Question: Zeon, a large profitable corporation, is considering adding some automatic equipment in its production facilities. An investment of $200,000 will produce an initial annual benefit

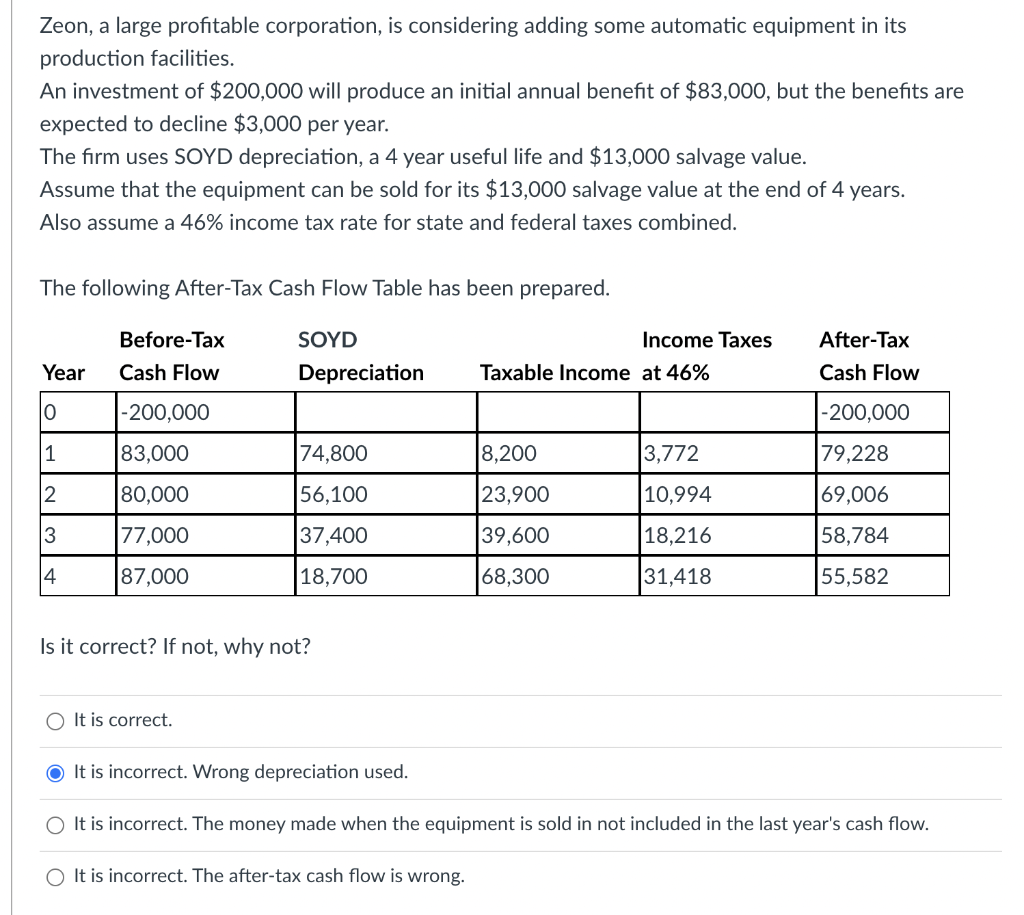

Zeon, a large profitable corporation, is considering adding some automatic equipment in its production facilities. An investment of $200,000 will produce an initial annual benefit of $83,000, but the benefits are expected to decline $3,000 per year. The firm uses SOYD depreciation, a 4 year useful life and $13,000 salvage value. Assume that the equipment can be sold for its $13,000 salvage value at the end of 4 years. Also assume a 46% income tax rate for state and federal taxes combined. The following After-Tax Cash Flow Table has been prepared. Before-Tax SOYD Depreciation Income Taxes Taxable income at 46% After-Tax Cash Flow Year Cash Flow O -200,000 |-200,000 1 83,000 74,800 8,200 3,772 79,228 2 80,000 56,100 23,900 10,994 69,006 3 77,000 37,400 39,600 18,216 58,784 4 87.000 18,700 68,300 31,418 55,582 Is it correct? If not, why not? It is correct. It is incorrect. Wrong depreciation used. O It is incorrect. The money made when the equipment is sold in not included in the last year's cash flow. It is incorrect. The after-tax cash flow is wrong

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts