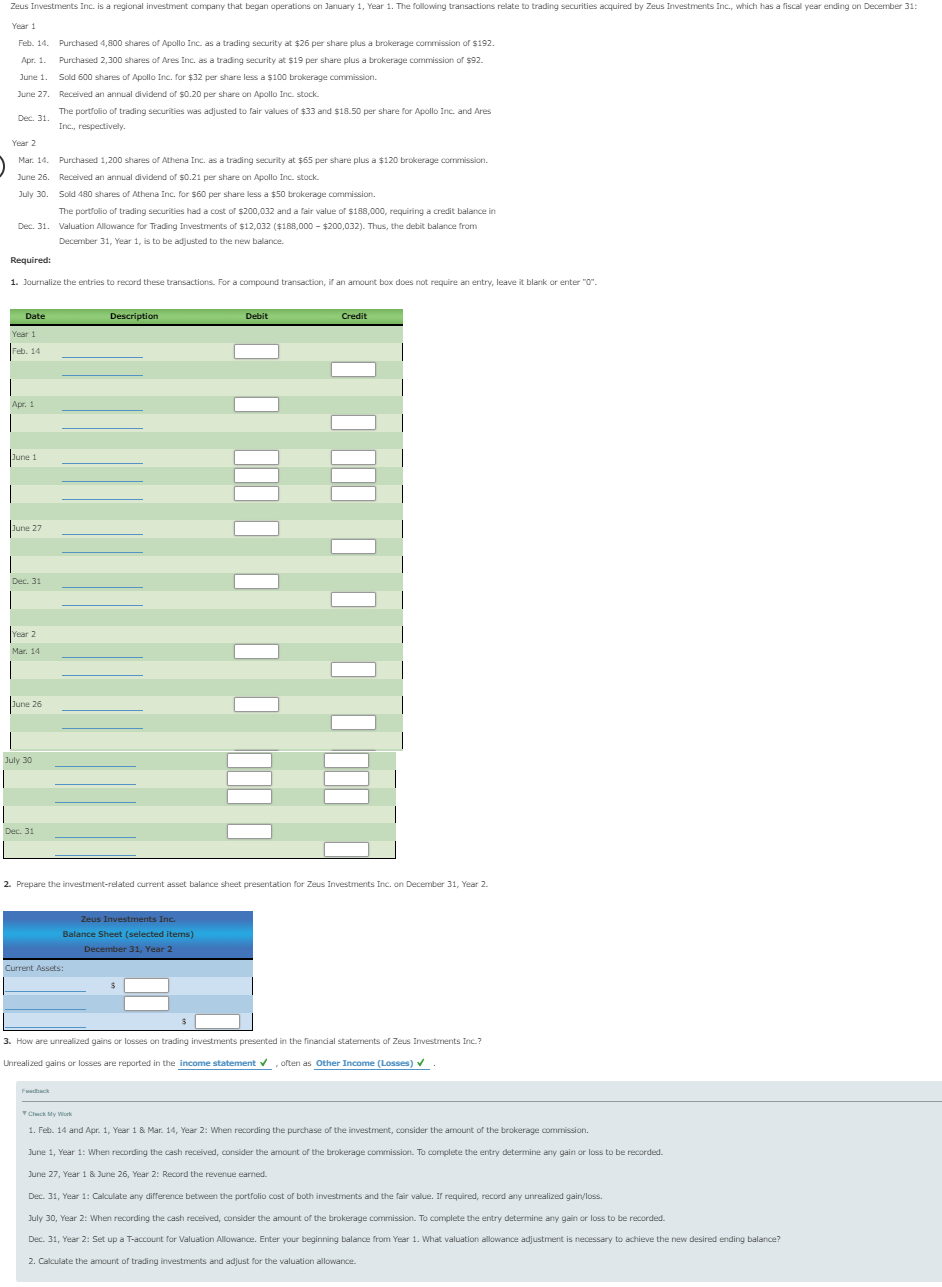

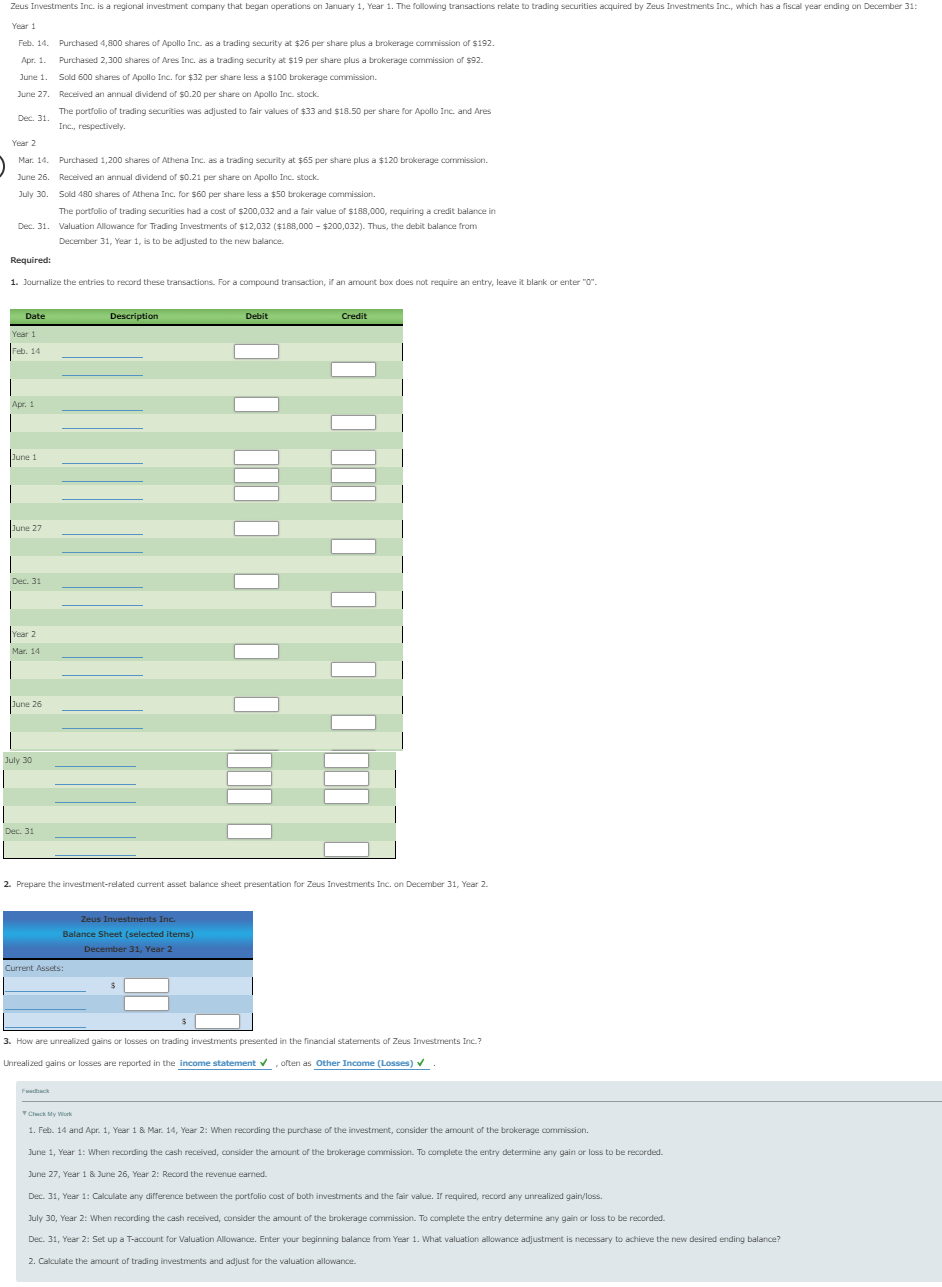

Zeus Investments Inc. is a regional investment company that began operations on January 1, Year 1. The following transactions relate to trading securities acquired by Zeus Investments Inc., which has a fiscal year ending on December 31: Dec 31. Year 1 Feb. 14. Purchased 4,800 shares of Apollo Inc. as a trading security at $26 per share plus a brokerage commission of $192. Apr. 1. Purchased 2,300 shares of Ares Inc. as a trading security at $19 per share plus a brokerage commission of $92 June 1. Sold 600 shares of Apollo Inc. for $32 per share less a $100 brokerage commission. Dune 27. Received an annual dividend of $0.20 per share on Apollo Inc. stock The portfolio of trading securities was adjusted to fair values of $33 and $18.50 per share for Apollo Inc. and Ares Inc., respectively. Year 2 Mar. 14. Purchased 1,200 shares of Athena Inc. as a trading security at $65 per share plus a $120 brokerage commission. Dune 26. Received an annual dividend of $0.21 per share on Apollo Inc. stock July 30. Sold 480 shares of Athena Inc. for $60 per share less a $50 brokerage commission. The portfolio of trading securities had a cost of $200,032 and a fair value of $188,000, requiring a credit balance in Dec. 31. Valuation Allowance for Trading Investments of $12,032 ($188,000 - $200,032). Thus, the debit balance from December 31, Year 1, is to be adjusted to the new balance. Required: 1. Journalize the entries to record these transactions. For a compound transaction, if an amount box