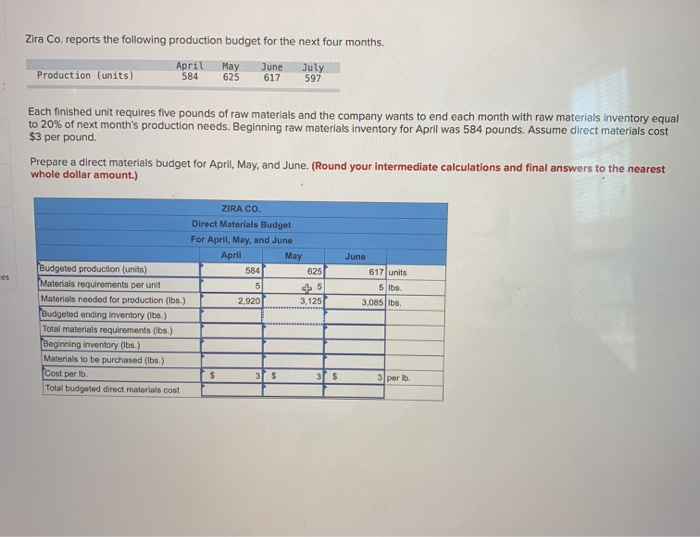

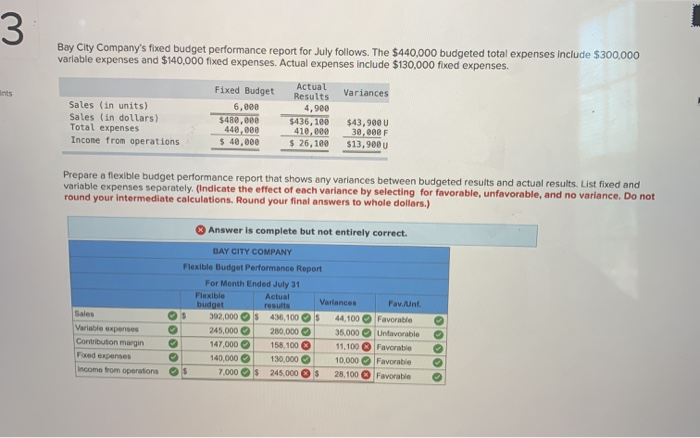

Zira Co. reports the following production budget for the next four months. April Production (units) 584 May 625 June 617 July 597 Each finished unit requires five pounds of raw materials and the company wants to end each month with raw materials inventory equal to 20% of next month's production needs. Beginning raw materials inventory for April was 584 pounds. Assume direct materials cost $3 per pound. Prepare a direct materials budget for April, May, and June. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) ZIRA CO. Direct Materials Budget For April, May, and June April May 584 625 5 2,920 3,125 June 617 | units 5 lbs. 3,085 lbs. Budgeted production (units) Materials requirements per unit Materials needed for production (lbs.) Budgeted ending inventory (lbs.) Total materials requirements (bs.) Beginning inventory (lbs.) Materials to be purchased (lbs.) Cost per lb Total budgeted direct materials cost $ 3 $ 3 $ 31 per lb. 3 Bay City Company's fixed budget performance report for July follows. The $440,000 budgeted total expenses include $300,000 variable expenses and $140,000 fixed expenses. Actual expenses include $130,000 fixed expenses. Fixed Budget Actual Results Variances Sales (in units) 6,000 4,900 Sales (in dollars) $480,000 $436, 100 $43,900 U Total expenses 440,000 410,000 30,000 Incone from operations $ 40,000 $ 26, 100 $13,980 V Prepare a flexible budget performance report that shows any variances between budgeted results and actual results. List fixed and variable expenses separately. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance. Do not round your intermediate calculations. Round your final answers to whole dollars.) Answer is complete but not entirely correct. BAY CITY COMPANY Flexible Budget Performance Report For Month Ended July 31 Flexible Actual Variances budget results Fav.unt Sales 392,000S 436,1005 44.100 Favorable Variable expenses 245,000 280,000 35.000 Unfavorable Contribution margin 147,000 158, 100 11,100 3 Favorable Fored expenses 140,000 130,000 10,000 Favorable Income from operations $ 7.000 $ 245,000 $ 28.100 Favorable OOOO OO