Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zhang Corp. designs and manufactures basketball jerseys for high school sports teams. Since each team's uniform is unique in color and design, Zhang uses a

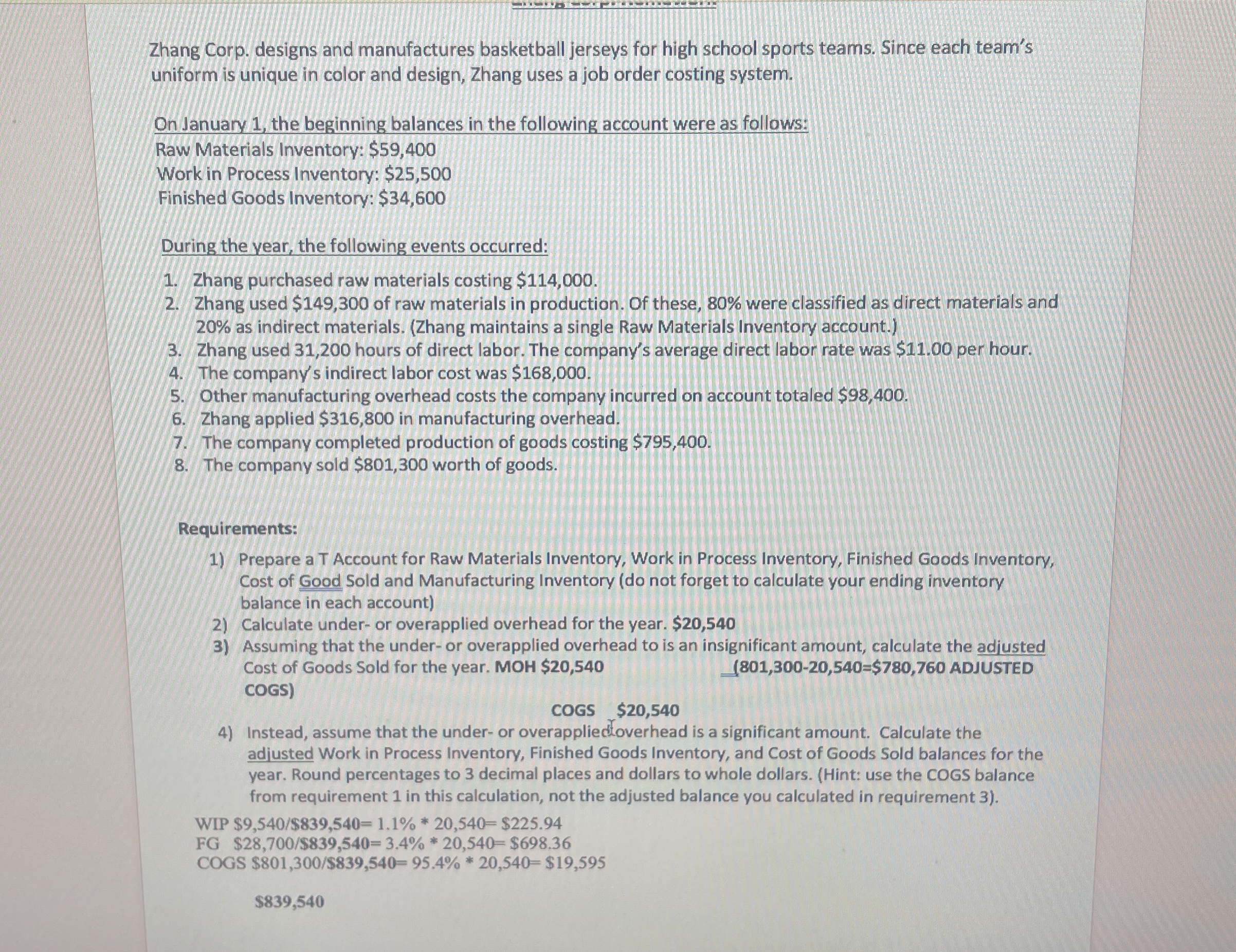

Zhang Corp. designs and manufactures basketball jerseys for high school sports teams. Since each team's

uniform is unique in color and design, Zhang uses a job order costing system.

On January the beginning balances in the following account were as follows:

Raw Materials Inventory: $

Work in Process Inventory: $

Finished Goods Inventory: $

During the vear, the following events occurred:

Zhang purchased raw materials costing $

Zhang used $ of raw materials in production. Of these, were classified as direct materials and

as indirect materials. Zhang maintains a single Raw Materials Inventory account.

Zhang used hours of direct labor. The company's average direct labor rate was $ per hour.

The company's indirect labor cost was $

Other manufacturing overhead costs the company incurred on account totaled $

Zhang applied $ in manufacturing overhead.

The company completed production of goods costing $

The company sold $ worth of goods.

Requirements:

Prepare a T Account for Raw Materials Inventory, Work in Process Inventory, Finished Goods Inventory,

Cost of Good Sold and Manufacturing Inventory do not forget to calculate your ending inventory

balance in each account

Calculate underor overapplied overhead for the year. $

Assuming that the underor overapplied overhead to is an insignificant amount, calculate the adjusted

Cost of Goods Sold for the year. MOH $

ADJUSTED

COGS

COGS $

Instead, assume that the under or overappliedoverhead is a significant amount. Calculate the

adjusted Work in Process Inventory, Finished Goods Inventory, and Cost of Goods Sold balances for the

year. Round percentages to decimal places and dollars to whole dollars. Hint: use the COGS balance

from requirement in this calculation, not the adjusted balance you calculated in requirement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started