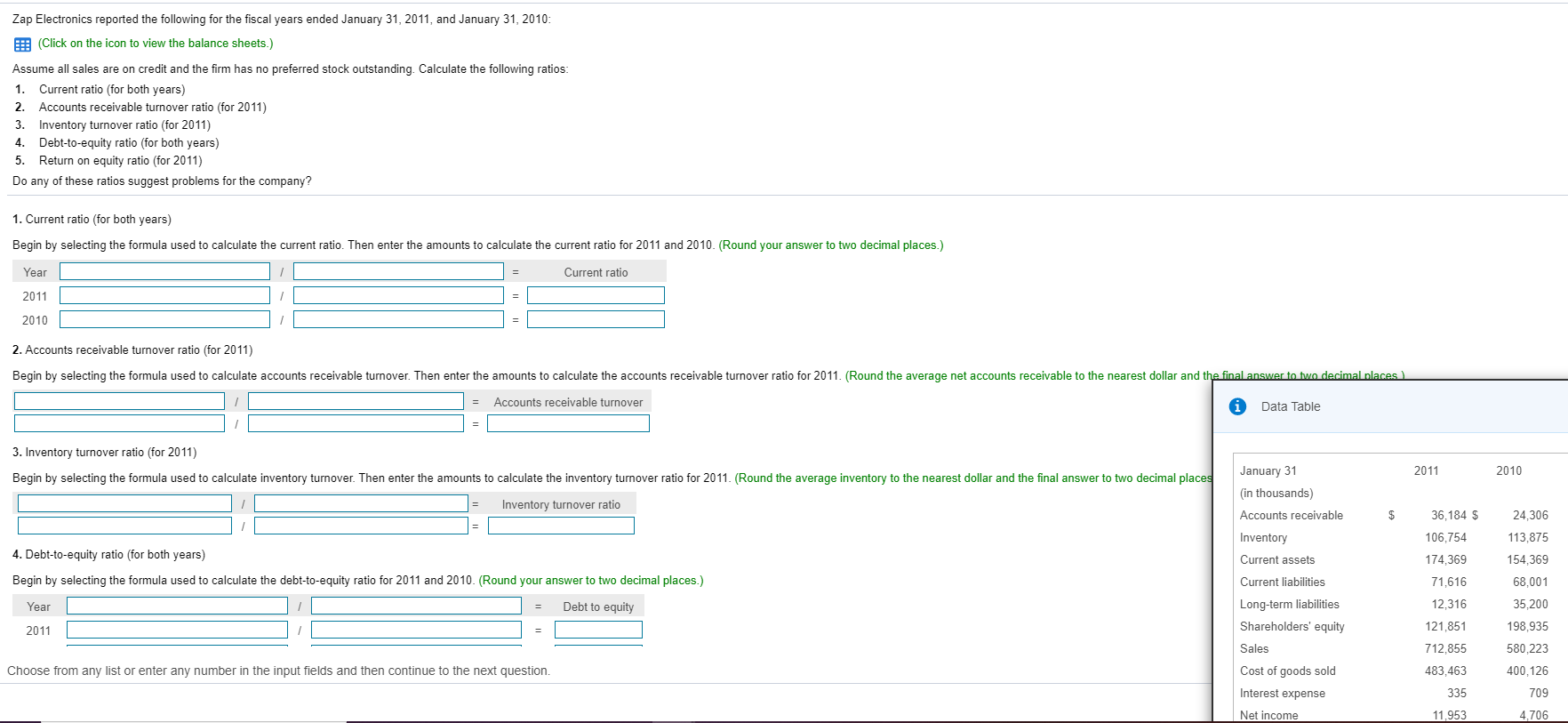

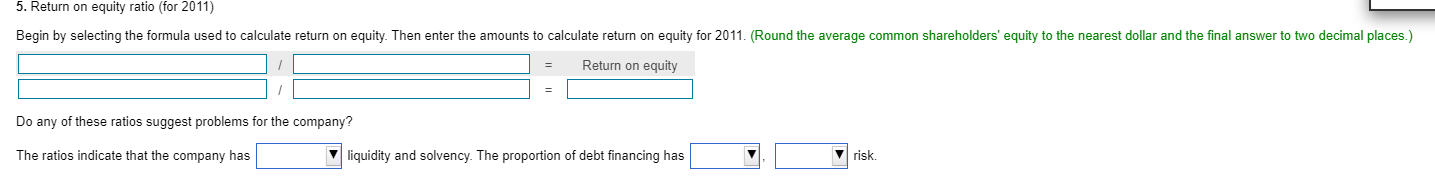

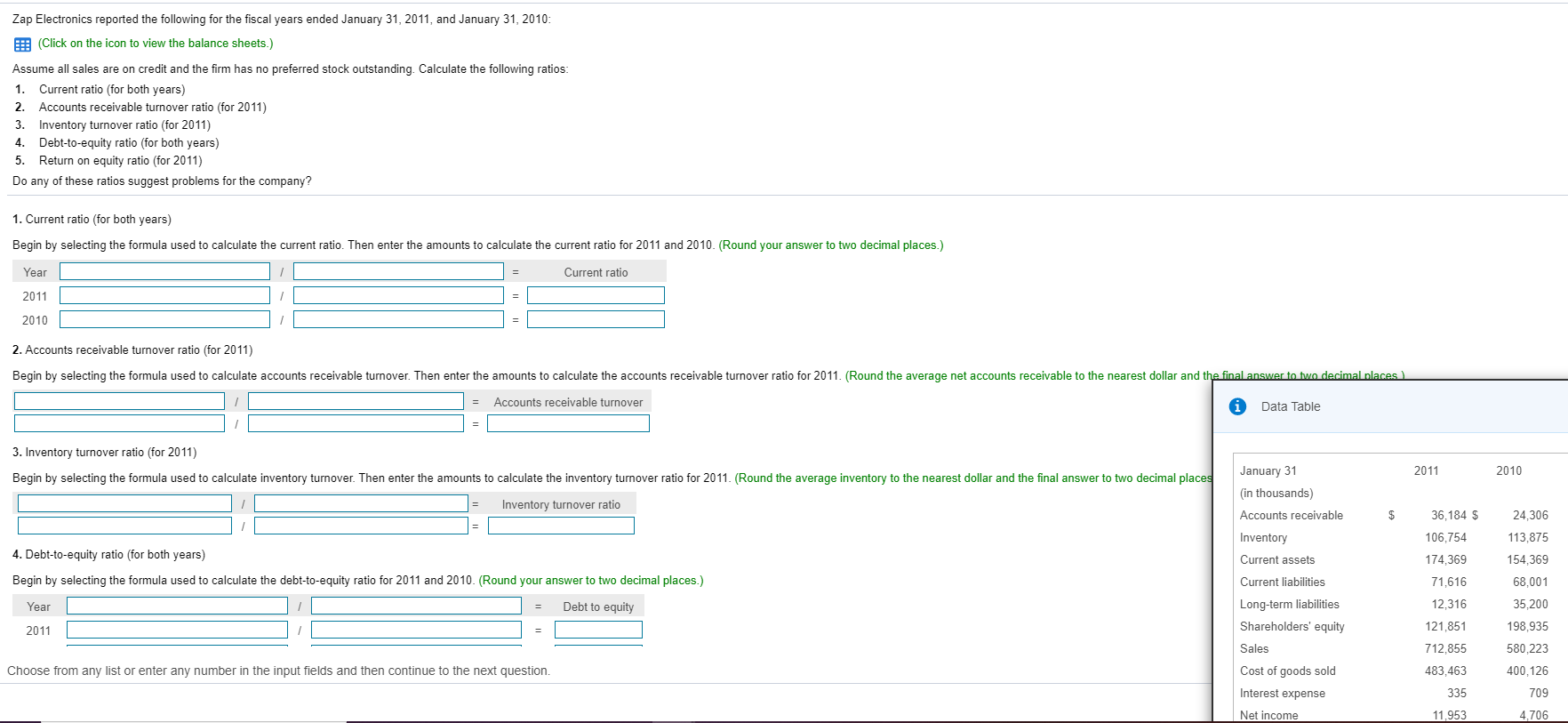

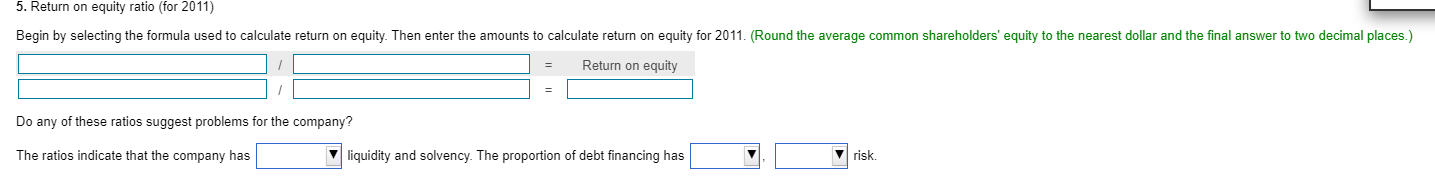

Zap Electronics reported the following for the fiscal years ended January 31, 2011, and January 31, 2010: (Click on the icon to view the balance sheets.) Assume all sales are on credit and the firm has no preferred stock outstanding. Calculate the following ratios: Current ratio (for both years) 2 1. Accounts receivable turnover ratio (for 2011) Inventory turnover ratio (for 2011) Debt-to-equity ratio (for both years) 3. 4. 5. Return on equity ratio (for 2011) Do any of these ratios suggest problems for the company? 1. Current ratio (for both years) Begin by selecting the formula used to calculate the current ratio. Then enter the amounts to calculate the current ratio for 2011 and 2010. (Round your answer to two decimal places.) Year Current ratio 2011 2010 2. Accounts receivable turnover ratio (for 2011) Begin by selecting the formula used to calculate accounts receivable turnover. Then enter the amounts to calculate the accounts receivable turnover ratio for 2011. (Round the average net accounts receivable to the nearest dollar and the final answer to fwo decimal places ) Accounts receivable turnover Data Table 3. Inventory turnover ratio (for 2011) January 31 2011 2010 Begin by selecting the formula used to calculate inventory turnover. Then enter the amounts to calculate the inventory turnover ratio for 2011. (Round the average inventory to the nearest dollar and the final answer to two decimal places (in thousands) Inventory turnover ratio Accounts receivable 36,184 $ 24,306 S 106,754 Inventory 113,875 4. Debt-to-equity ratio (for both years) Current assets 174,369 154,369 Begin by selecting the formula used to calculate the debt-to-equity ratio for 2011 and 2010. (Round your answer to two decimal places.) 71,616 68,001 Current liabilities Long-term liabilities 12,316 35,200 Debt to equity Year Shareholders' equity 121,851 198,935 2011 Sales 712,855 580,223 Cost of goods sold 400,126 Choose from any list or enter any number in the input fields and then continue to the next question. 483,463 Interest expense 335 709 Net income 4,706 11,953 5. Return on equity ratio (for 2011) Begin by selecting the formula used to calculate return on equity. Then enter the amounts to calculate return on equity for 2011. (Round the average common shareholders' equity to the nearest dollar and the final answer to two decimal places.) Return on equity Do any of these ratios suggest problems for the company? The ratios indicate that the company has risk liquidity and solvency. The proportion of debt financing has