Question

Zimmer Company owns an executive plane that originally cost $1,280,000. It has recorded straight-line depreciation on the plane for seven full years, calculated assuming

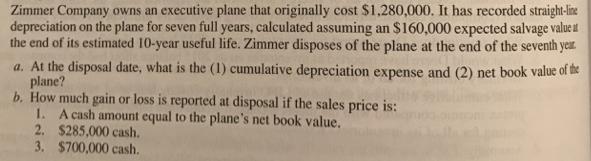

Zimmer Company owns an executive plane that originally cost $1,280,000. It has recorded straight-line depreciation on the plane for seven full years, calculated assuming an $160,000 expected salvage value at the end of its estimated 10-year useful life. Zimmer disposes of the plane at the end of the seventh yer. a. At the disposal date, what is the (1) cumulative depreciation expense and (2) net book value of the plane? b. How much gain or loss is reported at disposal if the sales price is: 1. A cash amount equal to the plane's net book value, 2. $285,000 cash. 3. $700,000 cash.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

The Legal Environment of Business

Authors: Roger E Meiners, Al H. Ringleb, Frances L. Edwards

11th Edition

9781133419716, 538473991, 1133419712, 978-0538473996

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App