does not require an entry, leave it blank or enter "0". Description Debit Credit Date Year 1 Feb. 14 June 1 June 27 Dec. 31 year 2 Mar. 14 June 26 July 30 Dec. 31 2. Prepare the investment-related current asset balance sheet presentation for Zeus Investments Inc. on December 31, Year 2 Zeus Investments Inc. Balance Sheet (selected items) December 31, Year 2 Current Assets: 3. How are unrealized gains or losses on trading investments presented in the financial statements of Zeus Investments Inc.? Unrealized gains or losses are reported in the income statement , often as Other Income (Losses) . Chuck My Work 1. Feb. 14 and Apr. 1, Year 1 & Mar. 14, Year 2: When recording the purchase of the investment, consider the amount of the brokerage commission. June 1, Year 1: When recording the cash received, consider the amount of the brokerage commission. To complete the entry determine any gain or loss to be recorded. June 27, Year 1 & June 26, Year 2: Record the revenue earned. Dec. 31, Year 1: Calculate any difference between the portfolio cost of both investments and the fair value. If required, record any unrealized gain/loss. July 30, Year 2: When recording the cash received, consider the amount of the brokerage commission. To complete the entry determine any gain or loss to be recorded. Dec. 31, Year 2: Set up a T-account for Valuation Allowance. Enter your beginning balance from Year 1. What valuation allowance adjustment is necessary to achieve the new desired ending balance? 2. Calculate the amount of trading investments and adjust for the valuation allowance