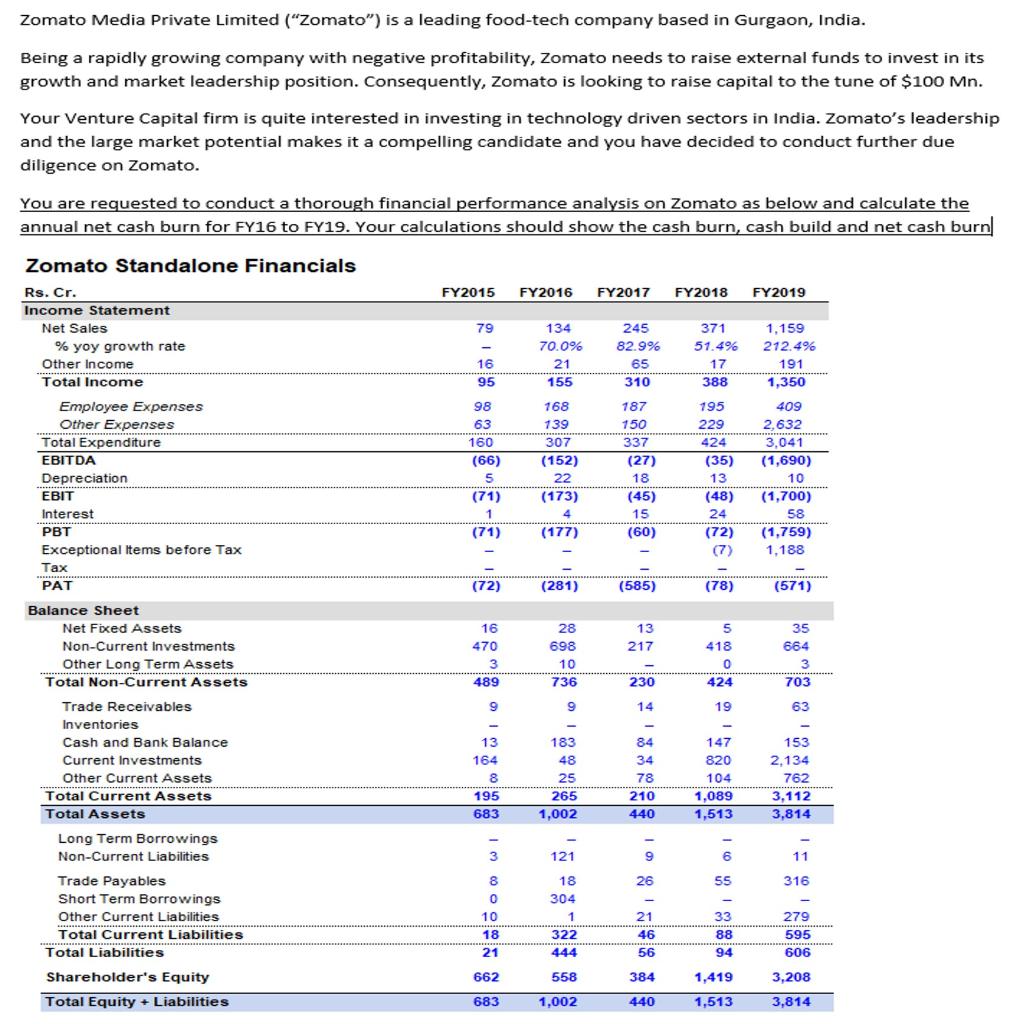

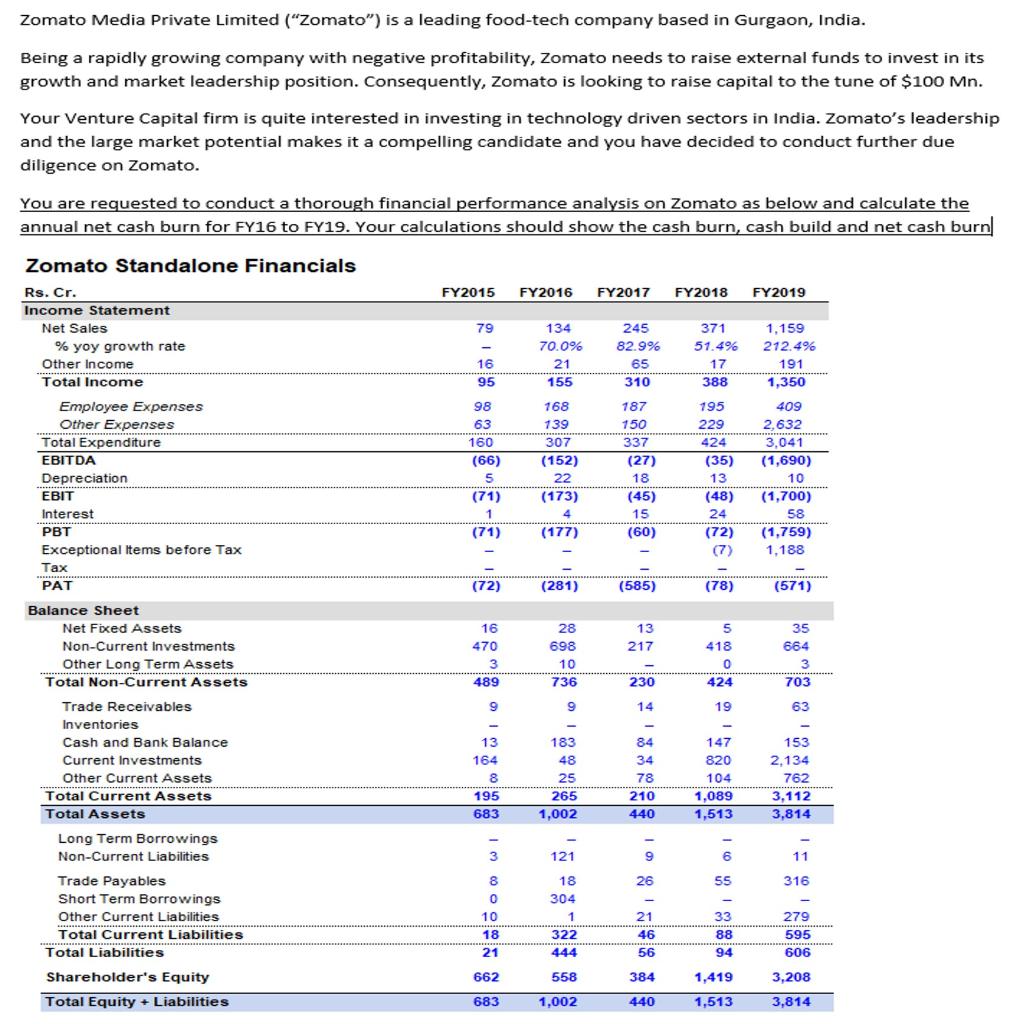

Zomato Media Private Limited ("Zomato") is a leading food-tech company based in Gurgaon, India. Being a rapidly growing company with negative profitability, Zomato needs to raise external funds to invest in its growth and market leadership position. Consequently, Zomato is looking to raise capital to the tune of $100 Mn. Your Venture Capital firm is quite interested in investing in technology driven sectors in India. Zomato's leadership and the large market potential makes it a compelling candidate and you have decided to conduct further due diligence on Zomato. You are requested to conduct a thorough financial performance analysis on Zomato as below and calculate the annual net cash burn for FY16 to FY19. Your calculations should show the cash burn, cash build and net cash burn FY2015 FY2016 FY2017 FY2018 FY2019 79 134 70.0% 21 155 245 82.9% 65 310 371 51.4% 17 388 16 95 98 63 Zomato Standalone Financials Rs. Cr. Income Statement Net Sales % yoy growth rate Other Income Total Income Employee Expenses Other Expenses Total Expenditure EBITDA Depreciation EBIT Interest PBT Exceptional items before Tax Tax PAT Balance Sheet Net Fixed Assets Non-Current Investments Other Long Term Assets Total Non-Current Assets 160 (66) 5 (71) 1 168 139 307 (152) 22 (173) 187 150 337 (27) 18 (45) 15 (60) 195 229 424 (35) 13 (48) 24 (72) (7) 