Question

Zeus Inc. recorded credit sales of $1,750,000 during 2015. At December 31, 2015, the company had a $250,000 debit balance in Accounts Receivable and a

Zeus Inc. recorded credit sales of $1,750,000 during 2015. At December 31, 2015, the company had a $250,000 debit balance in Accounts Receivable and a $3,000 credit balance in Allowance for Doubtful Accounts. Required:

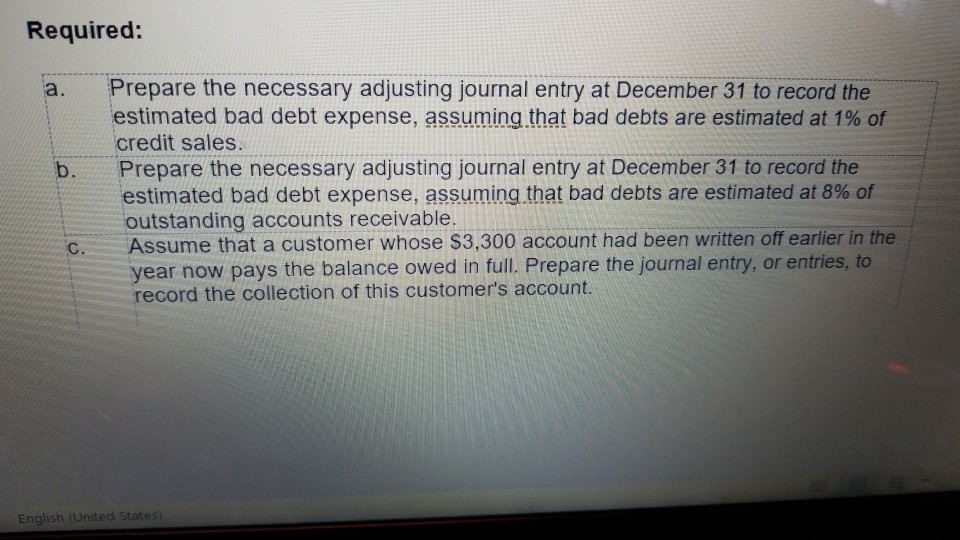

| a. | Prepare the necessary adjusting journal entry at December 31 to record the estimated bad debt expense, assuming that bad debts are estimated at 1% of credit sales. |

| b. | Prepare the necessary adjusting journal entry at December 31 to record the estimated bad debt expense, assuming that bad debts are estimated at 8% of outstanding accounts receivable. |

| c. | Assume that a customer whose $3,300 account had been written off earlier in the year now pays the balance owed in full. Prepare the journal entry, or entries, to record the collection of this customer's account.

|

PLEASE help.Thanks

Required: a. Prepare the necessary adjusting journal entry at December 31 to record the estimated bad debt expense, assuming-that bad debts are estimated at 1% of credit sales. Prepare the necessary adjusting journal entry at December 31 to record the estimated bad debt expense, assuming-that bad debts are estimated at 8% of outstanding accounts receivable b. C Assume that a customer whose $3,300 account had been written off earlier in the year now pays the balance owedi record the collection of this customer's account English (United States)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started