Zita tells you that she is thinking of expanding her business and has the opportunity to purchase four small mobile carts similar to the one

Zita tells you that she is thinking of expanding her business and has the opportunity to purchase four small mobile carts similar to the one that was rented for the Hernandez wedding. The costs of purchasing these four carts will be $16,000 and the carts have a useful life of five years. Normally, these carts would cost $48,000 to buy, but the original owner passed away two years ago and the carts have been locked in storage all this time. The family has a list of original clients, including festival organizers, so, although it is not guaranteed that she would get that business back, there appears to be an opportunity to get some immediate business. The only other potential buyer is her direct competition, and she fears that if he buys the carts, that he might take some of the new clientele that she has generated in the shop this month. She asks your advice as to whether this IS a potentially profitable move. Using the financial statements you have prepared, outline to Zita whether or not you think she should buy the mobile carts and provide reasons for your recommendations.

(Your answer should specifically reference at least two items from each statement).

2. Do you think ZZ Pops is in a good financial position at the end of April? Explain your answer using at least two ratios that you have studied this semester.

Some ratios you can write about are Current Ratio, Gross Profit Margin, and Debt to Asset.

Some ratios you can write about are Current Ratio, Gross Profit Margin, and Debt to Asset.

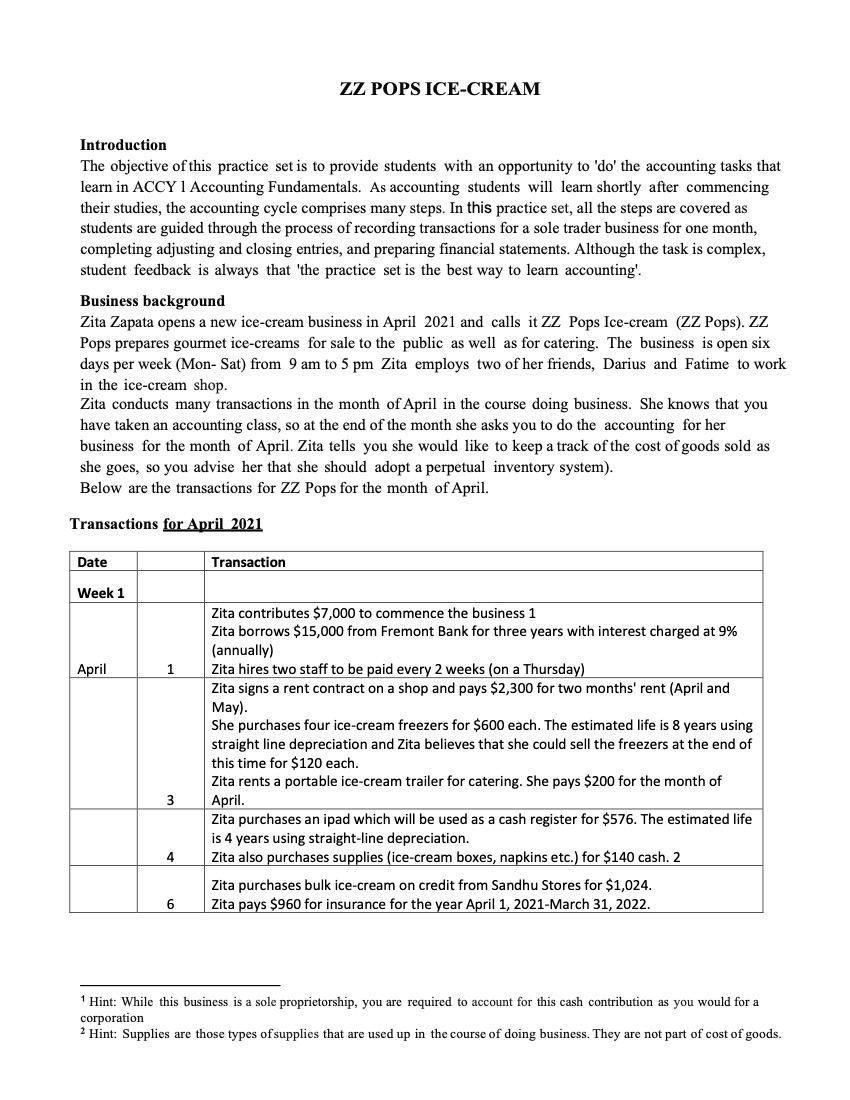

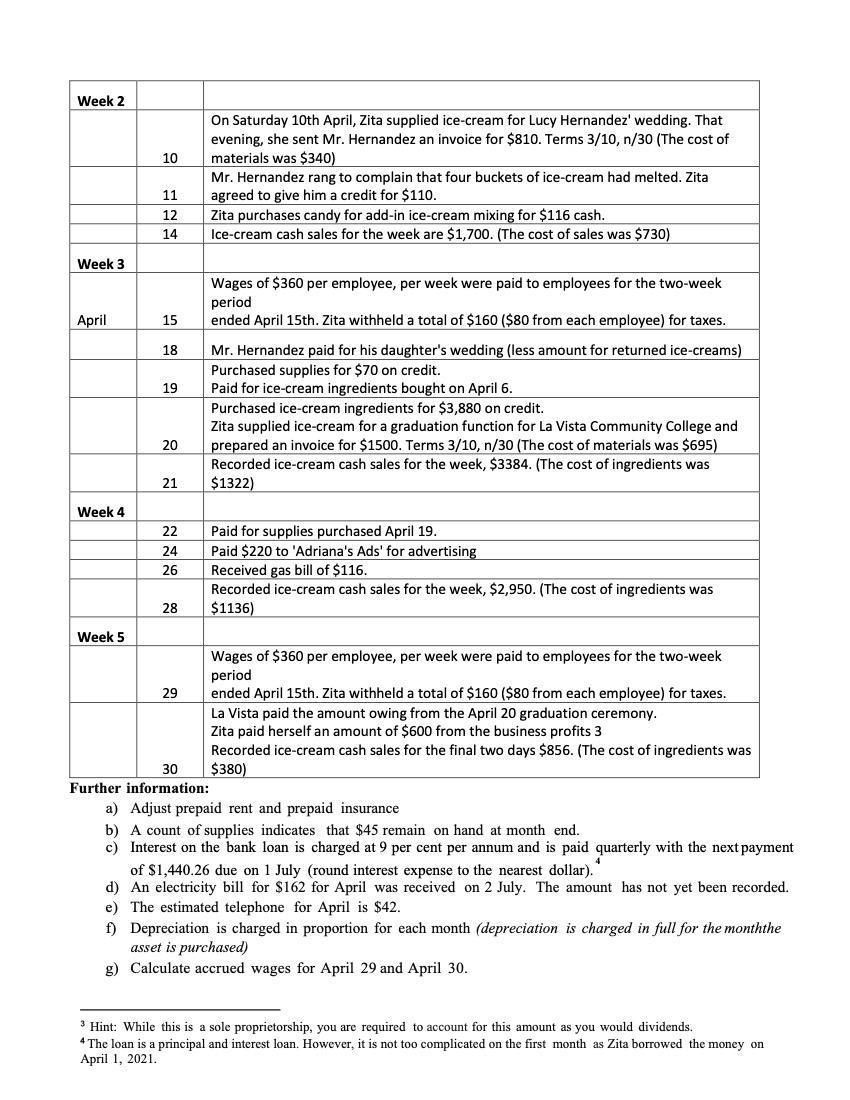

Introduction The objective of this practice set is to provide students with an opportunity to 'do' the accounting tasks that learn in ACCY 1 Accounting Fundamentals. As accounting students will learn shortly after commencing their studies, the accounting cycle comprises many steps. In this practice set, all the steps are covered as students are guided through the process of recording transactions for a sole trader business for one month, completing adjusting and closing entries, and preparing financial statements. Although the task is complex, student feedback is always that 'the practice set is the best way