Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zee Bhd operates a defined benefit plan for its employees since its incorporation in 2003. The management of Zee Bhd has agreed on the

![]()

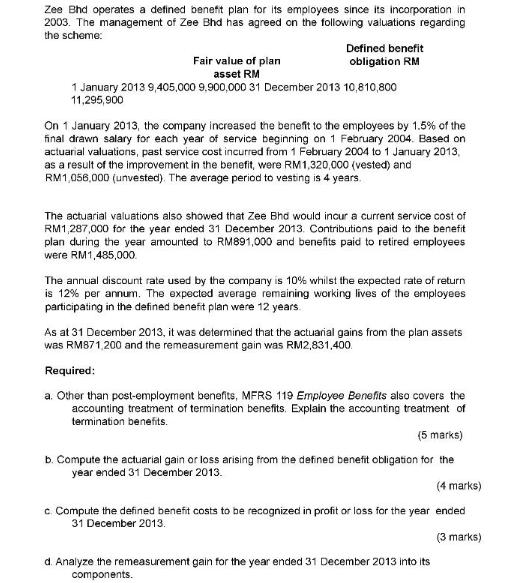

Zee Bhd operates a defined benefit plan for its employees since its incorporation in 2003. The management of Zee Bhd has agreed on the following valuations regarding the scheme: Fair value of plan asset RM Defined benefit obligation RM 1 January 2013 9,405,000 9,900,000 31 December 2013 10,810,800 11,295,900 On 1 January 2013, the company increased the benefit to the employees by 1.5% of the final drawn salary for each year of service beginning on 1 February 2004. Based on actuarial valuations, past service cost incurred from 1 February 2004 to 1 January 2013, as a result of the improvement in the benefit, were RM 1,320,000 (vested) and RM1,056,000 (unvested). The average period to vesting is 4 years. The actuarial valuations also showed that Zee Bhd would incur a current service cost of RM1,287,000 for the year ended 31 December 2013. Contributions paid to the benefit plan during the year amounted to RM891,000 and benefits paid to retired employees were RM1,485,000 The annual discount rate used by the company is 10% whilst the expected rate of return is 12% per annum. The expected average remaining working lives of the employees participating in the defined benefit plan were 12 years. As at 31 December 2013, it was determined that the actuarial gains from the plan assets was RM871,200 and the remeasurement gain was RM2,831,400. Required: a. Other than post-employment benefits, MFRS 119 Employee Benefits also covers the accounting treatment of termination benefits. Explain the accounting treatment of termination benefits. (5 marks) b. Compute the actuarial gain or loss arising from the defined benefit obligation for the year ended 31 December 2013. (4 marks) c. Compute the defined benefit costs to be recognized in profit or loss for the year ended 31 December 2013. (3 marks) d. Analyze the remeasurement gain for the year ended 31 December 2013 into its components. e. If the Employees Provident Fund (EPF). a defined contribution plan. provides an annual return of 12.5%, explain one (1) reason why an employee of Zee Bhd should also participate in the company's defined benefit plan.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Termination benefits are paid to employees when their employment is terminated by the employer The benefits may be in the form of a lump sum ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started