1,159 212.4% 191 1,350 409 2,632 3,041 (1,690) 10 (1,700) 58 (1,759) 1.188 4 (71) (177) (72) (281) (585) (78) (571) 13 217 16 470 3 489 9 28 698 10 736 9 5 418 0 424 35 664 3 703 63 230 14 19 13 164 8 195 683 183 48 25 265 1,002 84 34 78 210 440 147 820 104 1,089 1,513 153 2,134 762 3,112 3,814 Trade Receivables Inventories Cash and Bank Balance Current Investments Other Current Assets Total Current Assets Total Assets Long Term Borrowings Non-Current Liabilities Trade Payables Short Term Borrowings Other Current Liabilities Total Current Liabilities Total Liabilities Shareholder's Equity Total Equity + Liabilities 3 121 9 6 11 26 55 316 8 0 10 18 21 18 304 1 322 444 33 21 46 56 88 94 279 595 606 662 558 384 3,208 1,419 1,513 683 1,002 440 3,814 Zomato Media Private Limited ("Zomato") is a leading food-tech company based in Gurgaon, India. Being a rapidly growing company with negative profitability, Zomato needs to raise external funds to invest in its growth and market leadership position. Consequently, Zomato is looking to raise capital to the tune of $100 Mn. Your Venture Capital firm is quite interested in investing in technology driven sectors in India. Zomato's leadership and the large market potential makes it a compelling candidate and you have decided to conduct further due diligence on Zomato. You are requested to conduct a thorough financial performance analysis on Zomato as below and calculate