Question

Zola, Becker, and Amber were all CPAs and had worked in the industry for more than 10 years. Each had graduated from College, passed their

Zola, Becker, and Amber were all CPAs and had worked in the industry for more than 10 years. Each had graduated from College, passed their CPA on the first try and been very successful as Public Accountants. However, each of them wanted to be independent and start their own firm. They met at an industry conference and over dinner, after much discussion, they decided to form a three-person partnership: (YNT).

Over the next few weeks, they drew up a partnership agreement where they would share profits and losses equally and neither of them would be paid a salary. They also agreed to each contribute $100,000 of their own funds. They also realised that they would need an additional $400,000 in outside financing and began to look for a bank to provide them with the funds.

After some research, YNT settled on Citibank as the loan provider offering the most favourable terms. The bank requires that YNT provide 2 years of financial statements (income statement, balance sheet and statement of cash flow). YNT anticipates the firm will lose money in the first year and finally become profitable in the third year and remain that way into the future. Some features of the first year are:

- Hire 2 staff people and 1 office assistant; $8,000 per month; yearly cost of $96,000.

- Other expenses of $6,000 per month will be incurred; yearly cost of $72,000.

- Revenue of $120,000 is expected in the first year based on the following schedule:

| Income Statement | Jan-19 | Feb-19 | Mar-19 | Apr-19 | May-19 | Jun-19 | Jul-19 | Aug-19 | Sep-19 | Oct-19 | Nov-19 | Dec-19 |

| Revenue | ||||||||||||

| Write-Ups | $ 1,000 | $ 2,000 | $ 6,000 | $ 6,000 | $ 7,000 | $ 7,000 | $ 7,000 | $ 7,000 | $ 7,000 | $ 8,000 | $ 8,000 | |

| Audits | $ 10,000 | $ 10,000 | $ 10,000 | |||||||||

| Misc | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 |

| Total Revenue | $ 2,000 | $ 3,000 | $ 4,000 | $ 8,000 | $ 8,000 | $ 9,000 | $ 19,000 | $ 19,000 | $ 19,000 | $ 9,000 | $ 10,000 | $ 10,000 |

- Net loss anticipated for the first year will be $48,000.00

- Each partner will draw $6,000 per month to pay personal expenses. This will be a deduction from partners capital.

- Fixed assets of $150,000 will be purchased in the first month consisting of the following items:

- 2 Company Cars - $50,000

- Furniture and fixtures - $75,000

- Computers - $25,000

- To simplify transactions in the first year the following will occur:

- Revenue will be collected immediately (No receivables)

- Expenses will be paid immediately (No payables)

- Fixed assets will not be depreciated.

- The principal of the loan will not be repaid

- Interest will not be charged on the outstanding principal

- The business will begin on January 2, 2019

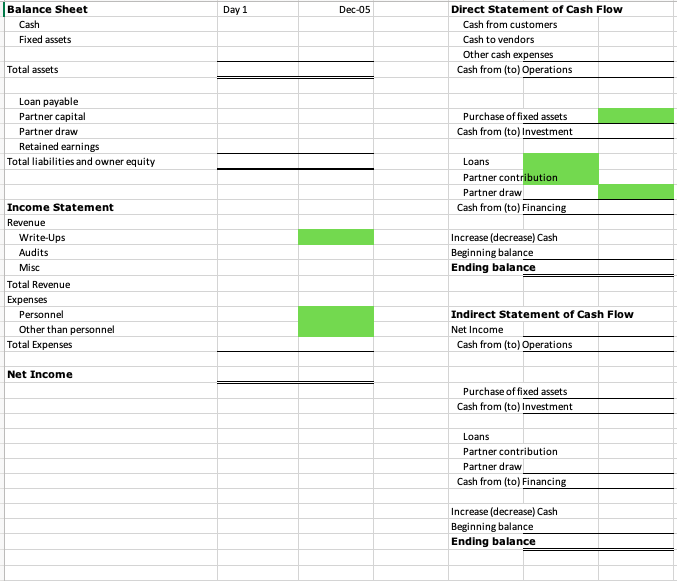

Based on the above information prepare (Balance sheet, income statement and statements-direct and indirect- of cash flow) for YNT.

YNT Public Accountants reflecting the first day of operation January 2, 2019 and the first month of operation January 31, 2019. Use the Template provided

Day 1 Dec-05 Balance Sheet Cash Fixed assets Direct Statement of Cash Flow Cash from customers Cash to vendors Other cash expenses Cash from (to) Operations Total assets Loan payable Partner capital Partner draw Retained earnings Total liabilities and owner equity Purchase of fixed assets Cash from (to) Investment Loans Partner contribution Partner draw Cash from (to) Financing Income Statement Revenue Write-Ups Audits Misc Increase (decrease) Cash Beginning balance Ending balance Total Revenue Expenses Personnel Other than personnel Total Expenses Indirect Statement of Cash Flow Net Income Cash from (to) Operations Net Income Purchase of fixed assets Cash from (to) Investment Loans Partner contribution Partner draw Cash from (to) Financing Increase (decrease) Cash Beginning balance Ending balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started