to learn accounting'. Business background Zita Zapata opens a new ice-cream business in April 2021 and calls it ZZ Pops Ice-cream (ZZ Pops). ZZ Pops prepares gourmet ice-creams for sale to the public as well as for catering. The business is open six days per week (Mon-Sat) from 9 am to 5 pm Zita employs two of her friends, Darius and Fatime to work in the ice-cream shop. Zita conducts many transactions in the month of April in the course doing business. She knows that you have taken an accounting class, so at the end of the month she asks you to do the accounting for her business for the month of April. Zita tells you she would like to keep a track of the cost of goods sold as she goes, so you advise her that she should adopt a perpetual inventory system). Below are the transactions for ZZ Pops for the month of April. Transactions for April 2021 Date Week 1 April 1 3 4 ZZ POPS ICE-CREAM 6 Transaction Zita contributes $7,000 to commence the business 1 Zita borrows $15,000 from Fremont Bank for three years with interest charged at 9% (annually) Zita hires two staff to be paid every 2 weeks (on a Thursday) Zita signs a rent contract on a shop and pays $2,300 for two months' rent (April and May). She purchases four ice-cream freezers for $600 each. The estimated life is 8 years using straight line depreciation and Zita believes that she could sell the freezers at the end of this time for $120 each. Zita rents a portable ice-cream trailer for catering. She pays $200 for the month of April. Zita purchases an ipad which will be used as a cash register for $576. The estimated life is 4 years using straight-line depreciation. Zita also purchases supplies (ice-cream boxes, napkins etc.) for $140 cash. 2 Zita purchases bulk ice-cream on credit from Sandhu Stores for $1,024. Zita pays $960 for insurance for the year April 1, 2021-March 31, 2022. Hint: While this business is a sole proprietorship, you are required to account for this cash contribution as you would for a corporation 2 Hint: Supplies are those types of supplies that are used up in the course of doing business. They are not part of cost of goods.

Step by Step Solution

3.26 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Based on the financial statements you have prepared it is clear that ZZ Pops is in a good ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started