the annual net cash burn for FY16 to FY19. Your calculations should show the cash burn, cash build and net cash burn FY2015 FY2016 FY2017 FY2018 FY2019 79 134 70.0% 21 155 245 82.9% 65 310 371 51.4% 17 388 16 95 98 63 Zomato Standalone Financials Rs. Cr. Income Statement Net Sales % yoy growth rate Other Income Total Income Employee Expenses Other Expenses Total Expenditure EBITDA Depreciation EBIT Interest PBT Exceptional items before Tax Tax PAT Balance Sheet Net Fixed Assets Non-Current Investments Other Long Term Assets Total Non-Current Assets 160 (66) 5 (71) 1 168 139 307 (152) 22 (173) 187 150 337 (27) 18 (45) 15 (60) 195 229 424 (35) 13 (48) 24 (72) (7) 1,159 212.4% 191 1,350 409 2,632 3,041 (1,690) 10 (1,700) 58 (1,759) 1.188 4 (71) (177) (72) (281) (585) (78) (571) 13 217 16 470 3 489 9 28 698 10 736 9 5 418 0 424 35 664 3 703 63 230 14 19 13 164 8 195 683 183 48 25 265 1,002 84 34 78 210 440 147 820 104 1,089 1,513 153 2,134 762 3,112 3,814 Trade Receivables Inventories Cash and Bank Balance Current Investments Other Current Assets Total Current Assets Total Assets Long Term Borrowings Non-Current Liabilities Trade Payables Short Term Borrowings Other Current Liabilities Total Current Liabilities Total Liabilities Shareholder's Equity Total Equity + Liabilities 3 121 9 6 11 26 55 316 8 0 10 18 21 18 304 1 322 444 33 21 46 56 88 94 279 595 606 662 558 384 3,208 1,419 1,513 683 1,002 440 3,814